How to optimize payments using network tokenization

CONTENTS

What is a network token?How do network tokens differ from other forms of tokenization?What are the benefits of network tokenization? What type of businesses should use network tokens? The Primer approach to network tokenization Agnostic tokenization means payment freedomA no-brainer for paymentsNetwork tokens are one of the hottest trends in payments today. It makes sense why there's such a buzz around them: It's a solution that promises to help merchants prevent fraud, improve authorization rates, and lower payment processing costs.

Let's explore network tokens and unpack the value they can deliver to merchants.

What is a network token?

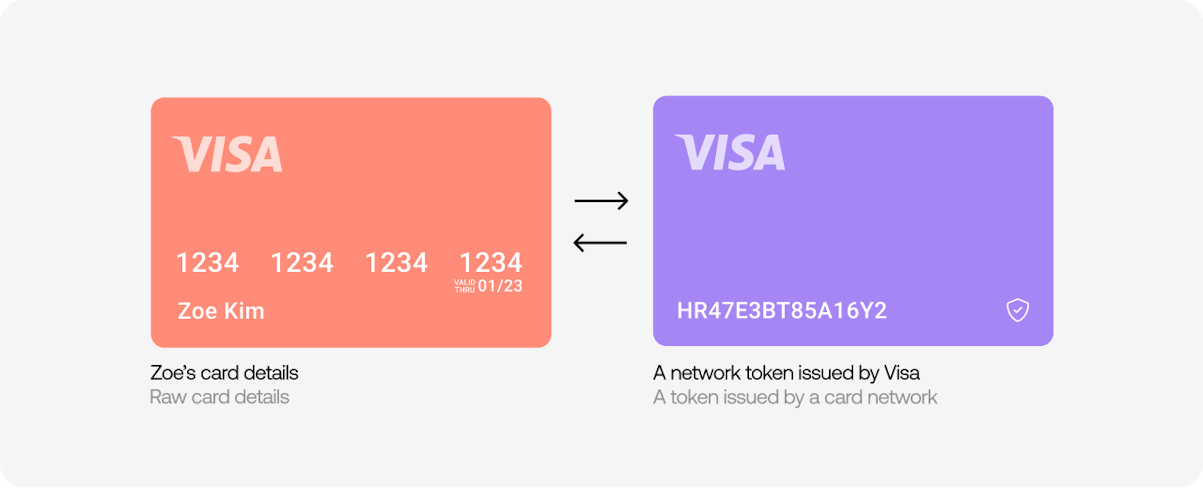

Network tokens are a proxy to the 16-digit primary account number (PAN)—the long number on a card. The card schemes, including American Express, Mastercard, and Visa, automatically generate these tokens in real-time when an individual uses their card.

How do network tokens differ from other forms of tokenization?

Many types of tokens exist in the payments ecosystem today: these include acquirer tokens, issuer tokens, payment tokens, and merchant tokens.

As their names suggest, different parties in the payment chain generate these tokens. They also serve slightly different functions. For instance, issuer tokens are generated to enable a customer to use their card on a mobile wallet like Apple Pay or Google Pay.

This is a different use case to a network token, which, as we explored earlier, is an alternative to a card's PAN.

What’s the difference between network tokenization and PCI tokenization?

PCI tokenization is where anyone generates a token and uses this instead of raw card data. Primer does this now, as does any PSP.

A network token is generated from the card network directly and is processor-agnostic. This is tied to the account of the card, and any updates (e.g., new card details) are sent from the card network to the token requestor, such as Primer.

What are the benefits of network tokenization?

Tokenized transactions that leverage network tokens provide multiple benefits to merchants and their customers. These include:

Reduced fraud rates

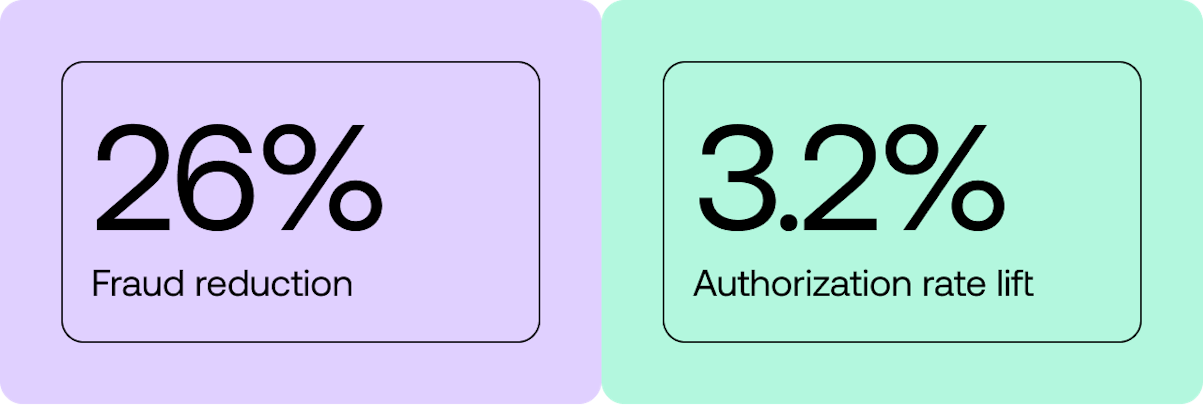

Using payment network tokenization is a more secure way to make a payment and reduces the risk of fraud because:

It minimizes the risk of exposing customers' sensitive card information because a token is passed around instead of the raw card details.

The token is also unique to the customer and merchant pairing and can't be used by a bad actor for any merchant online like they could with the PAN.

Increased revenue

Merchants using network tokens when processing transactions can expect increased authorization rates. To put this in perspective, research from Visa finds merchants using its tokens realize an average 2.1% authorization rate uplift for card-not-present transactions.

This uplift comes primarily from issuers having more confidence in the transaction's authenticity when a network token is used because of the fraud prevention characteristics outlined above.

Seamless user experience

The lower fraud and higher chance of payment approval delivered by network tokens are vital in creating a world-class customer payment experience.

But that's not all. Merchants using network tokens can ensure that their customers' card-on-file details are always up to date. That's because the card networks maintain the correct information between the card and the token.

This flow means the customer doesn't need to update their card information on a merchant's website, removing another friction point from the checkout.

Lower Interchange fees

The card schemes, like Visa and Mastercard, offer merchants lower interchange fees when transactions are processed with network tokens.

What type of businesses should use network tokens?

Every business selling online can benefit from network tokens for the reasons listed in the previous section. That said, a particular utility exists for those businesses offering subscription services.

These rely on recurring payments, but if a customer's card expires, the payment will fail, resulting in missed or lost revenue. As network tokens dynamically update the latest card data, these businesses are less likely to see payments fail and will reduce churn.

The Primer approach to network tokenization

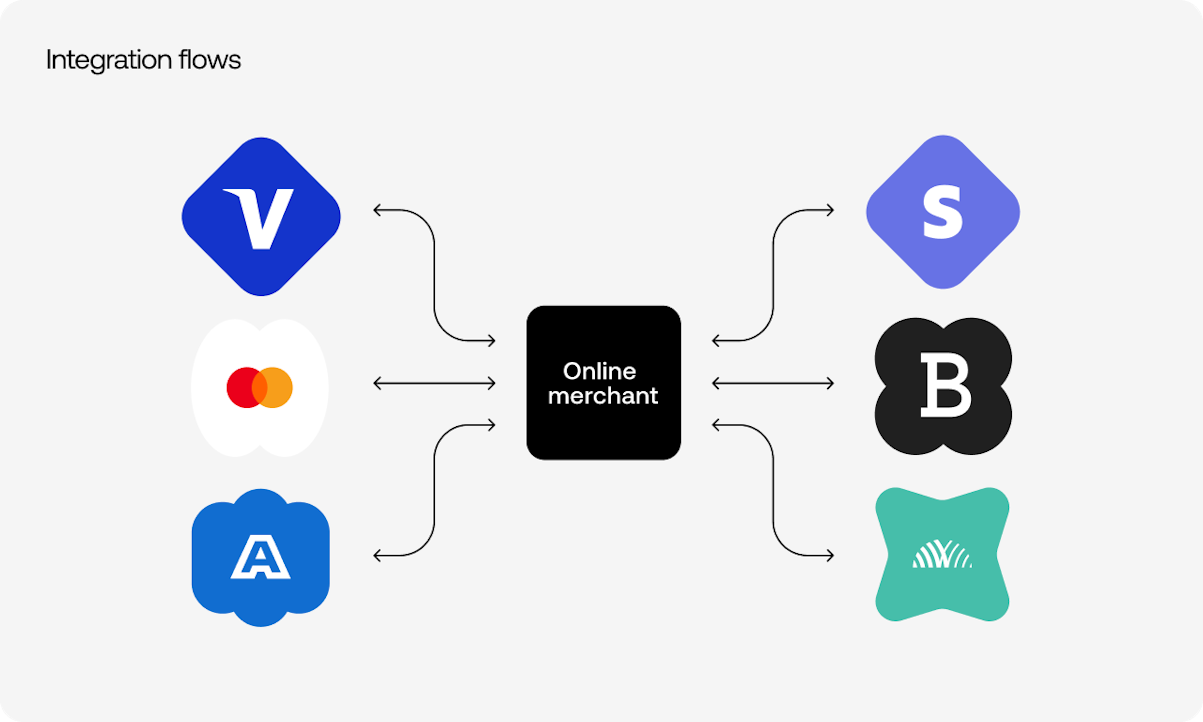

Network tokens are agnostic of processors as they are provided directly by the card networks.

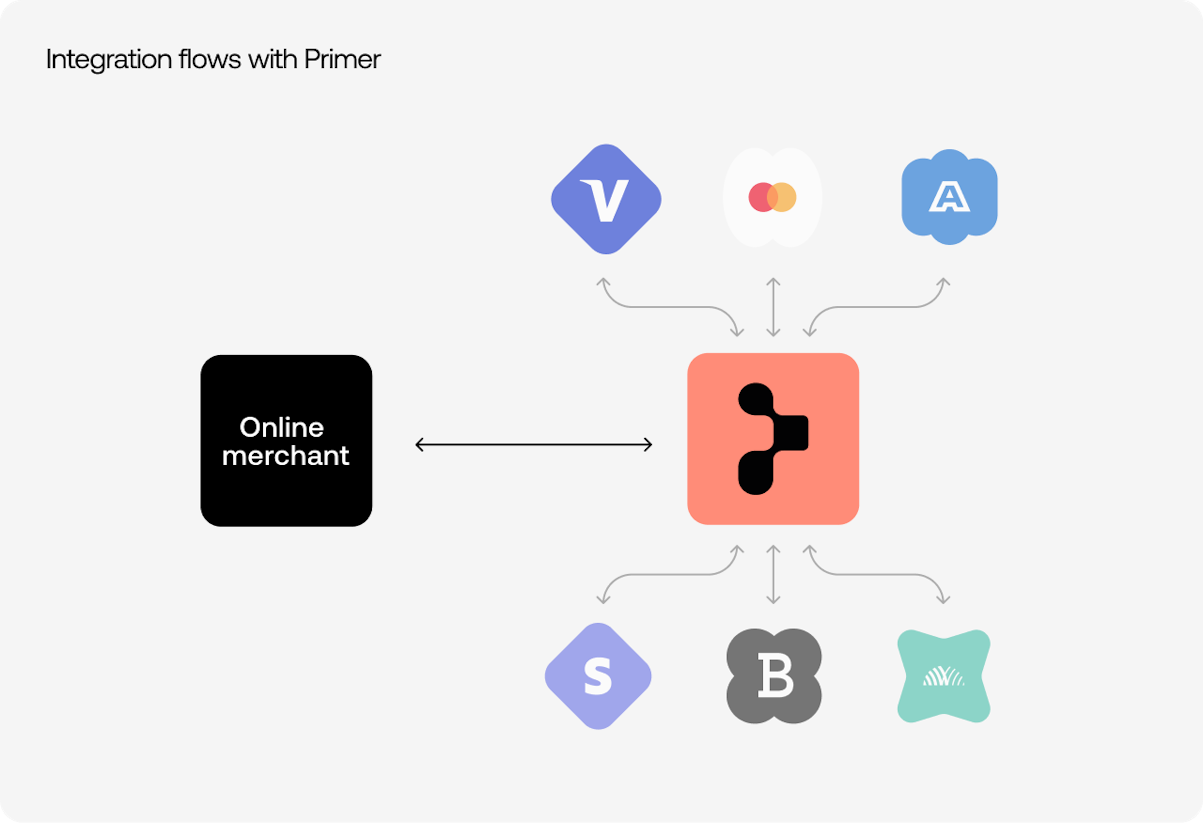

Primer acts as a centralized Technical Service Provider (TSP). It provides merchants with a unified approach to network tokenization, helping to simplify network token generation, application, and management.

Agnostic tokenization means payment freedom

Dependences are gone: Merchants can keep working with their favorite payment processors without restriction as the data is on their side.

Consistent experience for customers: Customers and their stored payment cards are not impacted if a merchant changes PSPs.

Never miss a payment: PSP is down? Payments are being rejected for a card type or country? Merchants can easily retry all payments seamlessly, as tokens can be utilized across other payment processors.

Learn more about how Primer allows merchants to utilize network tokens in our docs.

A no-brainer for payments

Network tokens not only protect the payments ecosystem from fraud. They also improve the overall payment experience. Throughout the card lifecycle, customer details are safe and secure, whether cards have expired, are lost, or stolen, so it's no wonder why this feature is among the hot topics right now un payments—it's a no-brainer.