How CodesDirect took control of their payments with Primer

Payments should be easy to manage without too much technical debt. With Primer, it was click, click, DONE.

Roy Wijkstra, Founder of CodesDirect

When CodesDirect launched in 2020, they never imagined handling payments would be such a nightmare. Based in the Netherlands, CodesDirect offers customers an easy way to purchase a wide range of digital products. As a certified reseller with 4 localized storefronts (and more to come), shoppers worldwide can buy gift cards, prepaid credit, games, software and more.

You could be living in Germany, but want to purchase a mobile phone top-up for your aunt in Morocco. Maybe you’re a teenager buying PlayStation credit, a business looking to offer gift card perks, or simply want to make anonymous payments.

With a growing range of products, regions and diverse customer base, the CodesDirect team quickly realized the complexity they’d be facing with online payments. We sat down with CodesDirect Founder, Roy Wijkstra, and Co-Founder, Amrish Gayadien, to hear all about their payment journey and how Primer has impacted their business.

Trapped in payment ecosystems

CodesDirect knew from the get-go they’d need a variety of payment methods to make it easy for anyone to pay online. However, when looking into PSPs on the market, they found that no one was giving them exactly what they needed. Roy explained:

Some processors offer a long list of payment methods, but then you’re locked into their ecosystem. Amrish and I feel very strongly about being sucked into ecosystems. Also, if you want anything ‘exotic’, like Boku or crypto, you need to build it yourself using direct APIs and similar complicated things.

Worse still, the fragmentation and lack of standardization in the payment industry stood out:

Every processor does their own thing, which makes it incredibly difficult to adapt and have everything fit together. There’s so much you need to do to ensure it all works together. If you integrate a processor and aren’t happy with how things are going, you’re locked in. So, even if you’re certain the grass is greener on the other side, you still hesitate because you’ve already done all this work.

After investing a lot of time and resources—like connecting a crypto provider to accept Bitcoin, only to have the connection require an unexpected change right afterwards—the team had enough.

I saw all this technical debt, and realized, “Oh, this is going to be an issue, this isn’t going to work.” I felt that payments should be easy to plan and manage, so I started looking for something else.

When CodesDirect came across Primer, they were impressed with the innovative product that was ramping up so quickly.

I wasn’t aware payment orchestration was a thing. Resh (Sr. Business Development Manager for EMEA) walked me through the product, and we immediately said, “We need this”. Even to this day, I’ve never seen anything like Primer.

Unlocking payments for CodesDirect

Things became instantly simpler with Primer: if CodesDirect needed more flexibility in terms of PSPs, they could switch to another that suited them better. They were no longer tied to services they didn’t want. Roy elaborated:

All the PSPs are focused on exactly this: locking customers into their ecosystems. Their fees go up, too, because you’re using all these services they offer, so you’re even more scared to jump ship. Primer doesn’t do this. Thanks to Primer, we’re in a better position to negotiate and have less technical challenges if we decide to switch certain processors or payment methods.

This means that if the team needed certain APMs one PSP doesn’t offer, they could source them from another PSP, within the same code base. Amrish and Roy repeated their need for flexibility and complete control over payments:

We need visibility. We need to see what's happening, how it’s happening, why it’s happening. We’re selling products that require flexibility, so we have to be able to steer payments a certain way.

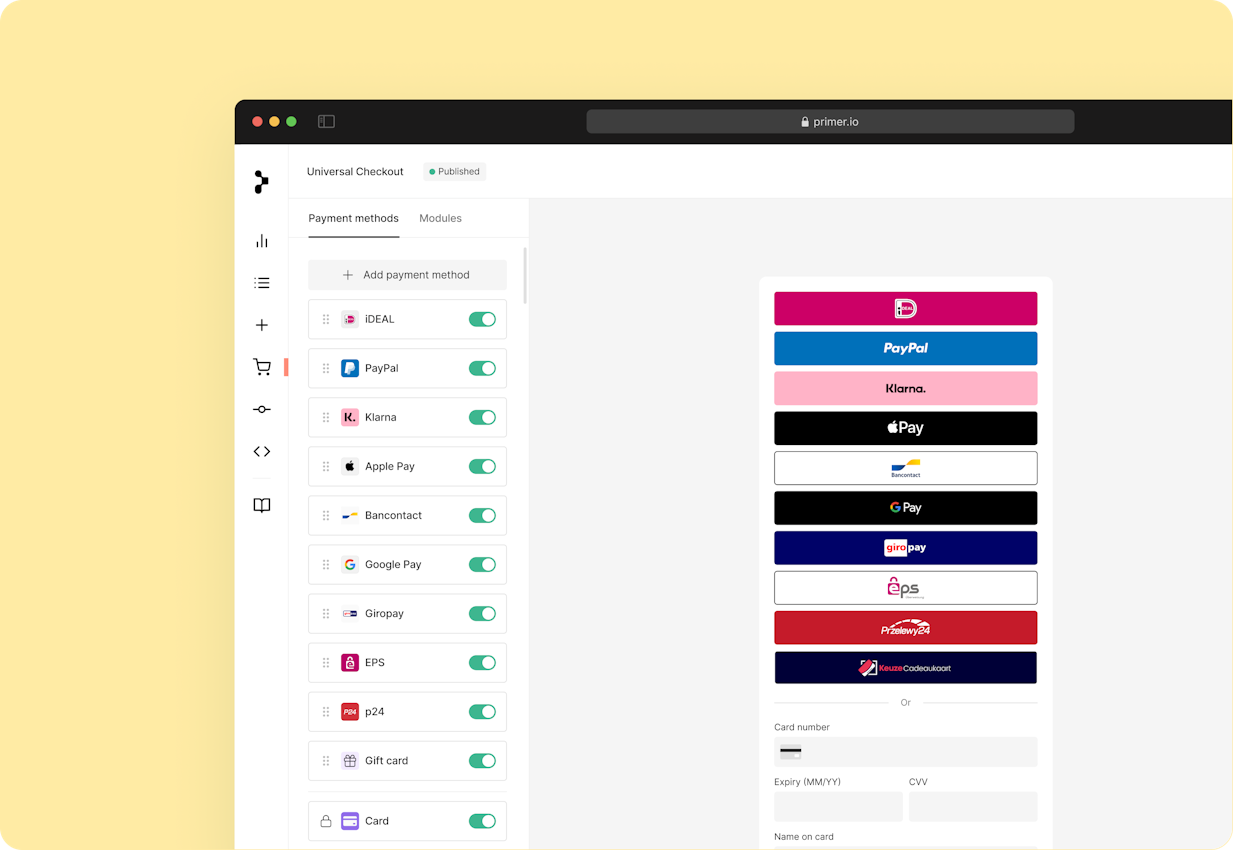

Falling in love with Universal Checkout

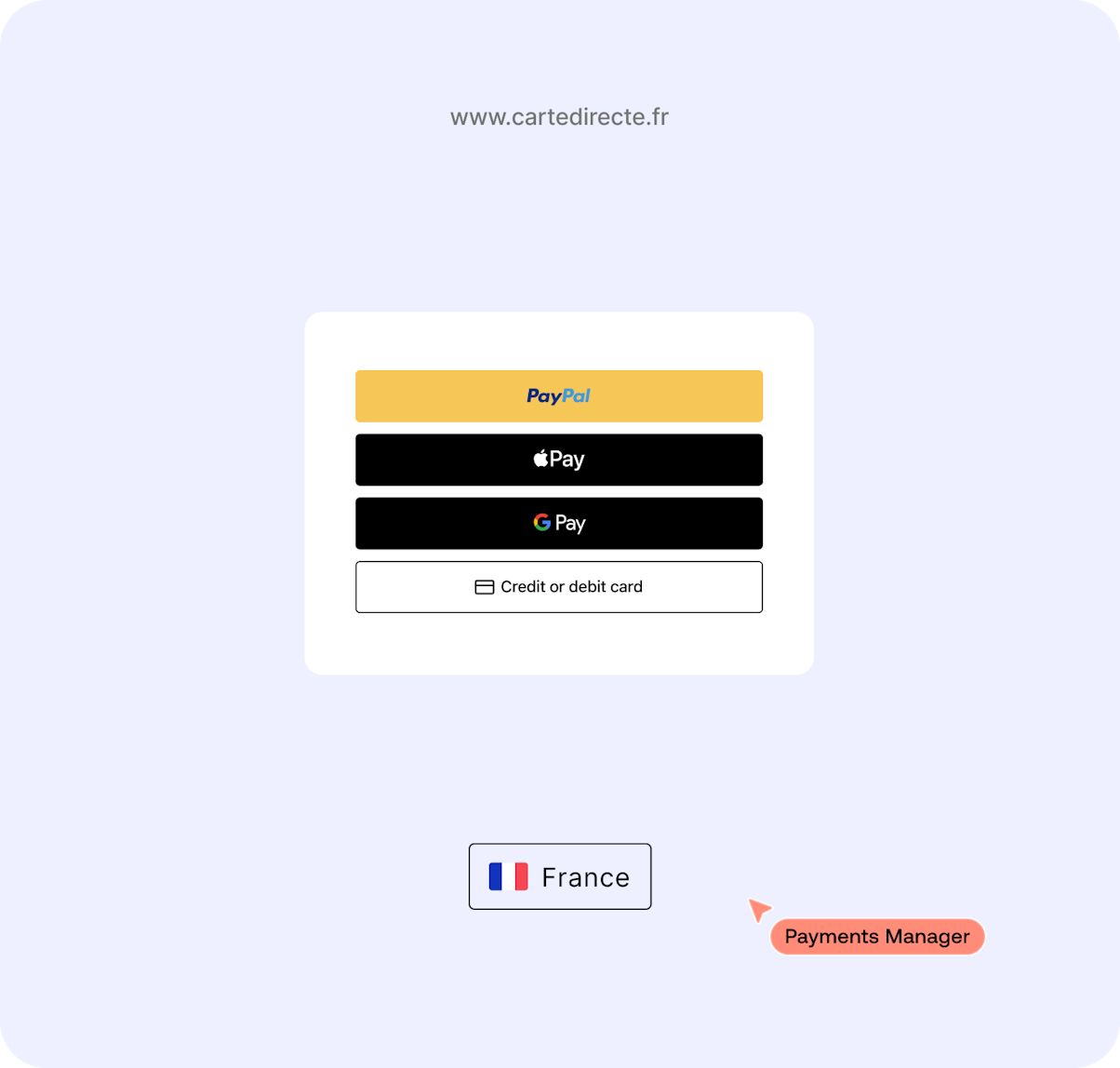

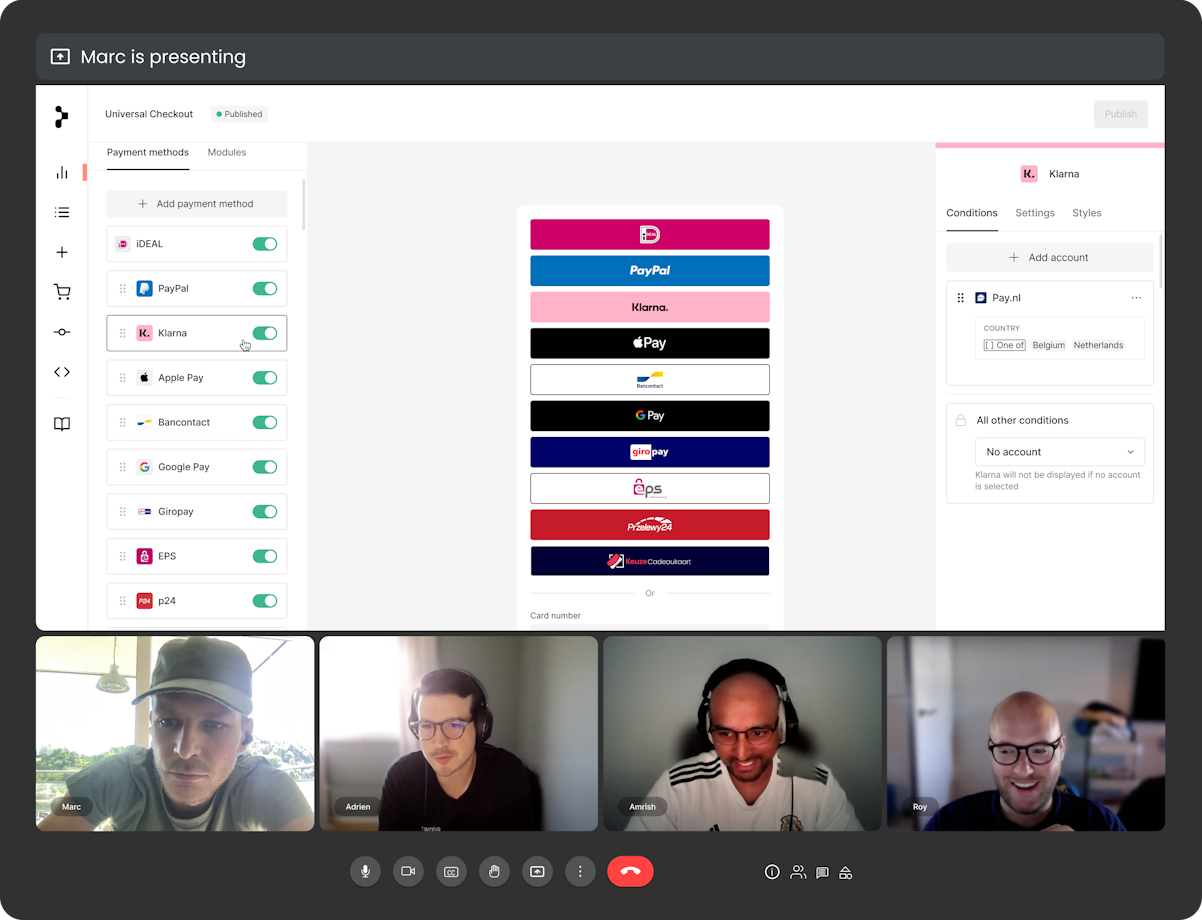

With their new freedom to choose and the ambition to enter new markets, CodesDirect started using Universal Checkout to create the best buyer journey, knowing each region needs its own.

With every PSP integrated, you have to work with different API keys, fields and databases, plus handle all the backend management… it’s complicated. Now, we don't—Primer made it really easy for us to adapt the checkout to the country we’re selling in. We just paste in Universal Checkout and manage it all in one dashboard. No more technical debt.

The team described their attempts to create the perfect checkout, constantly fiddling with different buttons, when they were displayed and how everything should look. Amrish chuckled as he told us about it:

Before, integrating an Apple Pay button was a nightmare, and it never really worked right. Primer has this Apple Pay button that just—click, works—exactly the way we wanted it to, with any processor. This is why we fell in love with Universal Checkout. This is what made Primer the perfect fit for us.

It��’s so easy, that anyone on the CodesDirect team can handle all things payments completely independently, which is exactly what they do.

Payments are the heart of our business. Everything is important, but without payments, nothing happens. So, Primer is now like our heart.

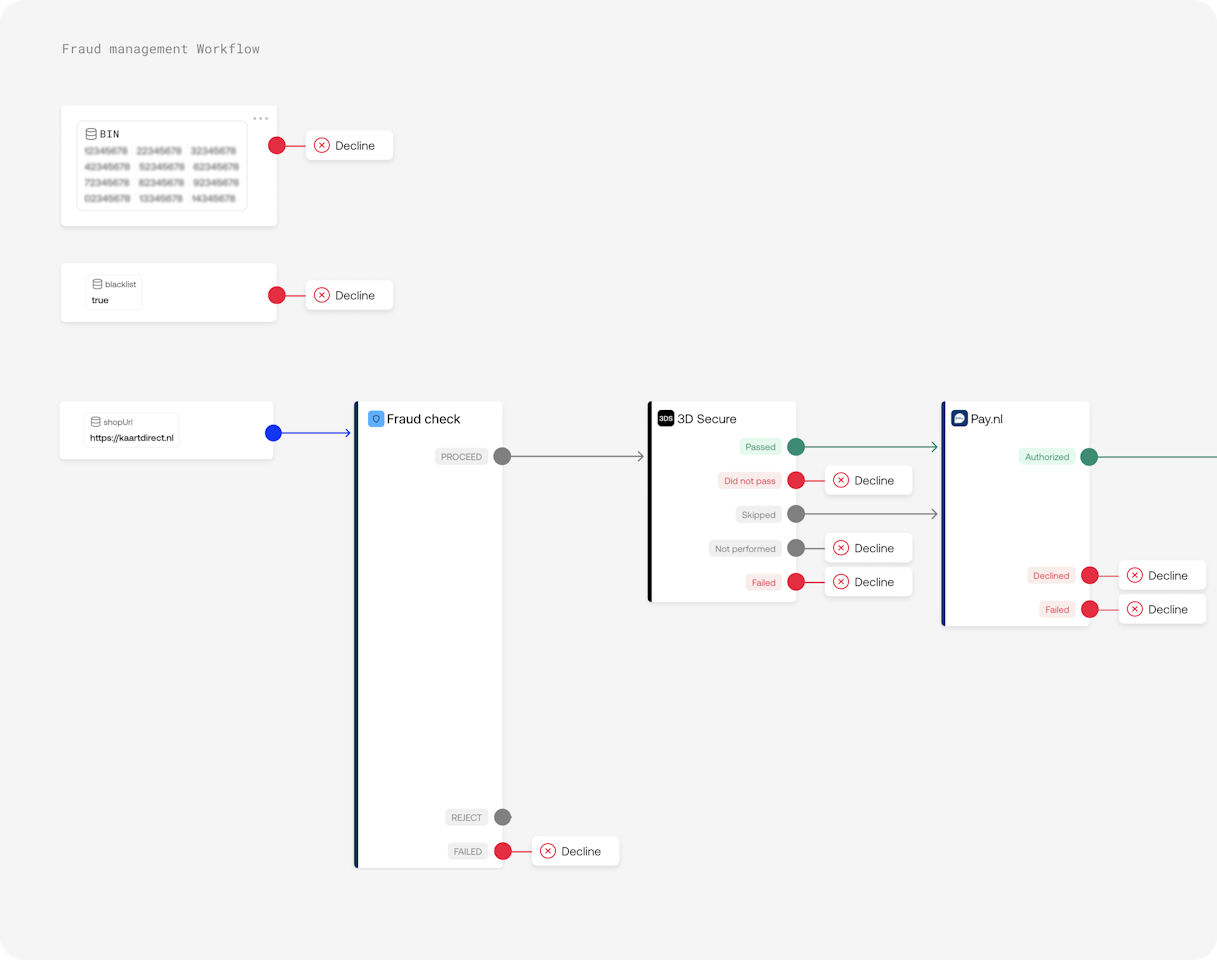

Handling fraud swiftly with a custom-made blocklist

Part of being fully in control over payments includes fraud management. CodesDirect leveraged Primer’s processor-agnostic, in-context 3D Secure function and comprehensive metadata to thwart attacks. By quickly detecting fraudulent transactions, the team created an automated blocklist based on collected data, like BINs, regions and historical client information, to prevent repeat fraudulent attempts. Amrish was amazed:

No PSP to date has much control over 3DS. We’re now fully in control of how we process credit cards. This means we can make the decision to force mandatory 3DS for certain countries or users with BINs. It’s sophisticated, we can immediately adapt to a fraud attack and make changes to stop losing a lot of money. We’re also saving on PCI compliance costs, which are normally very heavy.

Primer as an extension of the team

Amrish and Roy spoke of Primer’s unique ability to rapidly optimize the product, based on in-depth, high-level performance data and merchant feedback:

Primer has overarching visibility of other merchants’ conversions, so you can make data-based decisions to constantly improve the product. You can pinpoint if something’s causing friction, like how the fields work, where they’re placed, the tap function, or even if a specific payment method isn’t converting. You guys have all that visibility and can optimize the product and make changes way quicker than we ever could.

Roy mentioned that the way Primer works, this valuable payment knowledge becomes socialized and shared for everyone’s benefit: from the merchants, to Primer, to the end customer.

You have so much insight on how we process payments and our needs. We provide you with feedback, so all your other merchants are probably doing the same. Pile on all this data, and we’re actively contributing to the product, too. It’s like a community, and I’m really grateful to be in an open environment where this is possible.

The team enjoyed working closely together towards a shared goal:

In some ways, Primer’s been an extension of our team. For example, take Marc from Customer Success: he’s been such an inspiration, sharing all his knowledge with us from the beginning. He was there when we were really struggling with credit card payments, tokenization, PCI compliance, and was so on top of everything. We worked with Marc on a daily basis—he always made time for us.

We’ve had the opportunity to work with some of the best people in the industry—everyone I’ve come across at Primer is an expert. It’s always been smart people doing good things, while being as innovative as possible. I like this, it’s different from other companies.

What’s next?

In the next few months, Primer will help CodesDirect access and adapt to the French market with local payment methods, as well as adding crypto payments to their stack.

When asked about their vision and next steps for the company, Roy and Amrish spoke of exciting plans that will bring them to the next level, including working on their platform’s backend, plus a full brand redesign. Roy says the team can now properly focus on their company’s growth and evolution:

We’re a lot more relaxed now that our payments are being handled and things are moving forward in the right direction. You guys work behind the scenes on your product, always adding new features and making sure it all aligns perfectly.

It gives me peace of mind that I don’t have to obsess about staying up to date with all the fintech stuff, always checking to see what’s happening, what’s new, or how things are changing—because I know that some really smart people are already doing this for me. I can sleep better at night.