Meet your customers' payment preferences

A simple guide to alternative payment methods

Cards are off the table

Digitally savvy consumers expect a high degree of personalisation and choice in their shopping experience – whether it’s a curated product selection or being able to pay where, how, and when they want.

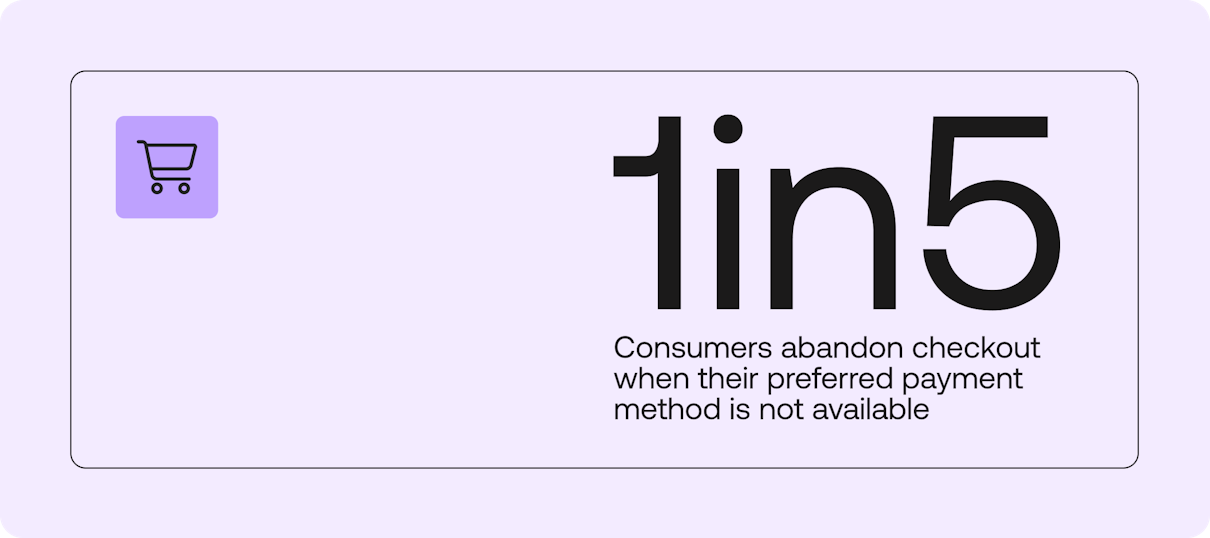

With one in five consumers abandoning their checkout when their preferred payment method is not available, merchants are under ever-increasing pressure to deliver the best possible experience to protect revenue and conversion while reducing checkout abandonment rates.

What’s more is that when merchants are looking to expand to new markets, payment methods become more localized and present a new layer of complexity. For example, American consumers prefer to pay by card whereas consumers in Asia may prefer cash or digital wallets.

APMs have been gaining ground over the once dominant cards and cash–with digital wallets alone accounting for roughly 49% of global ecommerce volume in 2021. Card use is projected to continue declining, while APMs like wallets, bank transfers, and BNPL are set to gain momentum across the globe.

To demystify Alternative Payment Methods (APMs), we have created a simple guide that looks at the popular and emerging APMs, examining key trends and how they work, so that merchants can make an informed decision when reviewing their payments strategy.

Types of alternative payment methods

1. Digital wallets

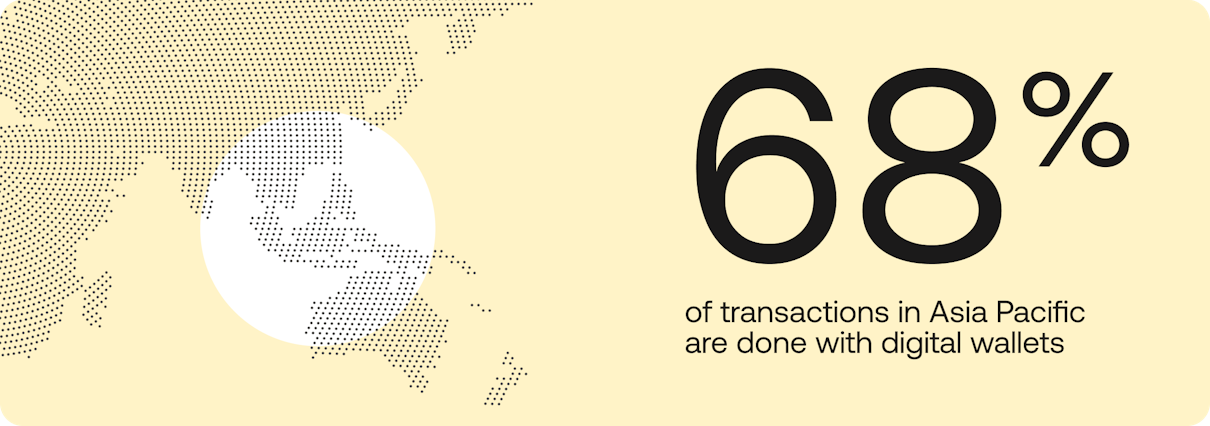

Digital wallets are one of the fastest growing payment methods, exploding in popularity within unbanked populations, where cash was previously dominant. In Asia Pacific, digital wallets now account for a whopping 68% of ecommerce transactions.

Acting as an electronic store of funds, users can easily access digital wallets to make payments, either with a unique identifier or through their electronic devices. With no physical card required, digital wallets are a preferred payment method for consumers allowing them to purchase and complete a checkout quickly, while still providing a secure transaction. This ease-of-use and security combined with many ways to “top-up” your wallets has helped with the rapid adoption of this payment method.

There are a number of different payment flows used by digital wallets, with some of the most common ones described below:

QR Code checkout flow: Examples include WeChat in China, PromptPay in Thailand, Bancontact in Belgium, GCash in the Philippines and KakaoPay in Korea. Users authorize a payment by scanning a generated QR code with their wallet app either online or in a physical store.

OTP checkout flow (One-time Password): Examples include OVO Wallet in Indonesia. Users are asked to enter their phone number and then complete the payment via the wallet app.

Redirect checkout flow: Examples include ShopeePay in SouthEast Asia and PayPal. The customer selects the digital wallet in the checkout page and is then redirected to the wallet website to authenticate and complete the transaction.

Wallet aggregator: An emerging trend has been of services that consolidate multiple digital wallets for a region. A popular example is AliPay+, launched by AliPay, that allows merchants to offer a number of popular wallets including Korea’s KakaoPay, the Philippines’ GCash, and Thailand’s TrueMoney, with a single integration.

2. Mobile wallets

Pass-through digital wallets, like Apple Pay and Google Pay, act as a digital representation of a financial account or card and allow users to make convenient contactless payments with a card or through their digital devices.

Markets with high card penetration tend to see the highest adoption of mobile wallets, like in the UK where contactless payment now represents more than 60% of all card payments.

Pass-through digital wallets greatly improve the speed of checkout, with quick biometrics authorisation, and with the wallets capable of storing additional information required at checkout, like the customer’s address, phone number, and email.

3. Bank transfers and Direct Debit

Digital banking has led to the growth of bank-to-bank payments in retail, becoming the 4th most popular way to pay globally, and dominating markets, like Brazil, where it’s used by more than 70% of the population.

Bank transfers allow consumers to pay online using direct online transfers from their bank account. To complete a bank transfer, customers select the payment method at checkout and then get redirected to their bank to authenticate and authorize the payment.

The rise in open banking technology has enabled more bank transfers which makes it incredibly convenient for online retailers and their customers. The extent of the impact and rollout varies depending on the country. In Singapore, more than 65% of the population use PayNow for one-off and recurring payments.

Direct Debit, while similar to bank transfers, is focussed on recurring payments. Consumers create an instruction to their bank to allow third parties to make withdrawals from their account on a recurring basis, often using a network like SEPA in Europe. Direct debit accounts for 4% of transactions in Europe and remains strong in Germany where it accounted for around 16% of e-comm transactions in 2021.

4. Buy Now Pay Later (BNPL)

Buy Now Pay Later (BNPL) allows customers to make a purchase and pay later - either in full or spreading the cost. For example, Klarna offers merchants a few products that they can display at checkout:

3 interest-free installments with the first payment on the checkout

Option to delay payment by 30 days with no payment upfront

Higher ticket financing with costs spread over 6, 12 or 36 months

For many consumers BNPL is more appealing than traditional credit because of faster credit approvals and low to interest-free repayment. BNPL companies are also more consumer-friendly, promising transparency and a great shopping experience. It’s especially popular with Gen Z who account for 75% of its users in the US, demonstrating a clear shift in consumer payment preferences for the next generation of spenders.

BNPL companies also appeal to merchants and help them drive revenue by giving them exposure to new customers, increasing conversion and average order value. This is a key reason behind the growth of BNPL across the globe, led by Klarna, Afterpay, Affirm, ShopBack PayLater, Atome, and PayPal.

5. Cash-based payments

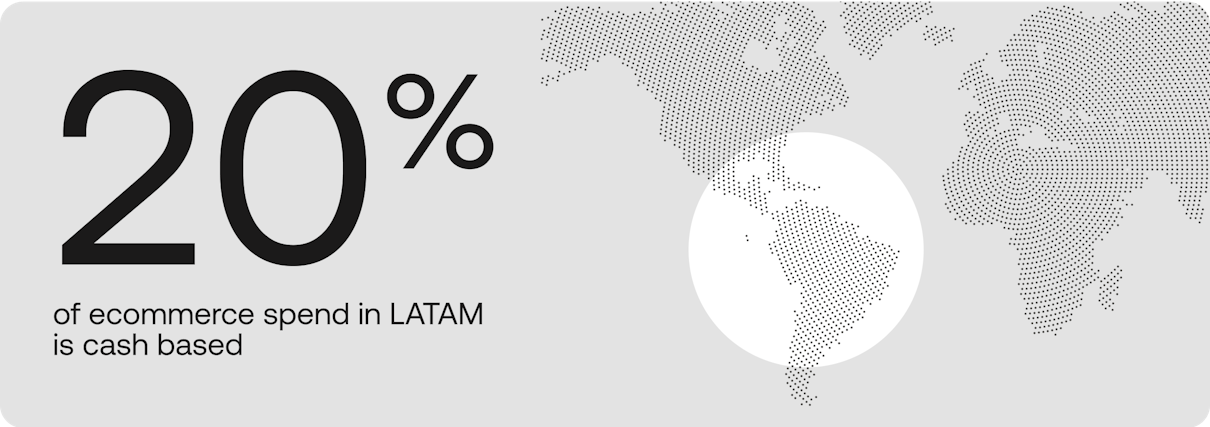

Cash-based payments are a popular payment method in some regions like Latin America where cash based payments account for 20% of ecommerce spend.

Cash-based payments typically start with a voucher with a barcode that the customer receives upon checking out. The customer can use this voucher at any participating physical store or bank and pay with cash.

While adopting cash-based payments gives merchants access to a wider group of consumers, merchants have to deal with a time delay on transactions being confirmed and longer settlement time.

That said, the payment method is seeing innovation in the customer experience. Some providers now let consumers scan their vouchers via their phone and then pay through their online banking app, making the payment instant and convenient.

6. Crypto

Despite being relatively new, high settlement speed and easy cross-border payments make cryptocurrency (or “crypto”) a strong candidate for being the dominant payment method of the future.

Despite being favored by high-income consumers and millennials, this is rapidly changing with an increased expectation to see crypto as a payment option at checkout across consumer demographics.

Consumers who want to pay with crypto need to make sure they have their crypto wallet set up. Where traditional payment methods “pull” the payment information from the customers’ card or bank account, in crypto payments the consumer pushes the payment from their wallet to the merchant instead. During this process the transaction is validated on the blockchain, which records the transaction and completes the payment.

For merchants looking to start accepting crypto, there are a few things to be mindful of:

Processing times vary depending on the digital currency used–it can take up to 10 minutes for users paying with Bitcoin or as little as 12 seconds with Ethereum.

Once the transaction is verified, it’s not possible to reverse the payment or make a refund.

A risk of underpayment and overpayment versus the transaction amount.

The easiest way for merchants to start offering crypto is by working with a partner. There are a number to pick from, including crypto focussed providers like Coinbase and TripleA, or traditional providers who now offer crypto payments, like Paypal.

Why you need alternative payment methods as part of your payment strategy

When scaling to new markets, a challenge for merchants is scaling their payment stack - and fast. Not only do they need to understand which payment methods are suitable in which market; but they also need to integrate and maintain those individual connections.

A ‘one size fits all’ approach could also alienate markets. Customers like familiarity, especially when it comes to parting with their money. Showing unknown or unrelatable payment options at the checkout is a risk to kill conversion.

Primer integrates with 100+ payment methods, including the world’s most popular APMs. What’s more, you can add new APMs to your payment stack in clicks, not code.

Learn more about our connections here.