Spotlight: Open Banking

A catalyst for innovation in financial services

Open banking is one of the hottest topics in payments, and for good reason, given its potential to reshape the financial services and payment landscape.

Yet, for all the excitement around open banking as a concept, it's fair to say it hasn't hit the home run many expected yet. In the UK, for example, only 11% of the population uses open banking services, according to the October 2023 Open Banking Impact Report.

That said, there's an inevitability of open banking entering the mainstream, so open banking should be on your radar.

Let's look at what open banking is, the trends surrounding it, and what questions you should ask when considering it as part of your payment strategy.

What is open banking?

Open banking allows third-party financial service providers to access customers' financial information and payment systems with their consent. It allows customers to share their banking data securely using open APIs (application programming interfaces).

Open banking is a broad concept, so as you'd expect, various things get bundled under the open banking banner. For example, sharing financial data enables customers to access new financial products and services that better meet their needs, such as personalized financial advice, budgeting tools, and easier ways to manage their accounts across multiple providers.

But it's payments where open banking has one of the most compelling use cases. Open banking payments are the next generation of account-to-account (A2A), facilitating the fast, low-cost, seamless transfer of funds between two bank accounts.

Keep reading to learn more about account-to-account payments.

The growth of account-to-account payments

An account-to-account payment is a direct fund transfer from one account to another, bypassing intermediaries such as card networks. Account-to-account payment has many benefits for merchants, not least cost, where the fees are considerably lower than accepting payments using traditional card rails.

There are three primary ways A2A payments occur:

Bank transfers: Payers initiate transactions through their online banking apps—often called push payments.

Domestic and regional payment schemes: Specific markets feature specialized payment schemes, like iDEAL in The Netherlands and PayNow in Singapore. An example of cross-border A2A payment is SEPA Instant.

Open banking: Key providers like Trustly and Volt enable direct A2A payments at the checkout on behalf of payers.

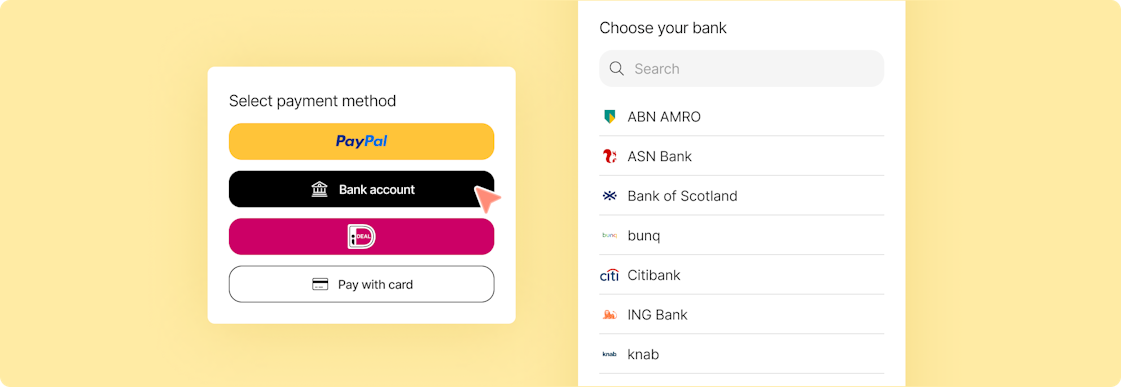

As mentioned earlier, open banking is the next generation of account-to-account that brings it right to the checkout. This means that consumers can make payments directly from their bank account in just a few clicks and without leaving the checkout flow.

Top open banking providers

With the anticipated growth of open banking payments globally, many providers now offer merchants the ability to accept open banking payments from customers. Some notable names include:

Tink

Trustly

Volt

Yapily

Five questions you should ask if you’re considering open banking

Open banking payments might not be mainstream, but it's coming. It'll pay to prepare and get ready to accept open banking payments from your customers before the demand comes.

Here are some questions to ask open banking providers to find the best solution for your needs.

1. What’s your coverage?

When selecting an open banking provider, it is crucial to consider the geographical coverage offered. Electronic Funds Transfer (EFT) is primarily used in the United States, while open banking is used mainly in Europe. It is important to note that certain open banking players may have diverse coverage based on the number of banking providers they have integrated with. In some cases, it's not just about the number of connections but also the breadth of connections. This will translate into offering extensive coverage in any banked population.

Depending on your market demographics, you must know the coverage breakdown across retail, business, or corporate bank accounts and each market. In summary, it’s critical that the open banking provider you choose has sufficient coverage in your target market to meet your customers' needs.

2. What's the API uptime?

Ask for the percentage uptime of any given API integration. What happens in the event of a failure, and what’s the fallback plan? Uptime can normally translate into a specific conversion rate based on the customer's ability to access the required bank and complete the payment.

3. What is the customer journey?

Within the open banking journey, there are additional steps the customer needs to take to complete the payment successfully that provide a layer of security, but—if not handled carefully—it could turn into a conversion disaster.

In Europe - does the customer have an easy way to check if they can pay with their bank of choice?

In the US, when it comes to the customer account verification step, do they need to enter the IBAN and other information manually every time, or is there a seamless journey for the returning customer?

How is the redirect handled to let the customer complete the payment with their bank account?

4. What’s your payment strategy?

Consumers expect a high degree of personalization and choice in their shopping experience – whether it’s a curated product selection or being able to pay where, how, and when they want. With one in five consumers abandoning their checkout when their preferred payment method is unavailable, merchants are under ever-increasing pressure to deliver the best possible experience to protect revenue and conversion while reducing checkout abandonment rates.

When looking for a cost-effective method and almost instant settlement of funds, account-to-account payments are a payment option that merchants should explore within their payments stack.

5. What’s your business model?

Depending on your business model, the ability to offer recurring subscriptions or refunds could be critical. Would one provider be compatible with your business model and meet your business use case requirements? If you are expanding into different geographies and would like to offer different flows such as EFT/ ACH, RTP, and recurring payments - does the provider cater to your requirements, or would you need to use a combination of integrations?

Global Open Banking Providers

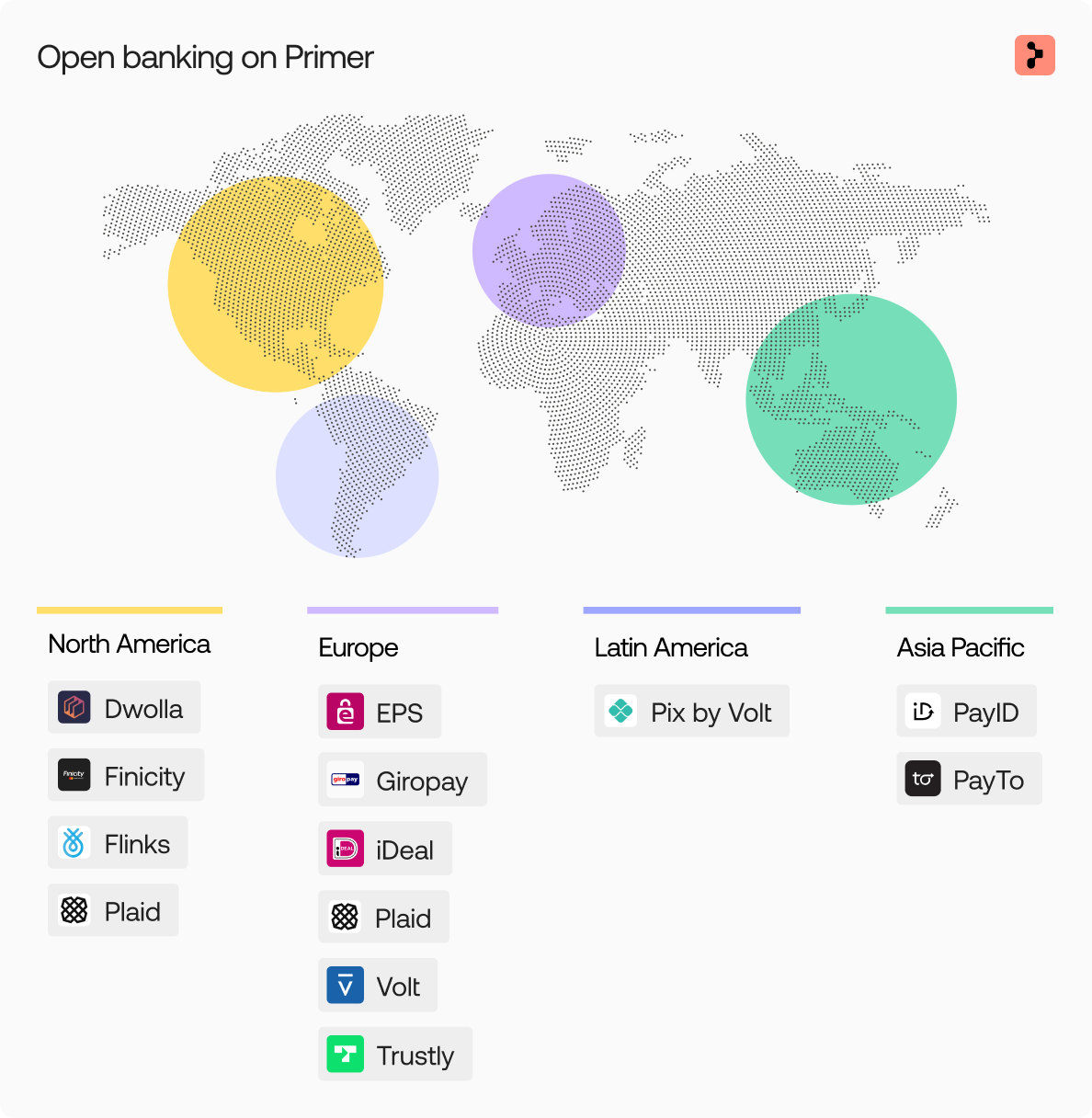

More than 50 countries are rolling out open banking initiatives globally. Some countries and regions have well-developed open banking ecosystems and regulatory frameworks, while others have less.

These “open ecosystems” typically comprise banks and financial institutions, fintechs, and technical service providers. Initiatives such as PIX in Brazil, the New Payments Platform (NPP) Consumer Data Right (CDR) in Australia, and the Smart Data Initiative in the UK have all set up working groups and roadmaps to outline data-sharing mechanisms.

Here’s a snapshot of some of the providers we have on the Primer platform today, and this is growing fast.

Conclusion

According to Volt, 76% of banks worldwide expect customers to adopt open banking over the next three to five years. So, open banking and instant payments are gaining fast adoption globally.

While growth is inevitable, we should expect more features and use cases to be unlocked as the industry matures. With all that said, we believe that open banking is one to size up for any payment roadmap.

FAQs

What are the different types of ‘fast payments’?

There are many different types of transfer methods and payment rails. However, the main difference is that they have varying processing times.

RTP: The Real-Time Payment (RTP) network is known as RTP. As the name suggests, when a payment is initiated, it is delivered directly to the recipient's bank account. This takes place through The Clearing House.

ACH: Any payment processed through the Automated Clearing House Network is considered an ACH payment. Payments are collected into batches and processed regularly throughout the banking day. This is also a popular B2B method.

Wire Transfers: This takes place directly between two banks. Since banks tend to work at a slower rate than RTPs, a wire transfer can take up to 48 hours for the funds to be available in the recipient’s account

Open banking payments: An alternative to purchasing goods online rather than using debit cards or manual transfers. A secure payment method with instant payins and payouts

Explore more payment methods.