Introducing Observability: Get unparalleled visibility across your payment stack

We’re thrilled to introduce Primer's latest product suite, Observability. Watch the demo to learn more.

With Observability we’re providing merchants with unparalleled visibility across their payment stack, helping them to optimize their payments, improve uptime, and drive more revenue.

What is Observability?

One of the most common pain points we hear from merchants around the world is that their payment data is a black box.

With their payment data living across multiple logins and dashboards, it’s impossible for merchants to see the full picture and use their own data to make data-driven decisions. What data they can get takes days to arrive, and has vastly different formats across the processors they work with.

We’ve built Observability to address these problems and to help merchants overcome these core payment related challenges:

Unifying their data – Observability consumes payment data from all payment processors and payment methods into one place

Proactively optimizing for revenue – We provide actionable insights to help merchants identify key patterns to increase authorization rates and maximize revenue

Detecting issues as they evolve – With real-time alerts, merchants can start solving payment problems before they affect customers, therefore reducing complaints, refunds, and chargebacks

Unify, optimize, and detect–in a nutshell. With Observability, payment product managers now have a single-source of truth for their payment data, and the tools at their disposal to make better, quicker decisions.

Before @Primer, we had entire teams dedicated to reporting. Now, we do it all completely on our own 💪🤓

Kyle Heller, Co-Founder & CPO at Veeps

How the product works

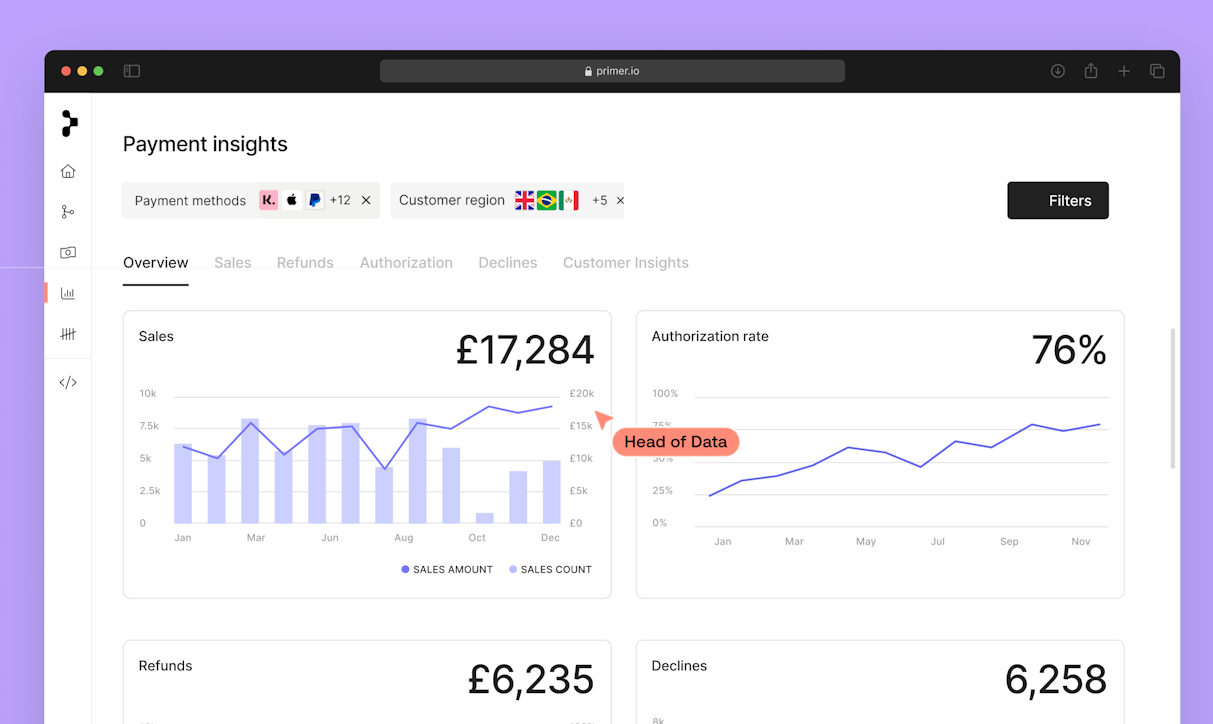

We start with the payment insights dashboard, which gives merchants a view into critical payment metrics, including sales, refunds, authorization rates, 3D secure conversion, decline metrics and more.

Primer standardizes this data across the 100s of processors and payment methods that we work with. So no matter which payment methods or processors you use, you can finally make a like-for-like comparison, and start to optimise payment performance.

We’ve built Observability to let you easily deep dive into your payment data.

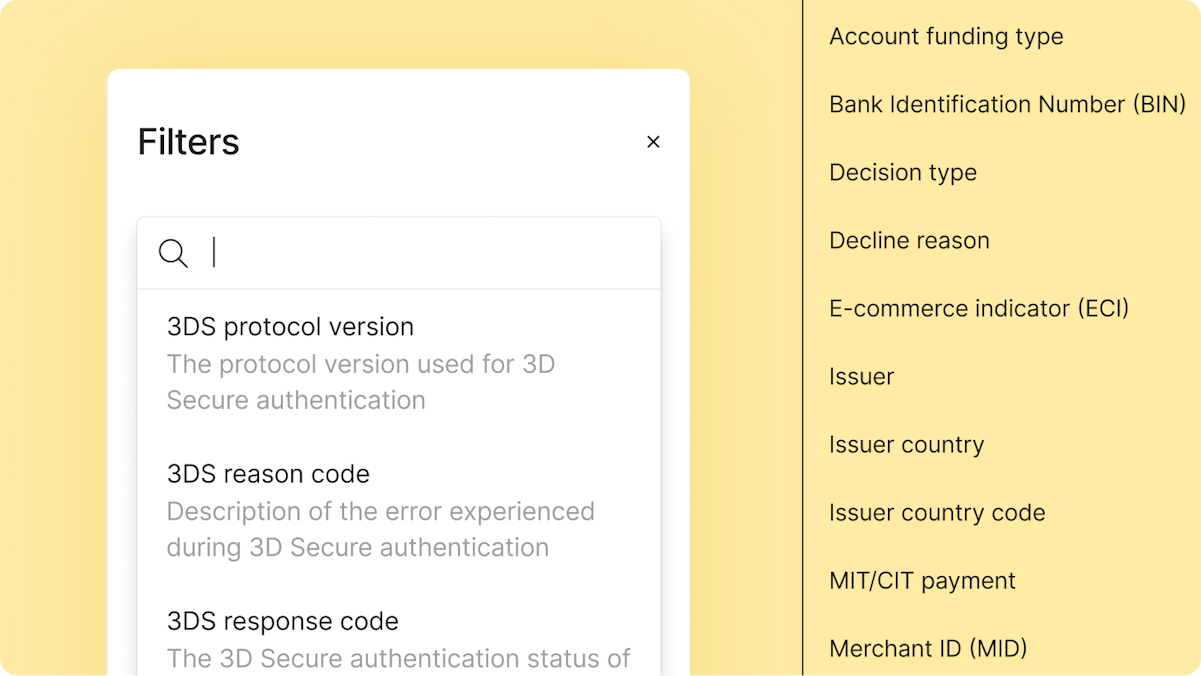

In payments, optimizations are often made on the fringes, and our 25+ filters empower merchants to analyse the most granular level of detail to optimise their payment performance.

Merchants can slice and dice their data by processor, MIDs, decline reason, etc. Merchants also get access to rich insights from Primer’s proprietary BIN service, decoupled 3D secure for card payments, unified decline code mapping, and more.

Finally, merchants can always get the full view of a payment, with a link direct to the raw payment data, including request and response details.

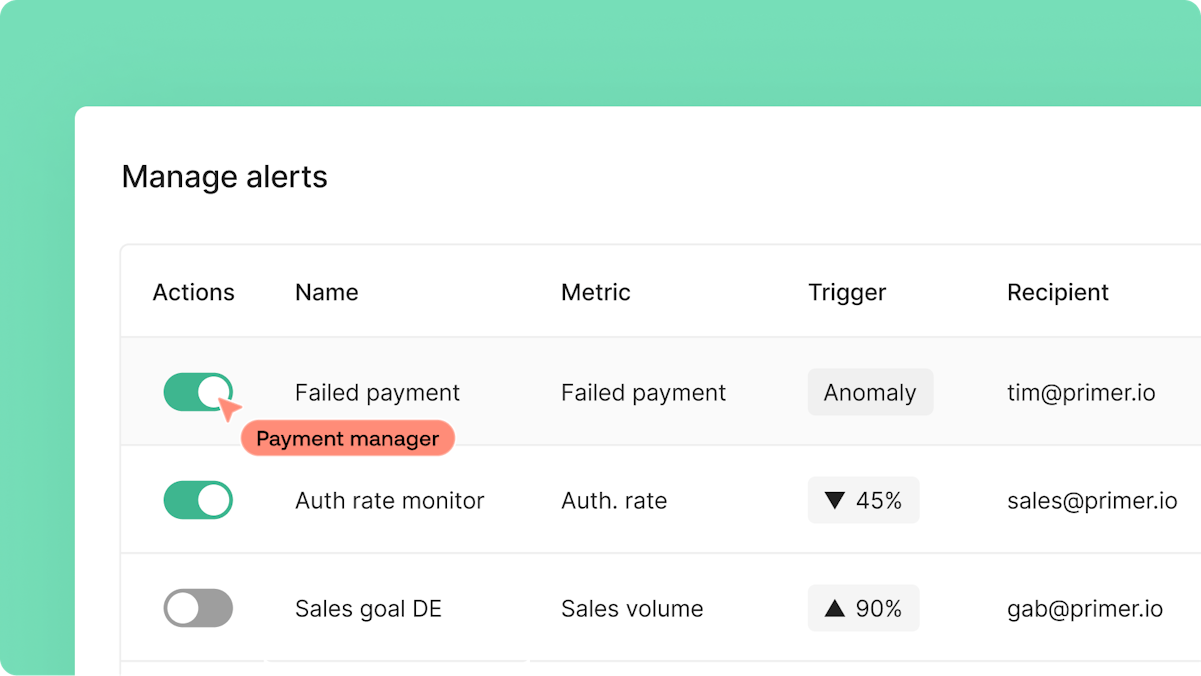

One of the benefits of working with real-time payment data is that Primer can detect issues as they happen, for example a spike in failed or declined payments.

Merchants can choose to get notified on pre-defined thresholds, or make use of our proprietary machine learning anomaly detection service.

We’re aware that merchants don’t monitor these dashboards 24/7. They can get notified on Slack, PagerDuty, or any 3rd party service when an issue arises–helping them resolve issues quickly, and minimise lost revenue.

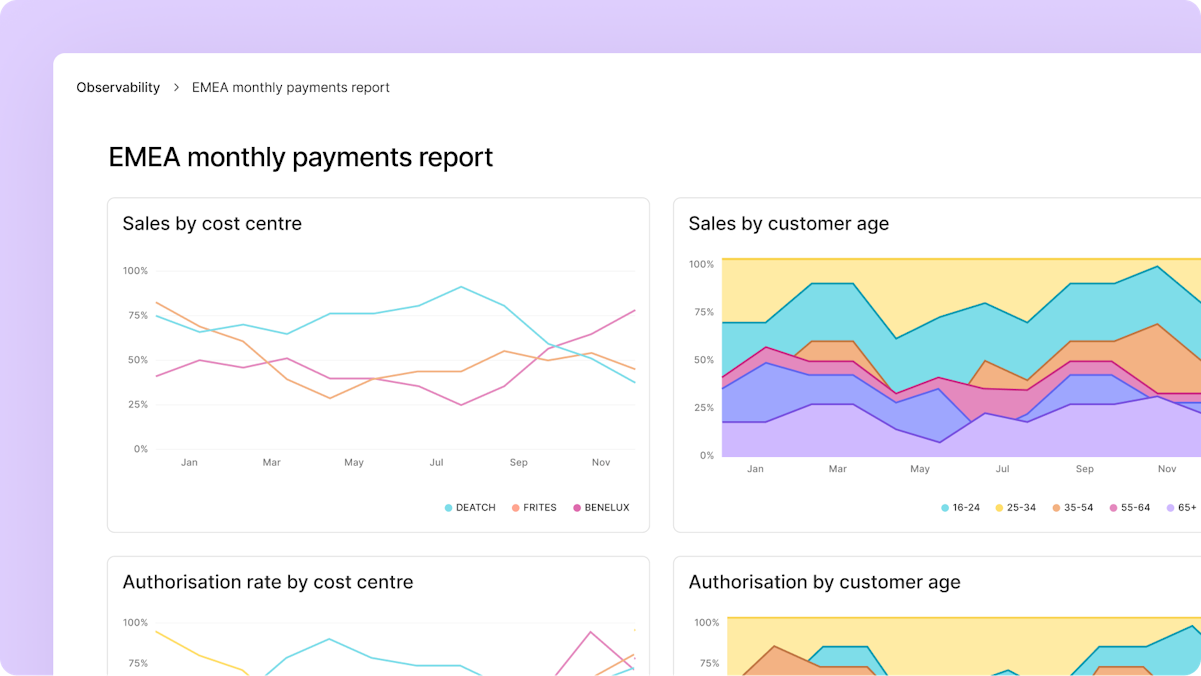

And to finish off, we appreciate that each business is unique and have therefore added the ability to create custom charts using any of the payment data we hold for merchants.

Keen to get a demo? Get in touch.

Use case: Optimizing processor performance with Observability

Our merchants are already using Observability to drive payment success.

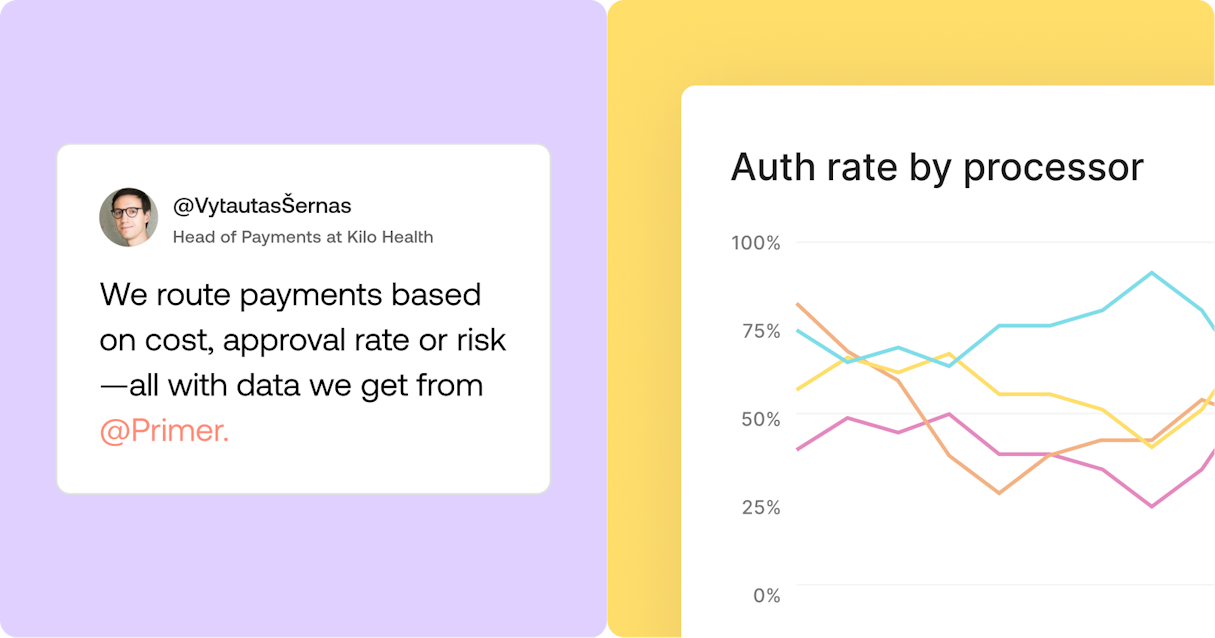

For merchants working with multiple processors across a number of markets, we help them unify their payment data across all their processors into a single dashboard.

With this unified view, it’s now possible to see which processors perform the best for each market down to the BIN level, simply by applying filters to our detailed charts. Merchants can then use this data to route incoming payments to the optimal processor.

Use case: Detecting and mitigating a spike in declined payments

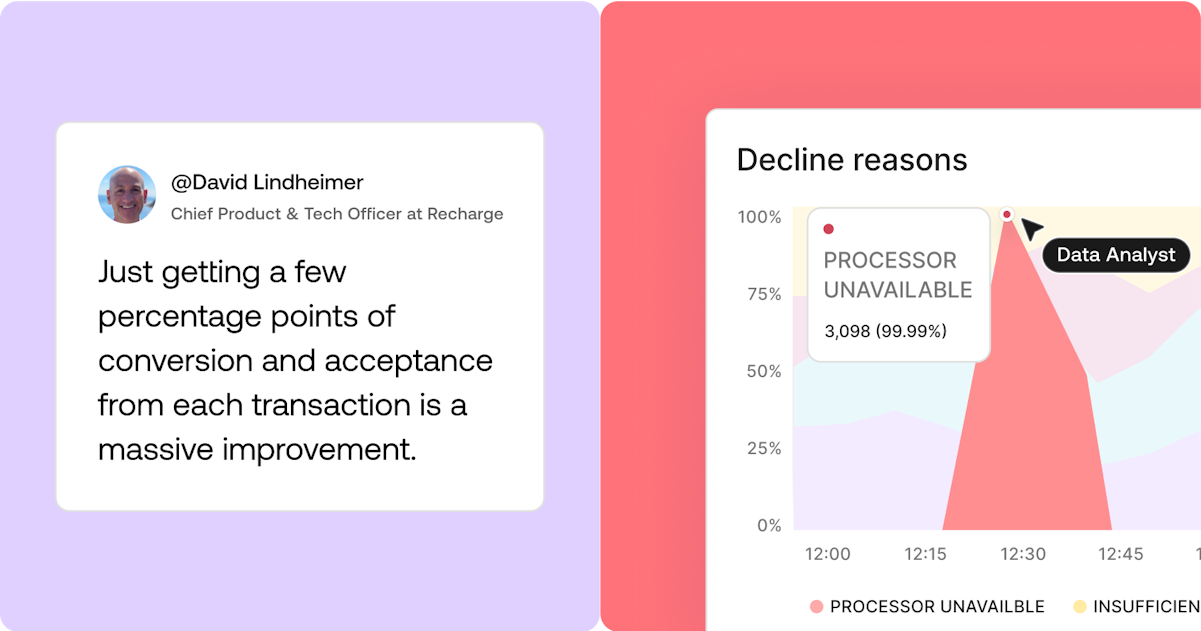

Observability helps merchants detect and mitigate potential issues, like an increase in failed or declined payments.

Our anomaly detection tools are constantly checking for any discrepancies in your payment data. For example, if there’s a spike in failed payments for a particular processor, you receive an immediate notification–on Slack, PagerDuty, or the system of your choice.

This notification helps you respond quickly, so you can swap out the affected processor to cut down on potentially lost revenue. If you’re using Primer to automate payments, you can quickly update your workflows to re-route payments until the outage is resolved, without a single line of code.

Great for data teams, too

We’re adding tools that your data team will love. This includes:

External payment insight API–so that you can import your own payment data into Primer’s Observability.

ETL (extract transform load), to help you stream your data and insights out of Primer into your data warehouse, easily.

These features are coming soon, and we'd be happy to give you a demo.

Book a demo

Observability is a comprehensive solution that provides merchants with a unified view of their payment data, helping them to optimize their payments, improve uptime, and drive more revenue.

To learn more, visit our product page or get in touch to arrange a demo.