What are co-badged cards?

A co-badged card refers to a debit or credit card that supports multiple card schemes. This is usually:

- an international network, such as Visa and Mastercard

- paired with a local brand, like Cartes Bancaires (France) or Dankort (Denmark).

Some regions have specific requirements that must be implemented in order to be compliant with local regulations.

It is your responsibility to meet these compliancy criteria.

Regulations

European Economic Area (EEA)

In the European Union, the Regulation (EU) 2015/751 sets the rules on how merchants should handle co-badged cards.

If you accept one of the following card networks, you are impacted by the regulation and must follow the guidelines outlined below:

- Bancontact (Belgium)

- Cartes Bancaires (France)

- Dankort (Denmark)

Other local card networks are available as co-badged cards in Europe - however only the three above can be used today for online card payments, and therefore are relevant for these guidelines.

Guidelines

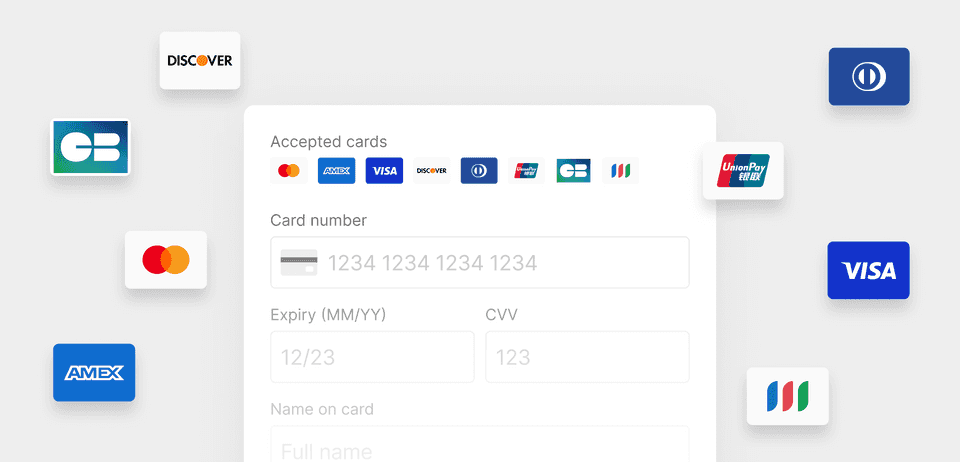

Identify the supported card schemes

You do not have to accept all card networks.

However, when the customer is about to enter their card details, you must make it transparent and clear which card networks are accepted.

This can be done by presenting the logo and/or name of all the supported card networks.

If you decide to present the logo, they must have the same clarity, size and quality.

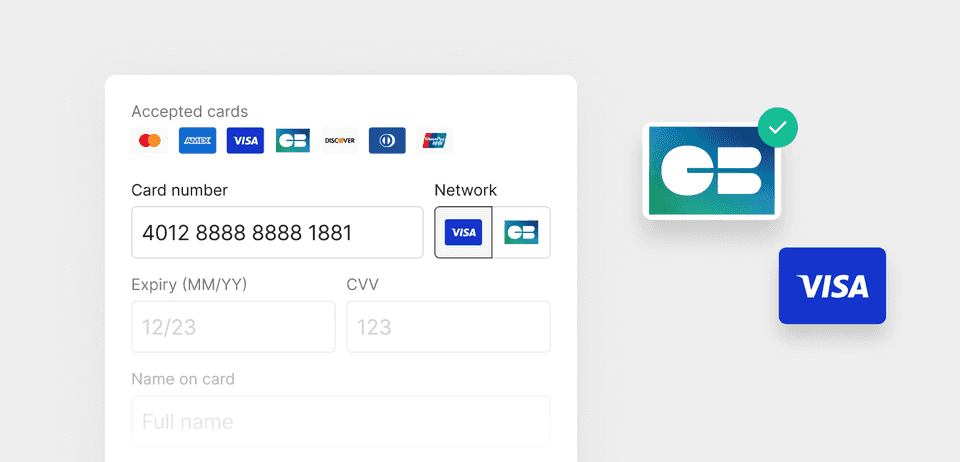

Choice of payment brand

If you accept all the card networks available on the customer’s co-badged card, you must enable the customer to choose which network they want to pay with.

You are free to set a default card network or pre-select one in order to reduce friction and optimize for cost. However, you must always honor the choice of the customer if they decide to override your preference.

In the case of recurring payments, the card network selected by the customer when they first entered their card must be honored for all subsequent payments.

To provide your users with the most seamless UX, we recommend you to use Primer Universal Checkout to automatically detect the networks as the user enters their card number.

Compliancy

This regulation was put in place in 2016.

Visa started conducting audits with the acquirers on the 31st of December 2023.

Failing to comply with the regulation exposes you to penalties defined by the acquirer and the card brand.

It is worth noting that "Bancontact Cards" is for now considered by Primer to be an independent payment method, and not a card network.

Other countries

Some countries outside of the EEA have other regulations related to co-badged cards. This is the case for Australia (with eftpos cards) and Saudi Arabia (with mada cards).

Primer does not support these card networks at the moment. This documentation will be updated when these card networks are added to Primer.

Get started with Drop-in Checkout

This feature is currently not available on Drop-in Checkout

Get started with Headless Checkout

In order to be compliant with the regulations, Headless Checkout enables you to

- detect the networks of the card number entered by the user

- retrieve the logo of each card network

- pass the card network selected by the customer to Primer

This feature is currently not available on React Native

Example projects

Feel free to use these example projects to get started quicker:

Pre-requisites

This guide assumes that you have already integrated a card form with Headless Checkout.

Make sure to follow the "Get Started with Headless Checkout" first.

Step 1. Set the list of supported card networks in the client session

When creating a client session, it is recommended to pass the list of the card networks supported for this particular session. This ensures that the customer is not asked to choose a card network that you do not accept.

The card network should be sorted in order of preference. This enables us to identify the default card network to consider if the user enters a co-badged card.

123456

// POST /client-session{ "paymentMethod": { "orderedAllowedCardNetworks": ["VISA", "CARTES_BANCAIRES", "MASTERCARD"] }}

With the example above:

- If the user enters a “Visa & Cartes Bancaires” card, the default network will be Visa

- If the user enters a “Mastercard & Cartes Bancaires” card, the default network will be Cartes Bancaires

Learn more about orderedAllowedCardNetworks in the API Reference.

This feature is currently not available on React Native.

Testing co-badged cards

Primer Sandbox Processor supports a few co-badged test cards to enable you to test your integration.

You can find them in the list of test card payments.

Integrations

This is the current list of integrations that provide support for co-badged cards:

- Worldline SIPs

- Stripe

Notes

Slow and unreliable internet connection

When the customer's network connection is slow or unreliable, it is possible that the customer finishes entering their card details before Universal Checkout retrieves the card networks.

In order to keep the friction low, it is important to note that Universal Checkout does not block the creation of a payment while the card networks are being retrieved or if the card networks could not be retrieved at all.

This means that, if a co-badged card is entered, the customer is not guaranteed to be presented a card choice before they submit their card details.

Selected card network on the payment method data

In the case of a card payment, you can get the selected network by looking at paymentMethodData.network.

We recommend against using paymentMethodData.binData.network as it only contains the international card network.