Snapshot: new Dashboard homepage

Tim here 👋 Product Manager for Dashboard. After speaking with hundreds of merchants across a variety of industries, we learned they all struggle with a fundamental issue: inconsistent data scattered across multiple dashboards, and overall lack of visibility across the payment lifecycle.

We just want consistent data from all of our payment services. The challenge is getting the right data in the right format.

Merchant in travel industry, United Kingdom

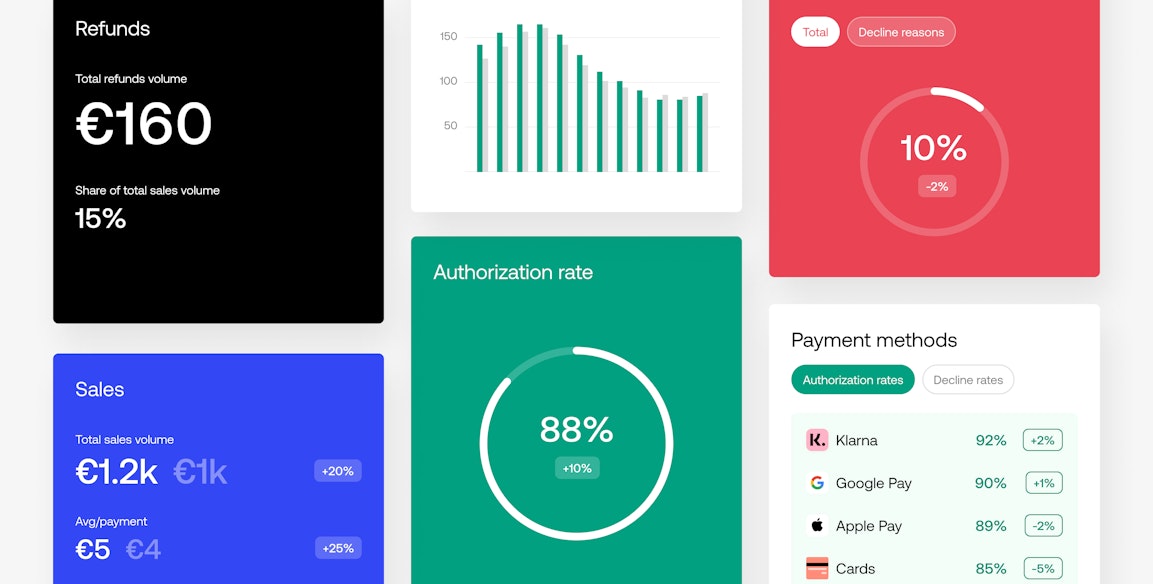

Snapshot is our first step towards giving you a centralized view, and insights across your payments stack with aggregated analytics.

With every service provider doing things their own way, simply aggregating data wasn't enough. With Primer Connect, our open app framework for third-party services, all connections adhere to the same underlying standards based on their connection "type" — so data can be normalized.

Here are few examples of what Snapshot can do today, but we're just getting started!

Check your payment performance

Assess the authorization and decline rates of your PSPs and payment methods side by side for the first time. From now on, you'll have an accurate understanding of how your payment services are performing, so you can make data-informed decisions.

We had an unusual amount of transactions being declined but we didn't know why. At some point we just stopped sending transactions to one of our PSPs and re-routed to another. We never got an explanation. It would be great to immediately see which processor is causing trouble.

Merchant in micro-mobility, France

Understand decline reasons

Declined payments aren't always a bad thing — you wouldn't want to process transactions on a stolen card, for example. Equally, you might want to retry a transaction at a later date for a softer form of decline. Understanding the reasons behind a decline is critical, but with PSPs and payment methods using non-standard codes, it's easier said than done.

We would like to route based on the decline reason, so that we can retry transactions that are declined due to 'Do not honor', but there is no point in retrying 'Stolen'. Currently, we just retry all declined transactions, which is expensive.

Merchant in Food delivery industry, Spain

We've given declines a spring clean. Card networks use standardized decline codes, but PSPs have their own mappings. We've seen some PSPs with over 150 codes! To make matters worse, the same codes can sometimes mean different things 🤦♂️

By analyzing transaction data across our merchant-base, we discovered that only a handful of codes were actually in use. We're dynamically tracking this as we introduce new processor connections.

Identify bottlenecks to improve conversion

Primer gives you full visibility of your customers from the moment the checkout is loaded, and through the entirety of the payment lifecycle. You might lose a customer mid-payment for a number of reasons, such as a slow response from a processor or fraud provider, a payment method that doesn't convert well, or frictional payment flows such as 3D Secure. Snapshot shows you exactly where this drop-off occurs, so you can take action.

Snapshot is just the very beginning for reporting and analytics at Primer. Work is well underway on a consolidated reporting solution to simplify settlement and reconciliation, and deliver market-first insights across the entire payments landscape.

We'd love to hear from you with your thoughts and requests to help increase data visibility across your payments infrastructure.