Everything we announced at our first product keynote of 2022

On April 5, 2022, Primer hosted its very first product keynote. In this virtual event, Gab and I led a full product demo, and merchants and partners using Primer shared valuable insight into their payment strategy. To top things off, we also revealed some exciting and major product releases coming later this year.

In case you missed it, here’s a quick recap of everything we announced at the event. You can also watch the full event recording, anytime you like.

Updates to Workflows

Primer’s Workflows are the heart of our platform, enabling merchants to build sophisticated payment flows that optimise for payment success. Improved authorisation rates, increased conversion at checkout, cost reduction, unified fraud efforts and smart fallback and retry strategies; Workflows allow merchants to implement enterprise-level business logic across the entire payment lifecycle, minus the code.

Now, Workflows are getting even more powerful. With this new update, not only can you add any number of third-party apps from across the payment and commerce stack into your Workflows seamlessly (such as fraud services, KYC, loyalty, payouts, shipping and many more)—you can now also connect any service from across the web.

Take customer support and internal operations as an example. These can now be significantly streamlined by adding actions and triggers from services like Slack, Zendesk, Twilio, SendGrid, and hundreds more in the future.

One-click checkout

If you’re not familiar with one-click checkout services, these aim to improve conversion at checkout by storing your customer’s details in a shared vault, across an entire network of partner-merchants.

So, if a customer has registered their details in an online store, they can sign in and make a purchase much faster next time. This ensures a swifter and more enjoyable customer journey, while reducing those dreaded cart abandonments.

Over the past couple of months, we’ve created a one-click checkout with no compromises. Thanks to our centralised, PCI-compliant vault, Primer’s one-click checkout is compatible with all payment services, across any payment processor. We’re making this available via Universal Checkout, so no additional integration work will be needed.

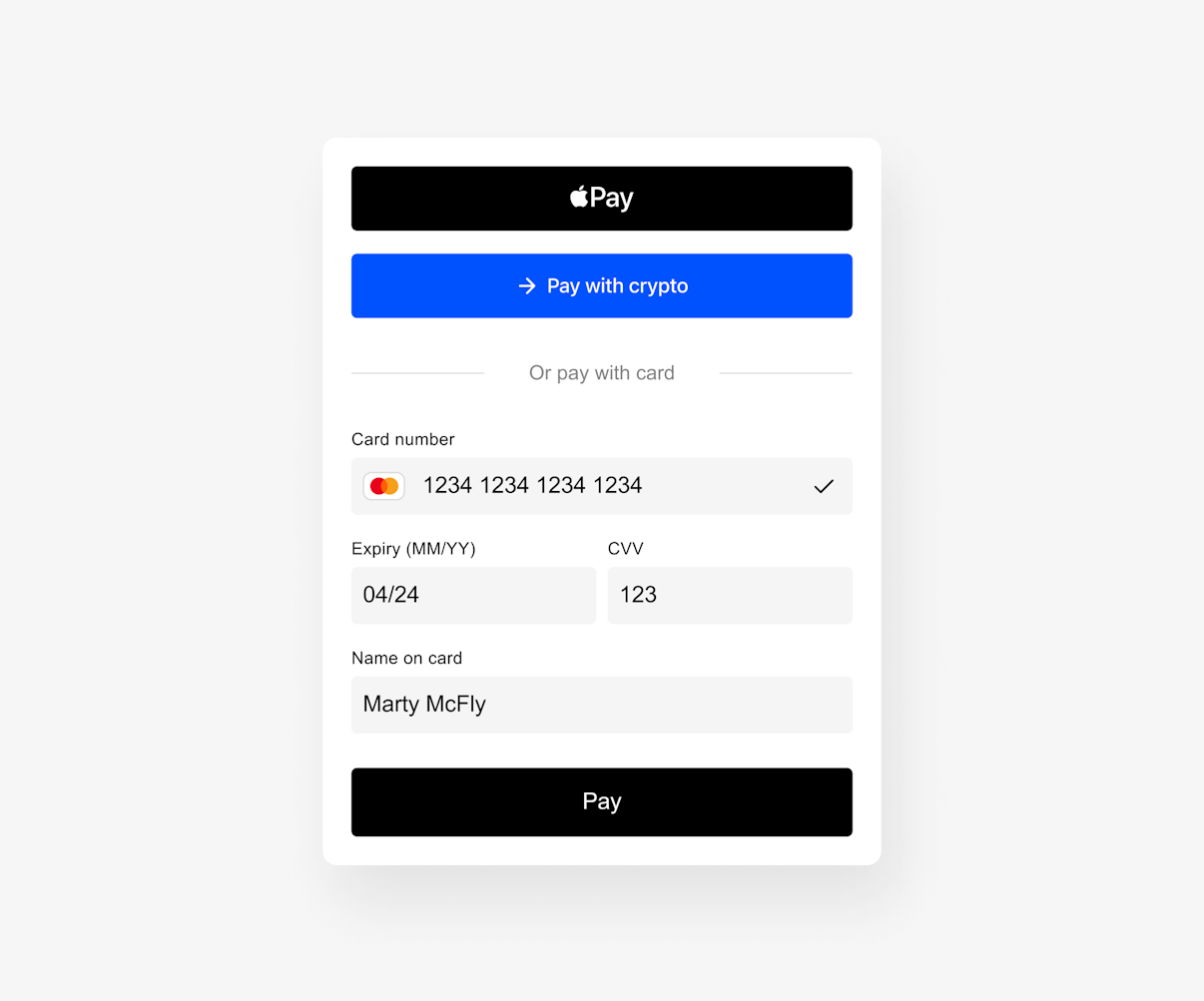

Crypto & Web3 wallets

As we expand and work with more and more global merchants, we see a growing appetite for crypto as a payment method. Similar to one-click checkout, we wanted to provide merchants and partners with maximum extensibility when implementing crypto alongside other, more traditional payment methods. Universal Checkout and Workflows make all this possible.

We’re excited to launch Web3 wallets on Universal Checkout, as well as support for crypto platforms and exchanges, so you can convert cryptocurrency to fiat currencies as part of the payment lifecycle.

We’re working with a select group of merchants to test both one-click checkout and Web3 payments, so if this is something you’re interested in exploring, get in touch with us.

Primer Adapt

We obsess over payment success at Primer. As an agnostic infrastructure, we have unique visibility of the entire payment stack, providing us with some incredibly powerful data across our merchant base. Our new Data Team has been hard at work building a game-changing new service called Primer Adapt.

Primer Adapt is an expanding set of services leveraging an ever-growing number of data points across the Primer ecosystem, to dynamically optimise your flows for payment success.

Adaptive 3DS can accurately predict whether or not customers will be prompted for 3DS authentication. It’ll also prompt customers for 3DS if their card has been declined, resulting in less friction for customers and fewer lost payments.

Not all processors are built the same, and authorisation rates vary over time. To increase payment success, Adaptive Routing dynamically selects processors with the highest likelihood of authorising any given transaction.

Adaptive Failovers track uptime and processor performance across our ecosystem in order to failover intelligently. This results in more payments and less chance of duplication, or having to void payments when incidents occur.

Reconciliation

Typically, finance teams need to log in to each processor portal, then collate data into a unified format for their ERP and accounting tools. These require ongoing maintenance and months of engineering effort if custom solutions are involved.

This fragmentation of data across transaction requests and settled payments leaves plenty of room for error, since no single source of truth is available. A black box, where merchants fail to understand the fees they’re paying, and why.

Complex spreadsheets no more. Primer is launching reconciliation—unified observability and financial ops management for the entire commerce lifecycle. You’ll get a unified ledger that seamlessly consolidates settlement data across all processors and handles reconciliation.

Primer automatically collects settlement data from your processors via APIs and SFTP in one place. This data is matched against your unified Primer ledger to identify conflicts, providing you with tools to quickly resolve these. Once reconciled, your transactions can be synced with your accounting, finance, and business intelligence tools.

We’re aiming to onboard merchants soon, so get in touch if you want to participate in our beta.

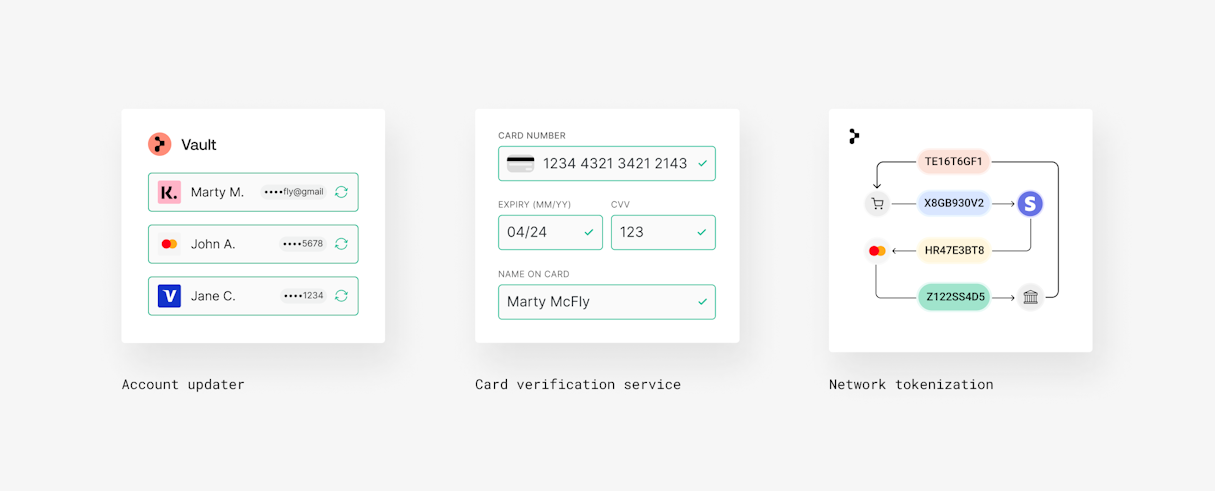

New payment services to increase your payment success

We’ll be launching new foundational payments services in the near future. These include:

Account updater

Card verification

Network tokenization

From reducing card declines and churn for subscription payments, to boosting authorisation rates—this critical infrastructure helps optimise payment success across your entire payment stack, while always remaining 100% agnostic.

We’ve got a lot more exciting things coming this year! Check out our product roundup on Primer’s Blog, and stay in the loop by following us on LinkedIn and Twitter.