How to dispute chargebacks efficiently

Handling disputes is widely considered one of the most challenging parts of payments and is a source of major pain for businesses selling online. Chargebacks are a major headache for merchants selling online. They can lead to significant financial and operational challenges, and unfortunately, over the years, bad actors have taken advantage of the chargeback process to defraud merchants.

It's best to prevent chargebacks from occurring in the first place. By proactively addressing customer complaints and ensuring they have a positive experience, you'll reduce the likelihood that they'll need to resort to a chargeback. This approach can also increase the chances of repeat business from satisfied customers.

Of course, even with preventative measures in place, some chargebacks may still occur. In these cases, having the right tools, data, and processes to effectively dispute the chargeback and minimize the impact on your business is important.

In this article, we'll delve into the world of chargebacks, exploring their impact on businesses and providing guidance on effectively disputing chargebacks.

What is a chargeback?

Chargebacks are a consumer protection mechanism introduced in the 1974 Fair Credit Billing Act. It allows individuals who've made a purchase online using their debit or credit the ability to recover their funds from the merchant if they're unsatisfied with the product or service they've received.

Some common reasons individuals may initiate chargebacks include:

Receiving damaged or defective goods.

The merchant not delivering the product or not delivering it within the expected timeframe.

The product or service received didn't meet the description.

The merchant charged the customer's card more than it should, or charged twice.

The purchase was made using a stolen card.

While these are typically legitimate reasons for initiating a chargeback, some individuals try to game the system and raise fraudulent chargebacks. This includes instances of 'friendly fraud,' the most common form of chargeback fraud. According to Chargebacks911, friendly fraud will account for six out of every ten chargeback claims in North America in 2023.

It's important to note that the terms 'disputes' and 'chargebacks' are often used interchangeably, but disputes represent the first step in the chargeback process. This is where the consumer issues a complaint to their card issuer. Chargebacks are the next step, where the transaction is formally reversed, and funds are returned to the cardholder.

This mechanism is as simple as it sounds, but its consequences can be complex, especially for merchants. In fact, for every $1 in chargebacks, merchants lost an average of $3.75 in revenue in 2022.

How do chargebacks affect your business?

Chargebacks can trigger a ripple effect of repercussions for merchants, spanning far beyond the monetary aspects. To understand the full impact, let's break it down into a few key points:

Administrative burden: Besides the financial hit, chargebacks also contribute to an administrative headache. The time spent resolving disputes can lead to increased labor costs and divert resources from core business operations.

Damaged Reputation: A high chargeback rate can raise red flags about the legitimacy and reliability of your business. In some instances, this could result in the termination of your merchant account, ending your ability to accept card payments.

Higher processing fees: Excessive chargebacks can lead to your business being classified as 'high-risk' by credit card processors. Over time, this increase in processing fees can significantly eat into your profit margins.

Scheme fees: The schemes may also impose penalties for each chargeback received should you fail to lower your chargeback ratio to an adequate level within a given timeframe. It's not uncommon for businesses in this situation to pay tens of thousands of dollars in fines.

Use Primer to streamline your dispute process further and have a unified view of dispute events across all payment processors.

How to dispute chargebacks and win

Managing chargebacks can be overwhelming, but having a strong plan can greatly enhance your chances of winning a dispute. Here, we break down six practical steps to help you effectively dispute chargebacks.

Understand the reason code

It is important to understand the reason code behind each chargeback. This code indicates why the customer initiated the dispute. Familiarizing yourself with these codes can help you tailor your response accordingly.

Be aware of the time limits

Be aware of the time limits associated with each stage of the dispute process. Credit card companies have strict deadlines, so it is imperative that you respond promptly and within the specified timeframes to avoid automatic loss.

Review the chargeback claim

Carefully review the chargeback claim for any inconsistencies or inaccuracies that can strengthen your dispute. It's also crucial to gather compelling evidence that supports your case, such as transaction records, customer communications, and proof of delivery.

Gather compelling evidence

To bolster your case, it's crucial to collect compelling evidence. This entails gathering all pertinent paperwork, such as transaction records, customer correspondence, and proof of delivery.

Craft a persuasive rebuttal letter

To write a convincing rebuttal letter, it's important to understand the opposing argument fully. Once you do, you can effectively refute their points and present your argument. A well-organized and clear letter will be more persuasive and demonstrate why your argument is superior.

Submit the dispute package and continuously monitor the case

The dispute package should include your rebuttal letter and supporting documents. Ensure everything is well-organized, understandable, and submitted within the deadline. Keep track of your case's progress and be prepared to provide additional information if the bank requests.

The difficulty in accessing dispute data

Monitoring and comprehending dispute data is essential, but collecting this information poses some challenges. First, payment processors send various dispute notifications, some of which are not provided by others. This inconsistency can make it difficult to distinguish notifications that require action from those that can be disregarded for consistency and standardization. For instance, some processors may send duplicate events for a chargeback win and a chargeback reversal, while others do not.

Secondly, different processors may use different terms to describe the same information. For example, what one processor refers to as an order ID may be called a payment reference or merchant reference by another. Documentation in the payment industry, particularly among legacy processors, could be enhanced to assist chargeback teams and data analysts in standardizing information. This approach can save developers time and ensure everyone is on the same page.

Using Primer to simplify dispute reporting across your processors

Our disputes product originated with the idea that Primer could create a single version of dispute events across all payment processors.

To do this, we developed a unified dispute lifecycle. This lifecycle distills the various dispute events into one view, so you no longer need a working knowledge of each payment processor's jargon or idiosyncrasies.

Moreover, each notification Primer sends also provides a uniform set of fields allowing any team member to understand the data. Again, Primer covers all the complex mapping from various processors, leaving your team free to use the data immediately.

Merchants can easily access their unified dispute data in two ways.

Use the disputes app in Primer Workflows

Primer Workflows connect apps in a simple UI without using a single line of code.

By creating a disputes app that's available to any merchant using our automation engine, we've unlocked a whole new set of use cases, including:

Sending dispute events to fraud tools like Riskified often requires this information to improve risk models or reimburse chargebacks.

Automatically refunding payments when a card issuer launches a retrieval investigation, avoiding chargeback fees.

Preventing orders from being dispatched if a dispute has been raised.

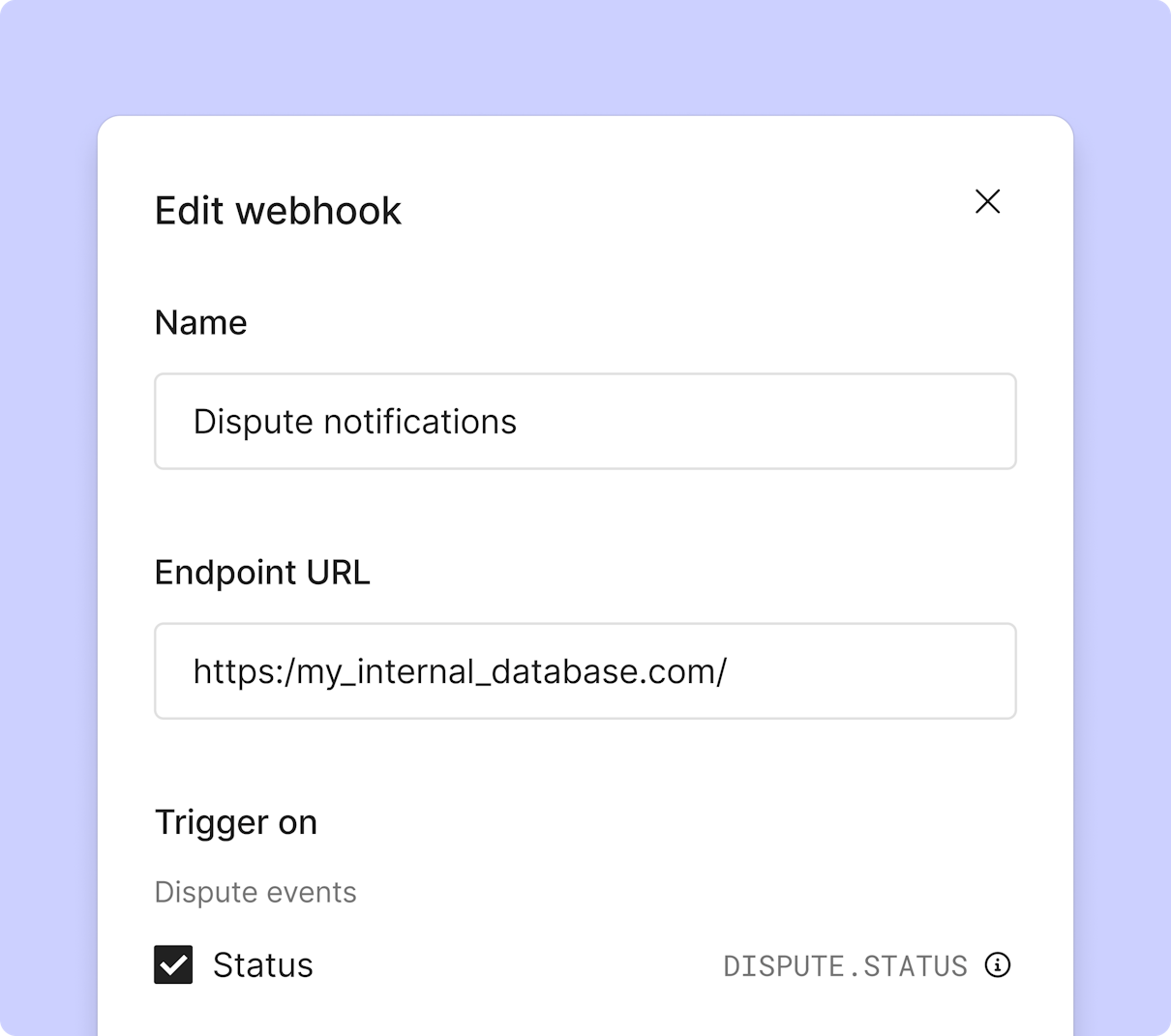

Set up webhooks in the dashboard

Using the Developers page in the Primer dashboard, in a matter of seconds, you can also set up webhooks to push this data wherever you need it. This allows you always to receive dispute data in the same format, no matter which payment processor or payment method is used. These webhooks allow data to be shared when a workflow makes less sense, such as sending data to a fraud engine that's been built in-house.

With Primer, making use of dispute data has never been simpler. Our unified disputes product allows your team to quickly access your data and effortlessly automate data flows in Workflows, with zero code or effort required.

Final thoughts

Navigating dispute chargebacks can be a daunting task for any business owner. But with the right knowledge and strategies, merchants can effectively manage and even reduce chargeback incidences.

A proactive, well-informed, and technologically-empowered approach can significantly alter the chargeback narrative for merchants. It's time to turn challenges into opportunities and complexities into simplified solutions, all for your business's financial health and growth.

For more streamlined dispute reporting across your processors, use Primer.

FAQs

What happens when a merchant wins a chargeback dispute?

The previously reversed transaction is reinstated when a merchant successfully wins a chargeback dispute. This means that the funds returned to the customer are once again debited from the customer's account and credited back to the merchant's account. However, the merchant typically won't recoup the administrative fees associated with the dispute process.

Does a chargeback hurt a merchant even if they win?

A chargeback can still impact a merchant negatively even if they win the dispute. First, there are the administrative costs of contesting the chargeback. These include the time and resources spent gathering evidence and crafting a persuasive rebuttal. These costs are incurred regardless of the dispute's outcome.

Secondly, while a successful dispute resolution removes the specific chargeback from the merchant's chargeback ratio, multiple chargeback occurrences can still be a red flag to banks and credit card processors. A pattern of chargebacks, even if disputed successfully, can potentially lead to higher processing fees or stricter terms in the future.

Who decides who wins a chargeback?

The decision of who wins a chargeback dispute lies primarily with the customer's issuing bank.