How Monitors and Alerts help merchants react in real-time to changes in payments performance

If you take a step back, it's remarkable how quickly everything happens after a customer presses 'pay.’

But not everything in payments is like that. Take your ability to understand your payments performance across all your processors. Is that something you can see in real-time?

In most cases, the answer is no.

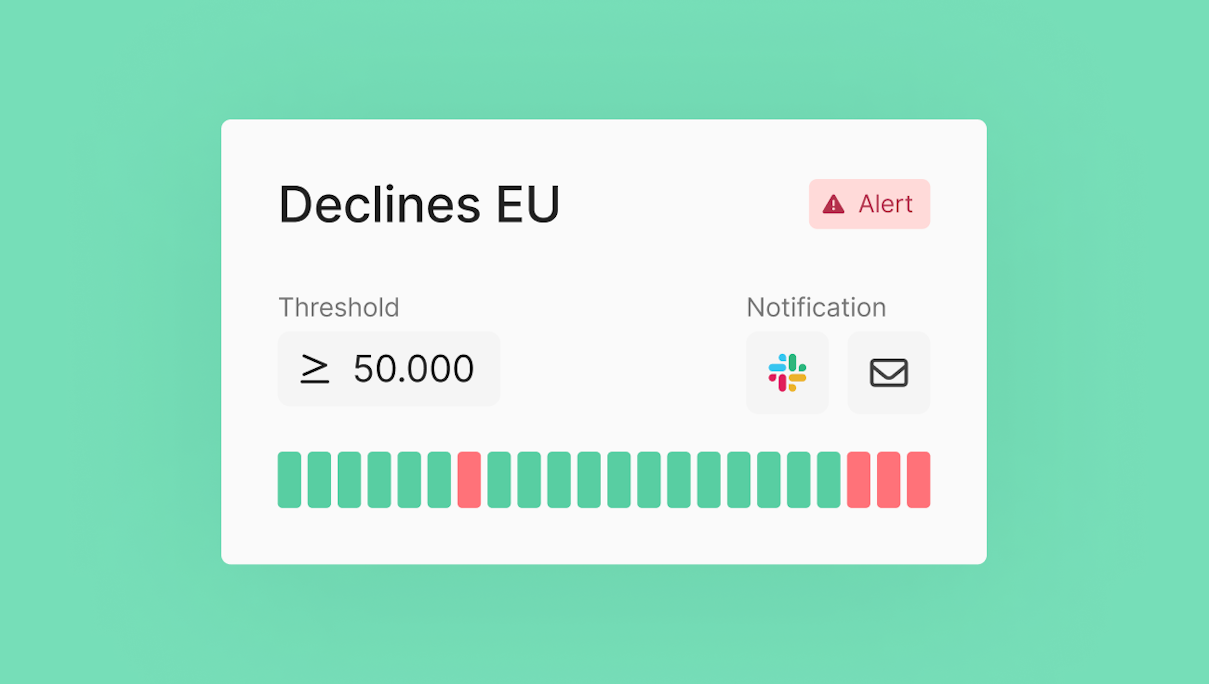

We’ve built our Observability platform to help you solve this problem. It gives you real-time visibility across your payments flows. It also empowers you to establish monitors that will trigger alerts if any significant changes in your payment performance occur.

Let’s explore the different monitors you can use to ensure you’re alerted when critical payment processing changes occur.

#1 Number of failed payments

Given the intricacies of the payment flow, you expect and tolerate some failures. However, when there's a sudden spike in failures, it demands immediate attention.

We recently observed such an incident. One of our merchants configured monitors to oversee the performance of all their payment methods. They received an alert when one of these methods experienced an unexpected increase in payment failures.

The merchant turned off the payment method—which constituted a small portion of the merchant's payment traffic—and identified a configuration issue with the processor. The merchant quickly solved this issue and switched back on the payment method, which returned to its expected level of performance.

Issues like this are cropping up for businesses daily. And while it may be a minor issue initially, the potential revenue loss can quickly compound if unnoticed, leaving you with a big problem on your hands.

#2 Authorization rate

Much like the practice of monitoring payment failures, we unsurprisingly see merchants using Observability to set alerts around their authorization rates. And they’re going granular, setting alerts for each PSP, and even going as far as monitoring performance at the BIN level.

Implementing these monitors allows you to react quickly to changes in performance. For example, if processor A’s performance suddenly dips, you’re identified and can start rerouting traffic to processor B while you explore the issue, minimizing the financial impact on the business.

#3 3DS Authentication rate

Authentication is a pivotal step in the online payment journey. However, introducing another step in the process increases the potential for errors. By monitoring 3DS performance, merchants can respond if there’s an increase in 3DS failure, such as temporarily allowing payments to pass without 3DS while resolving the issue.

#4 Total number of payments processed

Merchants usually expect surges in payment traffic during specific periods. For instance, retailers prepare for peak seasons, while ticketing sites experience increased demand when highly anticipated tickets, like those for a Taylor Swift concert, become available. But what about unexpected spikes? Merchants must be aware of these occurrences and promptly determine their causes.

If the spike results from a sudden demand for a specific product, merchants can employ tools like Split to distribute payment traffic across multiple processors. This approach prevents overload and ensures a smoother payment experience.

However, if the spike has more nefarious origins, alerted merchants can swiftly pinpoint the suspected fraudulent source and automatically implement rules to decline these payments.

#5 Refund rate

Tracking the refund rate is crucial for businesses. This metric directly correlates with profitability and offers insights into the effectiveness of the overall business operating model and customer satisfaction. An uptick in refunds could also indicate vulnerability to return fraud. By actively monitoring this metric, payment leaders provide invaluable strategic insights for the business.

Setting up Monitors and Alerts in Primer

Keep on top of changes in payments performance

In a perfect world, merchants would never receive an alert. But we know that payment is anything but perfect. And as the saying goes, "Forewarned is forearmed." So being alerted to dips in performance is a powerful capability. It empowers payment leaders to take rapid action, address issues promptly, and safeguard their business revenue. By staying proactive, they ensure that disruptions are minimized and the payment experience for customers remains smooth and reliable.