How Veeps leverages Primer to unify its commerce and payment stack

We’ve all been there. Your favorite band is touring, but the shows are sold out, resellers are charging exorbitant fees, and the show isn’t in your hometown. You have to book a hotel room, a train, or hire a babysitter; it becomes an ordeal.

Enter Veeps.

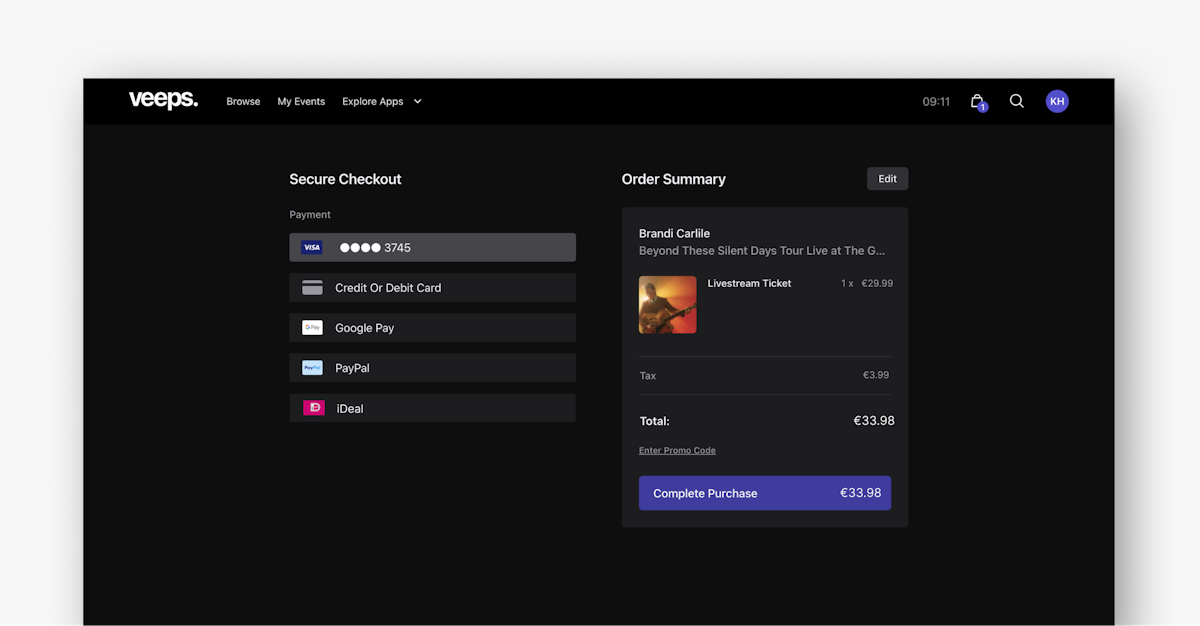

Veeps allows users from around the globe to directly access live concerts, music, and events via high-quality live streams. You just buy a ticket, and when it’s showtime, log in to your account and watch from any smart device.

As a global business with a presence in North America, Latin America, and Europe, Veeps has various needs when it comes to payments and commerce. That's why it's picked Primer as its partner to give it a powerful set of tools, and access to multiple payment methods and payment processors through one seamless integration.

We spoke with Kyle Heller, Co-Founder, and CPO at Veeps, to learn more about their business needs and how Primer is helping power its growth.

Feeling payment pain from day one

Payments play a key role in the experience Veeps is creating for its customers. But payments were also a pain point for the Veeps team from day one. As Heller explains: "I watched our engineers spend months and months updating and trying to maintain just a couple of different payment processors."

It was an unsustainable situation. Veeps is in the entertainment business, not the payments business.

"We don't want to build a payment solution," says Heller. "We just want to create a great customer experience and grow our business. That's why we've turned to Primer. It's allowed us to offload a lot of this effort so we can focus on other areas of our business."

Seeking insider expertise

Veeps wanted to work with someone that could match their payment ambitions. As a small yet fast-growing team, they needed to ensure they’d get valuable insight, something Kyle was keen to point out:

It makes so much sense that Primer was born of people from the payment industry, because they know the pain that engineers and product teams experience firsthand. You’re really thinking about payments and commerce progressively.

Primer is 100% agnostic, which provides a high-level overview of our merchants’ commerce ecosystem and needs. Veeps came to us for advice, and our experts were eager to offer input.

There’s no question Primer can’t answer. Whether it’s how to deal with international currencies or new regulations around 3DS, we’ve always felt like we’re in good hands. That’s pretty remarkable.

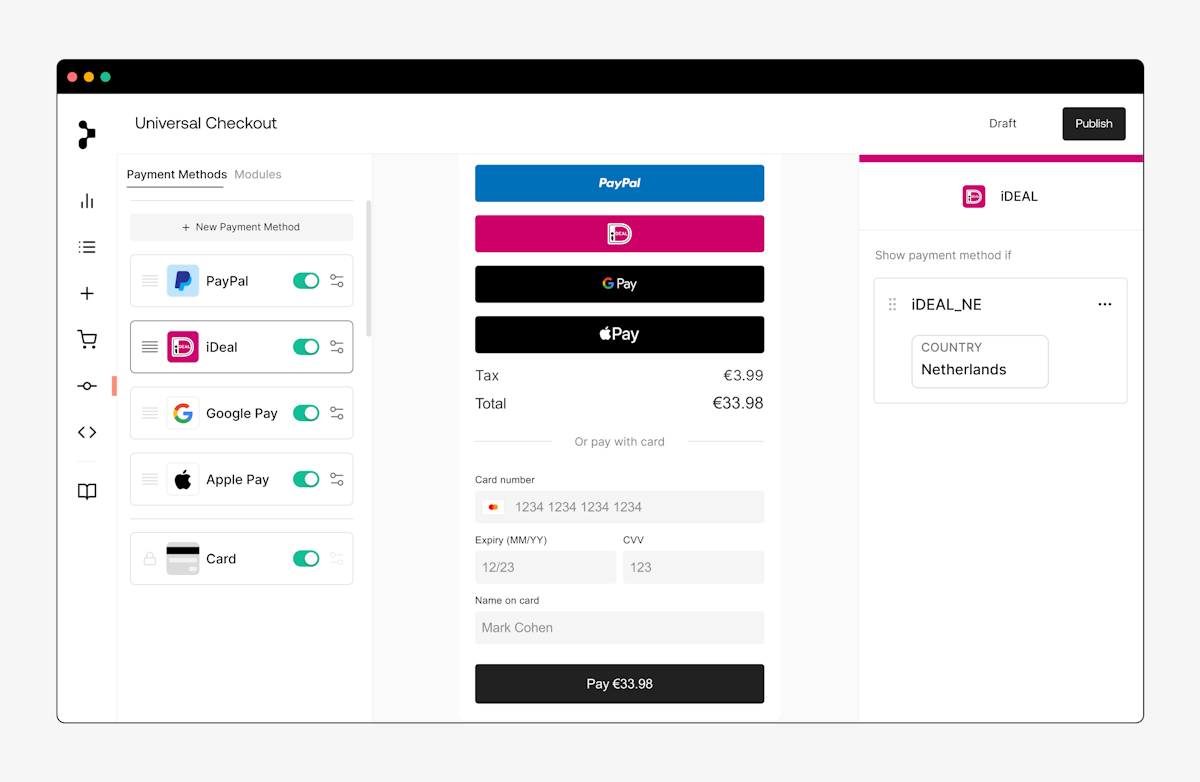

We’ve heard it many times before at Primer: Payments can be complicated, time-consuming and tedious to tackle. With our Universal Checkout, you get the best checkout integration with low code, allowing you to connect any global payment processor or method you wish to use. You can also build sophisticated and powerful Workflows for your payments and commerce stack with a few simple clicks. Kyle was surprised by how easy it was to get started:

Implementing Primer was quite simple, and the team was great at helping us achieve a completely customized and integrated checkout experience for our customers.

While anyone can integrate Primer (it’s really that easy), we’re always there to support—our goal is to help merchants get the most out of the platform. As Veeps continues growing and expanding to new markets, speed, reliability and efficiency are top of mind.

As an event company, we experience really high bursts in user traffic, so we need to be able to handle payments in a very reliable way. When we have hundreds of thousands of users hitting that payments API, we have to be able to collect those payments. Primer has done an amazing job at ensuring we can do so.

Adding local payment methods opened Veeps up to new markets

As a growing company, Veeps’ priority is to expand and succeed in new markets, which is why they have an iterative approach to testing and understanding customer needs. For example, they’ve received countless requests for local payment methods from users in Germany, Belgium and the Netherlands in recent months.

While the Veeps team works hard to accommodate their users, in the past, reacting to such requests proved very difficult. Adding new payment methods to their existing checkout flow was time-consuming and labor-intensive.

We can now switch payment methods on and off based on a specific region. If a user is in the Netherlands and we want to offer them iDEAL, we can do this without displaying this payment method to users in other regions where it’s not used. That’s a powerful concept.

A centralized view of the data that matters

A unified view of their payment and commerce infrastructure is essential to Veeps. They wanted to see all their payments data across their entire payment stack, including key indicators such as acceptance rates and top declines, without having to scroll through multiple tabs or dashboards.

Knowing what’s going on with all our transactions is a powerful resource for the entire team, and has helped them truly understand how payments fit into our business.

As a Ticketmaster/Live Nation subsidiary, the Veeps team was used to getting their reports from huge, dedicated data teams. When they communicated this challenge to us, we built a reporting API they could use to populate their artists’ dashboards. Since working with Primer, the Veeps team's workload has been significantly reduced by getting consolidated data in fewer steps.

As a company, building trust with our artists is one of the most important things to us, and the best way to do this is to provide transparent reporting and accounting—Primer allows us to do that. This feature lets us leverage payments and use Primer to deepen our customers’ trust in us.

More about commerce & financial ops >>

Managing all commerce flows in one place

Another big challenge for Veeps has been managing their broader commerce stack, particularly taxes. As a U.S.-based company, they’re all too familiar with varying tax rates based upon state and the type of product on offer. And all this before considering the regulatory implications of operating in Europe, Latin America and Asia.

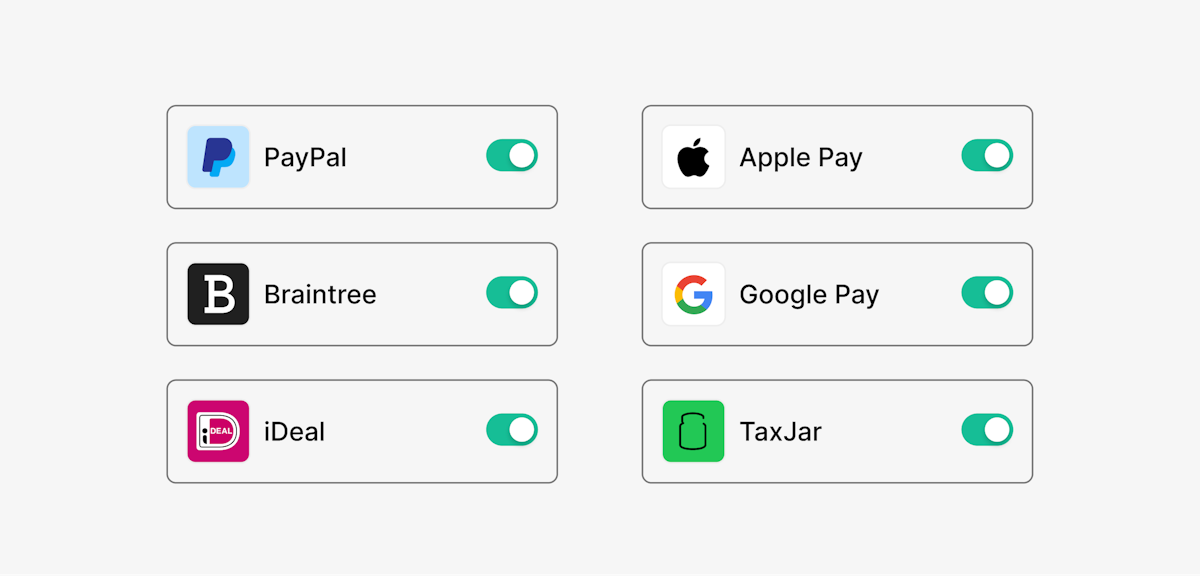

When they shared this issue with us, we pointed out that Veeps could add TaxJar with no code to efficiently calculate tax at checkout. Any commerce or payment service on Primer, AKA Connections, can be added to a workflow with a simple click of a button.

Primer introduced tax solutions to help us manage workflows without additional dev work. This saved us a good few months of engineering time and helped us get to market much faster.

Kyle sums things up nicely:

As the payment industry evolves, we feel like we’ll never fall behind. We’ll always be right there with Primer, with the ability to integrate anything without having to rely on engineering time or engineering tasks. That’s super powerful for us.

Want to leverage payments for growth like Veeps? Get in touch with us.