How Primer gives merchants the tooling to prevent payments fraud

Payments fraud is an issue affecting every business. Recent research estimates businesses will lose $48 billion globally to online payments fraud this year alone. And the risks are growing. Fraudsters are deploying various innovative methods to find new weak spots and exploit businesses and their customers.

But of course, you knew that. The questions you have are:

What can I do about it?

How can I do it without negatively impacting the experience for my legitimate customers?

How do I seamlessly scale my approach to payment fraud prevention?

And, whispering quietly, how can I flip payment fraud prevention into commerce enablement?

We might have some of the answers. In this blog, I’ll explain how Primer’s position as a unified payments infrastructure gives you the tools you need to enhance your payment fraud management system and tackle fraudulent transactions head-on.

Deploy specialist fraud prevention providers across your entire payment ecosystem

Let’s first set some expectations: Primer isn’t a specialist payment fraud management system. And that’s a strategic choice. There's an entire ecosystem of specialist payment fraud management systems using advanced machine learning and AI models to help merchants prevent payments fraud.

However, we also identified a common pain point. Merchants often must invest significant resources in integrating, configuring, and maintaining these specialized platforms across multiple payment service providers. They also must build intricate conditioning logic. We wanted to remove that friction for merchants wanting to use these platforms so you can protect your business more easily.

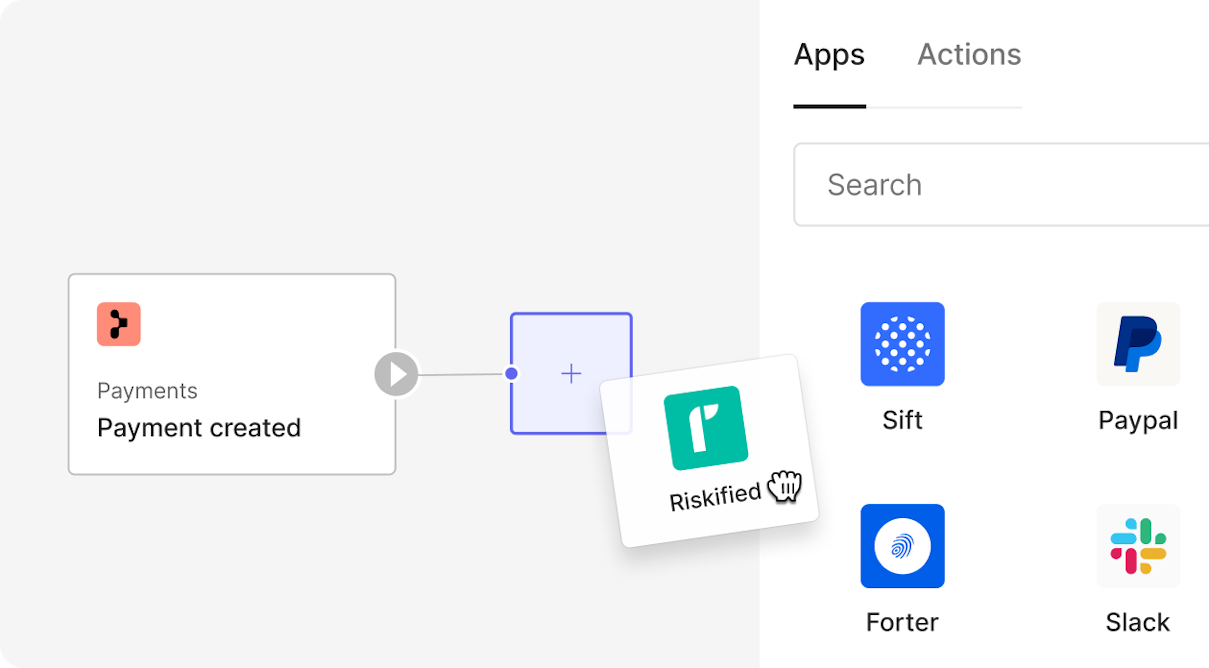

We allow merchants to activate and manage these applications in just a few clicks on the Primer platform. We’ve built integrations with the world’s leading fraud prevention providers, including Riskified, Forter, Sift, and Signifyd. This allows you to use their services via the Primer platform. We’re also allowing merchants to use the fraud tools offered by the PSPs, such as Stripe Radar, and configure, manage, and maintain custom rules with no code.

So, for merchants using Primer, gone are the days of spending hours, days, and weeks building these integrations. We’ve done the heavy lifting, allowing you to turn these services on in just a few clicks.

Access proprietary tools to mitigate the risk and impact of fraud

In addition to seamlessly integrating one or more specialist fraud prevention providers across your payment flows, Primer offers several other tools to fight fraud.

Let’s take a look.

Adaptive 3DS capabilities

Authentication and its role in fraud prevention can vary significantly across businesses. Each merchant has a unique perspective on how to use 3DS effectively within their overall strategy.

Take the example of a Buy Now, Pay Later (BNPL) provider we support. They utilize 3DS for initial transactions as a protective measure. 3DS isn't applied unless fraudulent activity is suspected for subsequent merchant-initiated transactions.

It’s a use case that meets the needs of their business. And one they were easily able to configure with our Adaptive 3DS solution.

Customizable workflows

Speed is of the essence when your business comes under attack from fraudsters. The attack needs to be stopped at the source right away to minimize the damage. We allow you to do this in our workflows, where you can set a rule to automatically decline payments from a particular market, issuer, or individual cardholder. You can do this in seconds in our workflows.

A merchant using Primer benefited from this functionality recently. Our Monitors and Alerts feature flagged suspicious activity directly to the merchant’s Slack channel. This turned out to be a significant and coordinated fraudulent attempt. Our customer success team was immediately notified and worked with the merchant to pinpoint the source. Using our Observability insights, they quickly discovered the fraud stemmed from a specific card BIN range. Within a few minutes, the merchant immediately blocked transactions from that BIN range within workflows and prevented what could have been a significant financial hit.

Network Tokenization

Network tokens, and tokenization, in general, are one of the hottest topics in payments. They can serve as both a fraud prevention tool and an enabler of seamless commerce. However, similarly to what we discussed about fraud prevention providers earlier, merchants struggle to unlock the value of network tokens due to fragmentation and various complexities.

To remove these blockers, Primer acts as a centralized Technical Service Provider (TSP), providing a unified approach to network tokenization. We allow you to use Network Tokens without code, drastically simplifying network token generation, application, and management.

Streamlined disputes

Our idea for our unified dispute product arose because we wanted to solve a big merchant pain point we were hearing and ultimately help simplify payments. We created a single way to handle dispute events that work for all payment processors in a unified manner.

We standardize what a dispute looks like so there is consistency when dealing with these. This means you don't need to be an expert in each payment processor's technical terms or quirks.

The cool thing is you can subscribe to a webhook event for each dispute for all your processors or use the trigger in workflows to automate operational processes. For example, each time there's a dispute, you can create a workflow to open a Jira ticket in your support desk or add a task to your project management system, streamlining the dispute-handling process for merchants.

Learn more about how to dispute chargebacks efficiently.

Volume Limiting

We take being a unified payments infrastructure seriously. We’re constantly assessing our architecture alongside our dedicated infrastructure and security teams to identify possible weak areas and apply better resiliency. Recently, we determined that one way to mitigate the cost of a fraud attack against our merchants is to add limits even before the checkout is loaded—so we built the feature and enabled it on the platform.

Step up your fight against fraud

The fight against fraud isn’t going away. If anything, it’s going to intensify. That might not be what any of us want to hear. But it’s the reality. If you’re interested in learning more about the range of tools we offer to help fight fraud, get in touch, we’re happy to chat.