Primer has lots of integrations with various processors and payment methods - this list continues to grow each week!

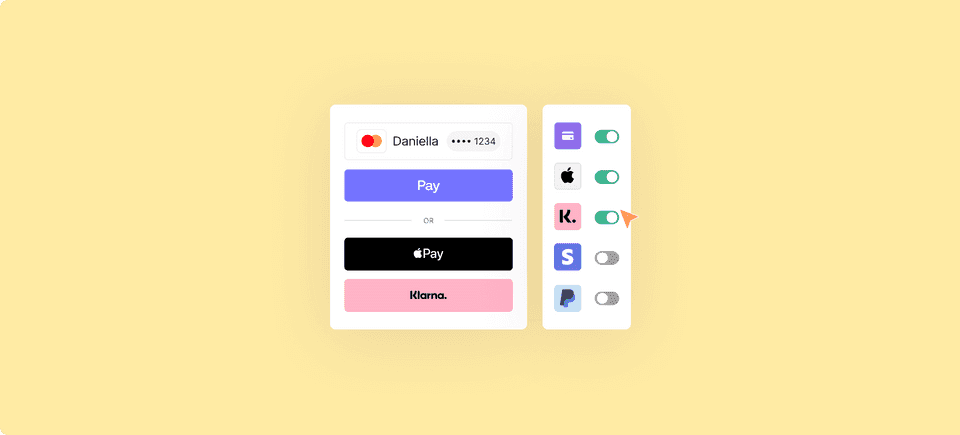

Primer’s unified payments framework means that once you’ve completed your Primer integration, adding and managing the payment methods in your checkout is all done via the Primer Dashboard.

How to use the payment method guides ?

Not all payment methods are the same and this set of payment method guides is here to help you get your preferred payment methods set up via Primer seamlessly.

Each payment method guide will outline:

- How to set up this payment method in Primer

- Implementation instructions for all platforms (Web and Mobile) and implementation types (drop-in UI and headless)

- Troubleshooting support

- How to test the payment method

What is a payment method?

It is important to differentiate between a processor and a payment method:

Processor

A processor communicates information from the customer to the merchant’s bank and the customer’s bank.

They are responsible for processing the payment and for handling refunds and cancelations if required.

Payment Method

A payment method is a vehicle that collects and passes information from the customer to the processor for the payment to be processed.

The most common payment method is a debit/credit card but there are many more popular payment methods, including digital wallets like Apple Pay & Google Pay.

Primer supports lots of different alternative payment methods and they are integrated in one of two ways into the Primer ecosystem:

Direct integration

Unified payment method integration that works interchangeably with different processors. This includes Apple Pay and Google Pay. Some payment methods are the processor themselves, such as PayPal and Klarna.

Via processor

The payment method sits on top of your processor. You may choose to access a payment method this way to simplify getting set up with access to multiple non-card payment methods through one processor.

Considerations

Primer is a payments infrastructure so you can choose how you want to get set up with payment methods, but a payment method integration may vary depending on the processor.

Different payment methods, different requirements

Not all payment methods behave the same. Below are some key examples to show you how the requirements can vary:

- Customization for some payment methods is supported which are specific to that payment method, such as Apple Pay where you can choose which button type to display.

- Certain fields are mandatory for some payment methods, such as Klarna which requires additional fields to be passed in the client session.

- Some payment methods only work with a set of processors. In this case, connecting the processor automatically adds the payment method to Primer, such as adding Buckaroo automatically connects iDeal via Buckaroo.

Same payment method, different processor: different flow

A payment method may have different flows depending on the capabilities and limitations of the compatible processors.

For example, when looking at iDeal, a popular payment method in central Europe:

- iDeal via Mollie redirects the user to a page maintained by Mollie to choose a bank

- iDeal via Adyen allows developers to build their own bank selection page

This is not always the case but if there are differences, they are mainly in the checkout flow or the fields that may need passing in the client session. Once the payment is created, Primer unifies the payment lifecycle so you only need to reason about payments once.

Implementation differences across platforms

Implementation of payment methods may vary across platforms and also based on your Primer integration type (drop-in UI or headless).

You can find guides for each platform (Web, iOS, Android, React Native) and integration type for each payment method.

Vaulting

Vaulting is the industry term for storing a customer’s payment method details for future use. This future use can be a new Customer-Initiated Transaction (CIT) or a Merchant-Initiated Transaction (MIT).

Some payment methods support vaulting, while others don’t.

Accepting Cards outside of Primer’s unified card integration

Some payment methods enable the customer to pay by card via their interface. This is the case for Klarna, PayPal, 2C2P, and many others.

These payment methods make use of their own processor to process card payments. Primer does not have access to the raw card data in these instances, and may not even know that a card has been used.

If a customer pays by card through Klarna, Primer will consider this a Klarna payment.

Different testing capabilities

Primer aims to unify the testing capabilities of all payment methods. However, some payment methods have key limitations that prevent them from being tested in sandbox.

Please refer to the payment method-specific guide for tips on how to best validate your integration.

Get started

- Set up processor and payment method connections in the Primer Dashboard

- Choose which payment methods to display in Universal Checkout in the Primer Dashboard

- Configure your workflows for processing all your payments via Workflows in the Primer Dashboard

- Complete your Primer API and SDK integration

- Start receiving payments from your customers! Manage your payments via the Primer Dashboard

If you require any further support above these guides, please don’t hesitate to reach out to our support team!