Realize more revenue with UpliftAI

Optimizing payments is a huge area of opportunity for every business. Even a slight uplift in authorization rates can significantly impact the bottom line.

The problem is that optimizing payments is hard. There’s no playbook to follow. There’s a near-infinite amount of variables at play. Payment leaders rarely have the data they need at their disposal. And the landscape is constantly changing.

We hear these issues from nearly every payment leader we speak to. We also hear how growing demands on them and their team mean they’re constantly making trade-offs between optimizing payment flows and building new functionality to support their business growth.

In other words: It’s a choice between innovation and optimization.

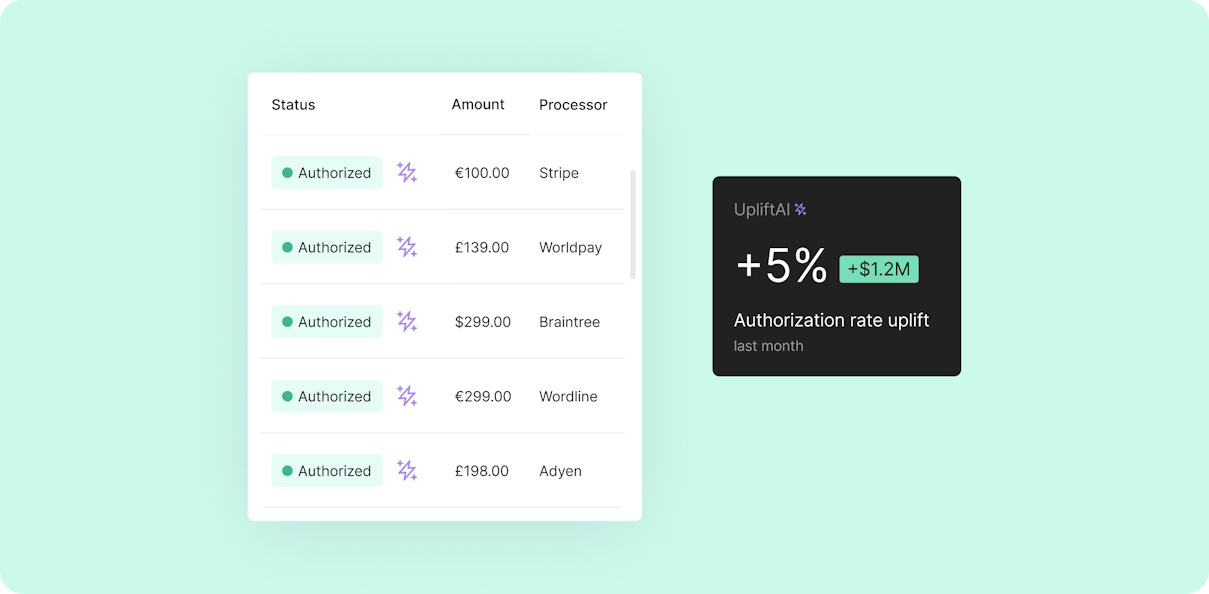

That’s why we’re thrilled to introduce UpliftAI, giving you the power to effortlessly optimize your payments.

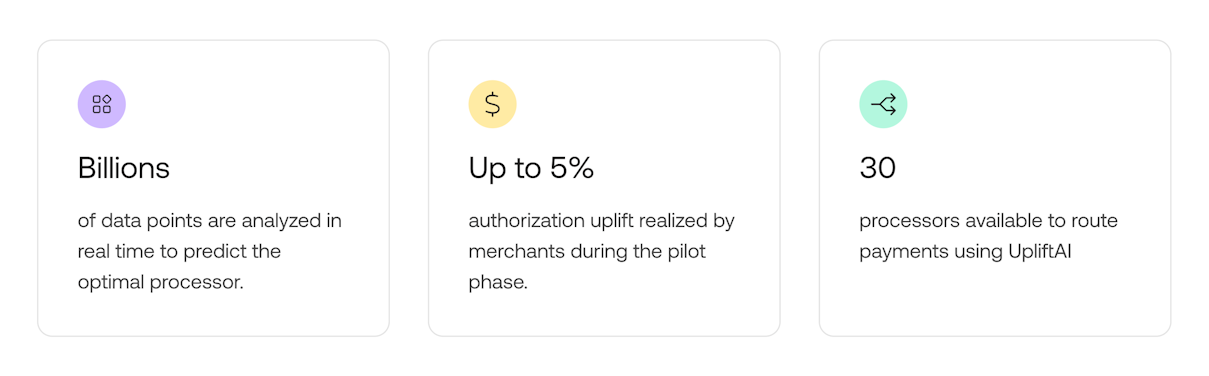

UpliftAI, our AI-driven smart routing solution, analyzes billions of data points flowing through the Primer platform to predict the ideal payment route for each transaction, in real-time, across all payment processors. And no complex coding or development work is required—you enable UpliftAI with the flip of a switch.

Several merchants operating in the retail, gaming, and travel industries have flipped the switch on UpliftAI in the last few months to realize an authorization rate uplift of as much as 5%, driving increased revenue and unleashing the potential of their payments.

How UpliftAI improves authorization rates

Payments is an incredibly dynamic space. Yet nearly all businesses approach it statically, using rigid rules to inform how they process payments. These rules may be complex, but they’re still static.

Let’s look at the steps a payment manager typically takes when optimizing part of the payment flow to illustrate the point.

First, they’ll spend time analyzing their data—which, as we know, is often not giving them the complete picture. Then, they’ll build a hypothesis around what they expect to see by changing X to Y before entering whatever system used to make that change—which can be very complex and often requires developer involvement.

It’s a time-consuming process, often relying on guesswork. And, to make matters worse, there's no guarantee the efforts will impact overall performance.

That’s how things had to be until now.

With UpliftAI, you can move away from this legacy, static, rules-based approach, becoming truly dynamic in how you process your payments. Let’s take a look under the hood to show how UpliftAI works:

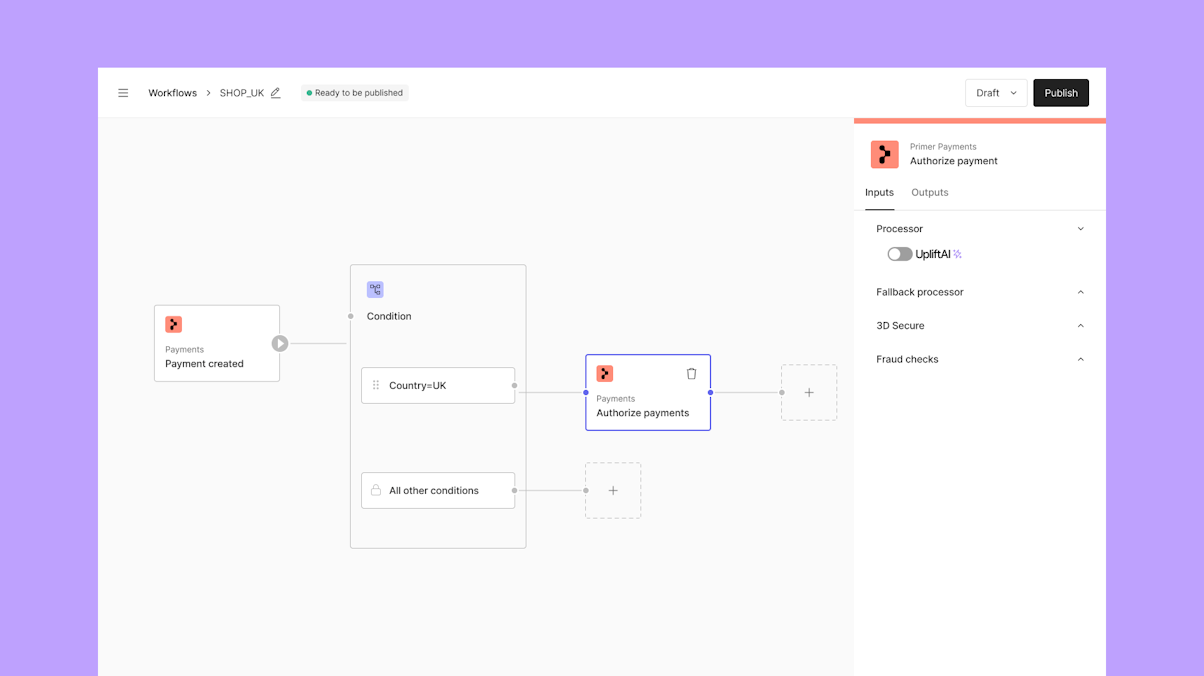

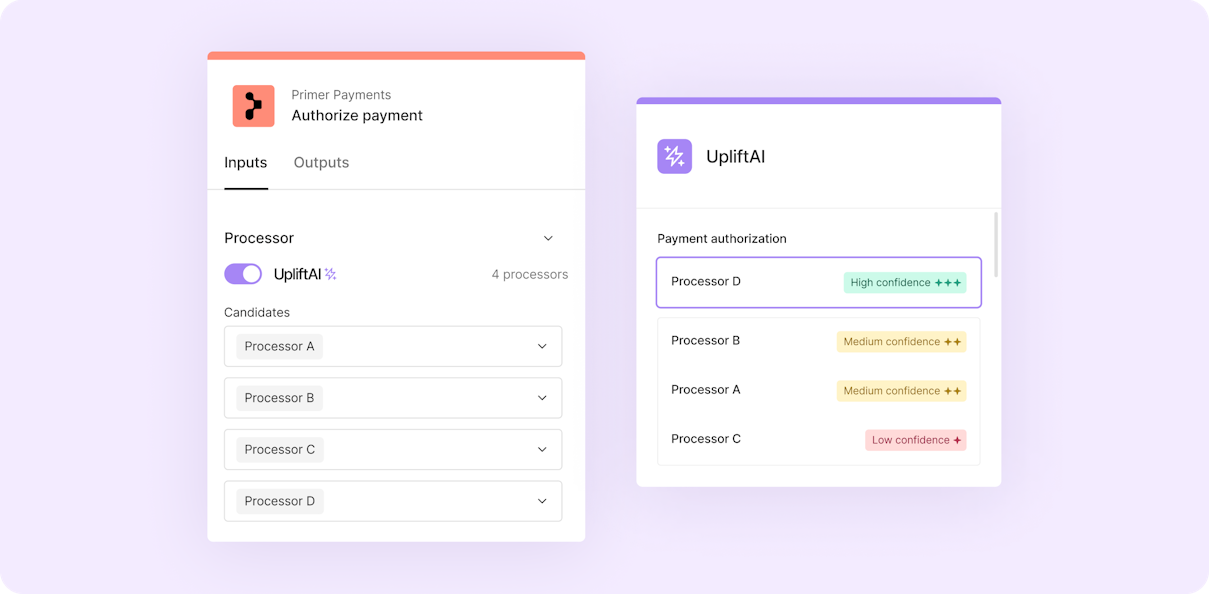

You configure UpliftAI in the ‘authorize’ section of the Primer Payments app and choose a default processor as well as up to four other processors you'd like UpliftAI to assess.

The Primer Payments app sends the data to UpliftAI through an API when your customer initiates a payment.

The UpliftAI algorithm simulates authorization with your different processors.

It calculates the confidence level for each processor with 25ms on average and sends its recommendation to the Primer Payments app.

The Primer Payments app sends an authorization request to the recommended processor.

Switching on UpliftAI on Primer

Here’s how you switch on UpliftAI on Primer with the flip of a switch.

Unboxing UpliftAI with Art Koci, Machine Learning Engineer at Primer

UpliftAI is a product we’ve been thinking about and working on for a while here at Primer. But we wanted to get it right and deliver something that genuinely adds value to merchants.

At its core, UpliftAI is a machine learning binary classification model that’s trained on millions of payments and billions of unique data points. And it’s learning every day with every new payment it sees.

However, two factors set the solution apart and make it unique in the payment space.

Primer is in a unique position, with virtually complete visibility of the payment lifecycle. This visibility enables us to create products like UpliftAI and help merchants improve performance across the entire payment stack.

We also spent significant time and effort building bespoke features and running experiments while creating UpliftAI. This isn’t an off-the-shelf model that anyone can replicate. For example, we ran experiments on hundreds of different data elements identified as having a potential impact, including building custom data points on top of the standard payment data.

These factors mean we’re bringing an incredibly powerful and unique solution to the market that will deliver significant value to the merchants who use it.

Check out this blog to learn more about how we built UpliftAI.

Insights from the UpliftAI pilot

Before we launched UpliftAI into the world, we wanted to ensure we tested its performance in the real world. For the last few months, we’ve run a pilot of UpliftAI with a group of merchants already using Primer. These merchants sell globally, work with multiple processors, and have built workflows to optimize their authorization rates.

We’ll launch case studies with our pilot merchants in the coming months. But here’s an overview of what we learned over the last few months. We used a control cohort of transactions (roughly 15% of each merchant’s volume) to assess the model’s performance.

All merchants on the pilot recorded an authorization rate uplift—some by as much as 5%.

Merchants only using two payment processors still saw an improvement in their authorization rates.

The more diverse payment samples regarding customer location, currency, etc., the better the model performs.

UpliftAI selected the merchant’s default processor for 75% of transactions. For the remaining 25%, UpliftAI made alternative suggestions.

The power of an AI-enabled Unified Payments Infrastructure

Primer’s position as a Unified Payments Infrastructure gives merchants using UpliftAI a distinctive advantage.

We see performance across all payment processors we have integrations with—something no individual PSP can achieve. We also see the data from all the businesses using Primer—providing UpliftAI with a more diverse data set than a merchant building an in-house optimization engine can access.

We also offer a complementary suite of tools that work in tandem with UpliftAI that allow you to unlock even more from your payments.

Recover revenue with smart fallbacks

AI is not infallible. There will be times when things change, and the algorithm makes an incorrect suggestion. These will be very rare, but they may happen. With Primer, that doesn’t mean you need to lose the sale. By implementing a fallback step in your workflows, you can reroute the payment automatically through a different processor should the one initially chosen by AI have a sudden outage—or other issues—and deliver a successful authorization.

Uncover deeper insights with Observability

Primer is anything but a black box. We built Observability to allow you to explore and use your payment data in whatever makes sense to your business. You can create high-level reports for reporting or go deep and explore the most granular aspects of your payments flow, allowing you to visualize payment success and revenue impact—and you can always double-click to find further optimization opportunities.

Abstract the complexity of authentication

Optimizing authentication using 3DS is another pain point for merchants and one that we’re helping solve with Adaptive 3DS. The solution ensures that you only ask your customer to authenticate when necessary. You can easily switch on Adaptive 3DS in your workflows, and it’ll kick in once UpliftAI has selected the optimal processor to process the transaction.

One small switch for you. One giant uplift for payments

AI in for payments is here. And with UpliftAI, you can unlock huge gains with one switch. But it’s just the start—using AI to optimize payment success is the beginning of the journey.

We’re incredibly bullish about the potential of AI to support business decision-making and performance along the entire customer journey. We’re exploring many ways of using AI both in service of our mission of rebuilding payments and commerce and to give you and your business the tools you need to unleash your full potential.