How Voi use payments to win more city licenses, activate more users & drive higher usage

Meet Caroline Hjelm. She's VP of Growth at Voi, Europe's fastest-growing eScooter hire platform. Her team are responsible for everything driving user growth from awareness and activation to retention and monetization - to support their mission to change how people move for the better, by providing a more sustainable, fun solution.

We set out to create cities that are made for living with less noise, less cars, less pollution, and more space for people. We're actually offering an alternative - that people like! It's enjoyable, easy to use, and it makes their lives better.

As e-scooter adoption rises, there are more players entering the market. When multiple scooters from competing brands are available side-by-side, consumers need to have a compelling reason to prefer one brand over another. This includes the payment experience.

The main purpose for us is when people choose to ride Voi, they should be able to pay with their preferred payment method. And when they've chosen their preferred payment method, it needs to work. It needs to be smooth. It needs to feel integrated with the Voi app.

Today, Voi is available in cities across dozens of different countries. Consumers in each of these countries have different expectations for how they can pay. To compete with other brands, Voi prioritized payments as a strategy for driving growth.

What we've realized during last year was that we needed to have a wider range, all the payment methods available. So, I've been working really closely with the payments squad in particular during this year.

In many markets, payment methods aren't a nice to have, but a necessity to reach potential riders.

Some markets like the German market where people, in general, don't like to pay by credit card. Having options for payment methods in those markets is crucial for us for creating a good user experience.

Payments don't just enable growth with riders, but also with cities.

Micro-mobility companies depend on local licenses to be able to operate in a given city. But, these licenses often come with conditions of how Voi must operate - including payment methods - which are required to tender for city licenses.

Another reason we want to expand payments is cities. They might require us to offer a certain type of payment method that suits their market. Getting those market-specific payment methods that will help us grow that will make the cities happy and will help us convert more users because they like the payment method that they're being offered.

Despite the growing needs for payments from riders and cities, and the opportunity to use payments to grow strategically, there wasn't in-house expertise or infrastructure at Voi to build out their market-by-market roadmap.

Voi needed a partner to accelerate and guide to turn payments from a 'wishlist' to a strategic growth lever.

Voi partnered with Primer to deliver their payment roadmap

Primer is the world's first automation platform for payments.

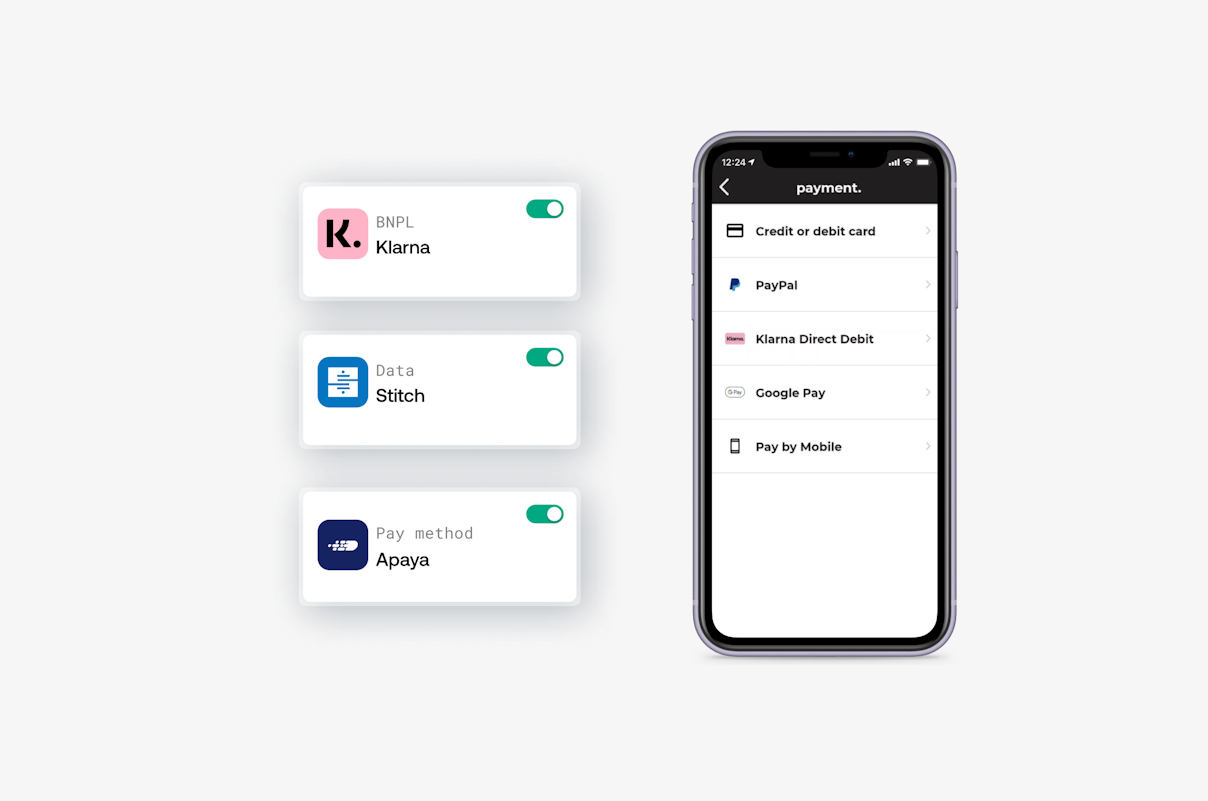

With Primer, Voi can connect and control their entire payments stack - payment service providers, payment methods, mobile checkout flows - with one platform.

Primer delivered both the infrastructure to connect everything together and the expertise to solve for Voi's specific needs in micro-mobility within the markets each they were targeting - in particular, the "long tail" of payment methods.

What made us go with Primer was the level of integrated partnership that Primer was offering and the level of flexibility as to which payment providers that Primer would be able to offer us than the large PSPs which only have the big payment methods and not the long tail. We were super interested in the long tail. Primer promised that they would be able to deliver those for us which so far they have.

Activating payment methods like Klarna is a point-and-click experience. For VOI, Klarna offers the payment method Pay Now - giving the customer the freedom to choose how to settle through direct debit. That means consumers are not at risk of losing their connection with VOI if, for example, their card expires or gets lost. Alex Naughton, Head of Klarna UK, shares more:

Smoooth payments are at the core of what we do at Klarna and Primer is supporting us in delivering the best payment and shopping experience to our customers - just like Voi. Thanks to this partnership we have been able to minimize integration time and bring our flexible and convenient payment solutions to even more consumers.

Alex Naughton, Head of Klarna UK

Delivering against Voi's evolving payments roadmap requires a close working relationship between our teams at all levels.

We haven't ever been working with a payment partner as closely as we're working with Primer. You can expect to spend more time than you would with one of the PSPs - that's for sure!

With the close partnership, together we can deeply and holistically solve the payments challenges that are specific to Voi's business.

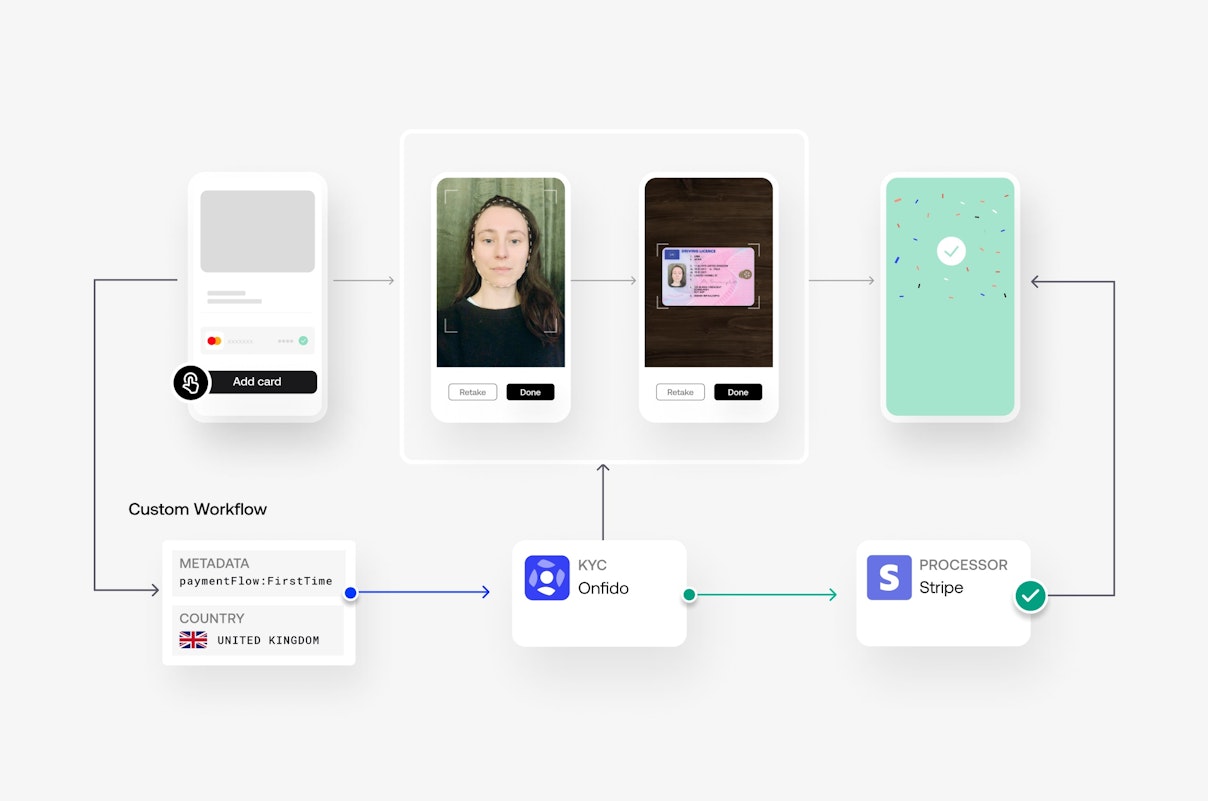

We needed a more customized approach and a more Voi-specific way of doing payment integrations. Our way of doing payments works so differently to e-Commerce, for example. We do micro-transactions divided into two different transactions - an unlock fee and then a pay-as-you-go fee that's charged per minute. That's something that requires more customization than just a purchase in an online shop.

Together, Primer and Voi can work together to deliver against the payments roadmap, continuing to remove friction for riders and enable expansion into more cities. In particular, integrating more services like KYC providers into their Primer workflows.

What's coming for us in the coming months is adding a payment method even closer to the onboarding flow. How can we tie it in with ID verification and some of those other services that Primer is providing.

Voi's payments strategy is converting more users into active riders

With Primer, Voi is empowered to build their perfect customer experience, including activating preferred payment methods in their onboarding flows.

We're seeing really good results for all the new payment methods that we're adding. It makes us want to continue building out our payment portfolio so we can offer customers what they want. It's helping us convert more users into active riders.

Voi is also seeing a difference in conversion rates to activating and even ride frequency when riders connect their preferred payment methods.

If we go through the new user flow, going from being a non-user, to downloading the app, to going for your first ride, that conversion rate is improved with having more options for payment methods.

Voi is now winning tenders for licenses in new cities. With Primer, they can quickly turnaround payment methods necessary for RFPs, for instance offering payments via mobile networks.

People are more aware of payments as a growth lever across the company for winning city licenses, activating riders, and building market share.

Looking to drive more conversion? Contact the team today.