What is payment orchestration and how can it maximize payment efficiency?

Today, on average five to six services are used to process one given payment, from payment methods, and fraud providers to accounting software. So it’s no wonder that businesses are constantly searching for ways to streamline operations and optimize processes.

This article will explore the concept of payment orchestration, how it works, and why it's an essential tool for streamlining payment processes and improving the customer experience. We'll also share our tips for using it to maximize payment efficiency so you can take advantage immediately.

Get our payment orchestration buyers guide and free RFP template.

What is payment orchestration?

Payment orchestration brings together different payment service providers, acquirers, apps, and banks onto a single platform. Otherwise known as a Payments Orchestration Platform (POP) - a control panel for all your payment needs.

POPs can handle different aspects of the payment process, including:

Smart routing - making sure all the money goes where it's supposed to go

Billing and settlement - making sure everyone gets paid

Payouts - getting money to the right people

Analytics - keeping track of payment performance

POPs come in two types. As a backend technology, the platform takes care of routing transactions across different providers. If it’s used as a unified frontend combined with backend technology, it can be linked to a user-friendly checkout experience for customers while also routing transactions for optimal authorization rates and reduced costs.

By consolidating and unifying everything into a single platform, you’ll benefit from holistic data insights and improved reporting features. This can help you make better decisions about payment operations with different variables such as processors, payment methods, security measures, and markets.

Why does payment orchestration exist?

As the payment ecosystem continues to evolve, payment processing has become more complex and fragmented. Payment orchestration exists to enable merchants to offer and adapt to new payment methods and technologies as they emerge. This ensures you remain competitive in a fast-changing environment and offer the best possible customer experience.

How does payment orchestration work?

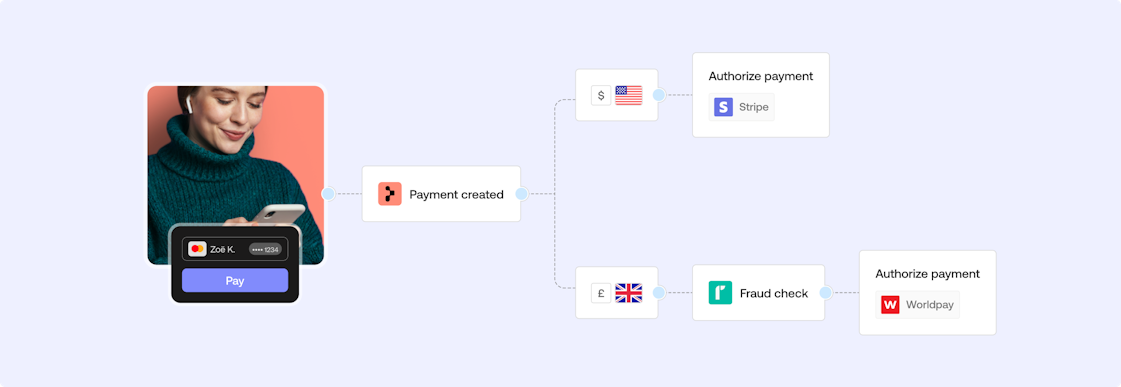

To fully grasp the power and potential of payment orchestration, let’s take a closer look at how this technology works in practice when making a payment:

When a consumer adds a product or service to their shopping cart online, they are directed to the checkout page, where they choose their preferred payment method from a list of options.

Once the customer places their order, their payment details are sent to a payment gateway. This process of collecting payment details, tokenizing (encrypting) the card, and passing along the transaction to the appropriate gateway is handed by the POP.

With payment orchestration, the platform automatically routes the payment request to multiple payment processors to reduce the number of false declines. If the first payment processor cannot authorize the payment, the same payment request is sent to another processor.

Once the acquiring bank receives the payment information, it communicates with the issuing bank to verify and authorize the payment. If the payment is approved, the acquiring bank sends the authorization response code to the payment gateway and the merchant.

By using multiple payment processors and a sophisticated routing system, payment orchestration reduces the risk of false declines and maximizes payment acceptance rates. This improves the customer experience, increases revenue, and helps prevent lost sales due to payment processing issues.

Find out if your business needs a payment orchestration platform.

Benefits of payment orchestration

Now that you know how it works, let's dive into the good stuff and explore the perks of payment orchestration.

Optimize costs

Using a payment orchestration platform is an effective cost-saving strategy. You can save both time and money by unifying your payment stack, and removing yourself from the build and maintenance of multiple payment providers and individual contracts.

You can route to the lowest cost provider on a transaction level, as perhaps one Payment Service Processor (PSP) has lower rates in a particular region. Plus, with their scale and expertise, payment orchestration providers can often negotiate better rates with PSPs and payment providers. This ultimately improves the bottom line and further streamlines the payment process to reduce overall expenses.

Increase speed to market

Payment orchestration minimizes the time and engineering resources required to integrate and maintain payment options. In reality, it could take an engineer months to build and maintain one connection, from writing the code to integrating the new payment partner. But with a payment orchestration platform, this can be done in a few clicks.

Expand to international markets

Research shows that 69% of consumers will abandon the shopping cart if their preferred payment method isn’t available. With access to a diverse range of providers, orchestration not only increases success rates on transactions but opens up new demographics. By dynamically presenting payment options at the checkout, it personalizes the customer experience, delivering a competitive edge.

Reduce fraud

Having a unified platform that manages the transaction lifecycle across multiple payment methods and providers enhances fraud prevention, especially in terms of managing 3DS. In fact, the ability of these platforms to leverage Strong Customer Authentication, combined with pre- and post-payment authorisation checks, significantly reduces chargebacks.

Authorize more payments

With access to multiple payment methods and the ability to route payments to the most optimal provider, you can reduce the likelihood of declined transactions and improve authorization rates.

This is particularly important for businesses that are expanding or operating in global markets and analyzing which payment service providers (PSPs) have higher authorization rates for specific data points, such as particular issuing banks.

Improve your authorization rates and maximize revenue with Primer

What to look for in a payment orchestration platform (POP)

Payment efficiency means using minimal resources to achieve high authorization rates, reduced fraud, lower costs, with a simplified technology stack. Consider these five things when selecting a payment orchestrator to help you maximize payment efficiency.

A unified frontend experience, regardless of the underlying processor

Customers expect their online experience with a brand to be consistent, especially when their interaction includes sensitive data - like at the checkout page. Each payment processor requires a different authentication journey, and this can have a huge impact on the frontend checkout experience for the user. Leveraging a POP ensures a frictionless checkout experience by enabling rules across multiple processors, such as authentication, geographies, and currency. The end users are presented with the most relevant options to them and their payment methods without the user interface (UI) being impacted, resulting in higher conversion.

Business intelligence across your entire payment stack

A modern orchestration platform extracts, analyzes, and pinpoints areas of optimization within your payment stack. By gaining a single view of processor performance and presenting insights through visualizations and reports, you can make more informed decisions to improve performance and optimize costs. Some platforms will also alert your business and schedule reports based on set conditions, allowing you to respond in a timely manner.

Fallback and retries to recover sales or downtime

Payments orchestration enables online stores to enhance payment reliability and redundancy. If one payment processor encounters issues or downtime, an efficient POP can effortlessly route transactions to an alternative processor. This mitigates payment disruptions and delivers a frictionless checkout experience to customers, no matter what’s happening behind the scenes.

Integrate your preferred third-party apps and services

Today, businesses need to use a multitude of apps and services. On average, five to six services are used to process one given payment - from payment methods, fraud providers to accounting software. Modern orchestration brings this together with the most relevant workflows to optimize costs, increase authorisation and conversion rates.

PCI L1 compliant vault with tokens that can be used across PSPs

Secure payment processing is a well-known catalyst for building trust among customers. A PCI (Payment Card Industry) Level 1-compliant vault securely stores sensitive payment information using tokens. This protects customer card details and meets strict PCI standards. It also offers compatibility with various PSPs, allowing seamless integration and enabling organizations to process payments without exposing sensitive data or managing separate vaults.

Discover what else you need to consider when seeking a payment orchestration platform.

The bottom line

When it comes to payment orchestration, Primer can help you simplify your payment stack and get the most from your payments and commerce investment.

Easily integrate and unify your entire payment lifecycle across processors, streamlining the payment process and reducing complexities. One integration is all it takes to complete the process.

Get our payment orchestration buyers guide and free RFP template.

FAQS

What’s the difference between a payment orchestrator and a payment gateway?

While a payment gateway is an essential software application that facilitates payment processing, a payment orchestrator is a unified platform that brings together a multitude of services. This helps businesses to manage multiple payment methods, gateways, and currencies in a more streamlined and efficient way.

Think of it like this: a payment gateway is like a toll booth that allows you to collect payment for passing through a specific road, while a payment orchestrator is like a traffic control center that manages multiple toll booths and routes traffic more efficiently.

Does my business need a payment orchestration platform?

There is no one-size-fits-all answer to this question, given that each business has unique needs. But if your business uses several processors and alternative payment methods (APMs) seek to enhance the efficiency and security of your payment stack, a payment orchestration platform might be the ideal solution.

What is an example of payment orchestration software?

Payment orchestration software, like that offered by Primer, has helped businesses like Zenyum, Beam, and Printify to consolidate their payment and business operations. This has allowed them to use their payment systems more frequently, with fewer risks.

By using payment orchestration software, these businesses have streamlined operations and made it easier to manage payments.

Don’t just take our word for it. Read our case studies 📖