How to build the world's best checkout with dynamic payment flows

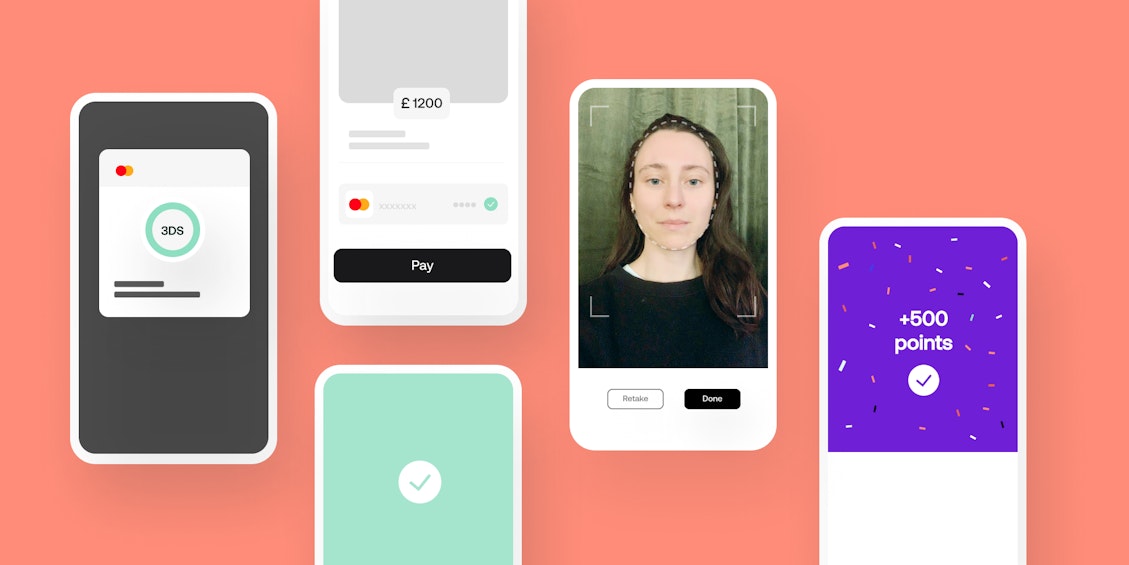

Universal Checkout is Primer's fully customizable, PCI compliant SDK for web and mobile. Today we're announcing an exciting update which will help you craft better commerce experiences now and in the future: "dynamic payment flows."

Universal Checkout is Primer's fully customizable, PCI compliant SDK for web and mobile. Today we're announcing an exciting update which will help you craft better commerce experiences now and in the future: "dynamic payment flows."

Welcome to our new blog! My name is Thomas Pasterk and I'm Product Manager for the Connections and Workflows teams at Primer. 🙋🏻♂️

Connections on Primer are services that sit across the payments stack, and we're adding new connection types all the time. These include: PSPs, payment methods, fraud platforms, BI tools, chargeback services, and more. Workflows enable you to build sophisticated payment flows across the transaction lifecycle through a drag-and-drop interface, seamlessly connecting services together with no code.

You can: implement complex routing to PSPs to optimise for cost and auth rates, improve your risk mitigation efforts by connecting to a unified fraud platform, add fallbacks in the event of service downtimes and to recover lost payments, and build completely customized payment flows with comprehensive conditions suited to the dynamics of your business.

Dynamic payment flows extends the capabilities of Workflows to the front-end checkout experience. This enables you to present user-facing flows with no additional integration effort! Universal Checkout will just do the right thing. Like magic! ✨

The following are preliminary examples of flows this can support, but we're excited to see what you'll come up with as we add new connection types.

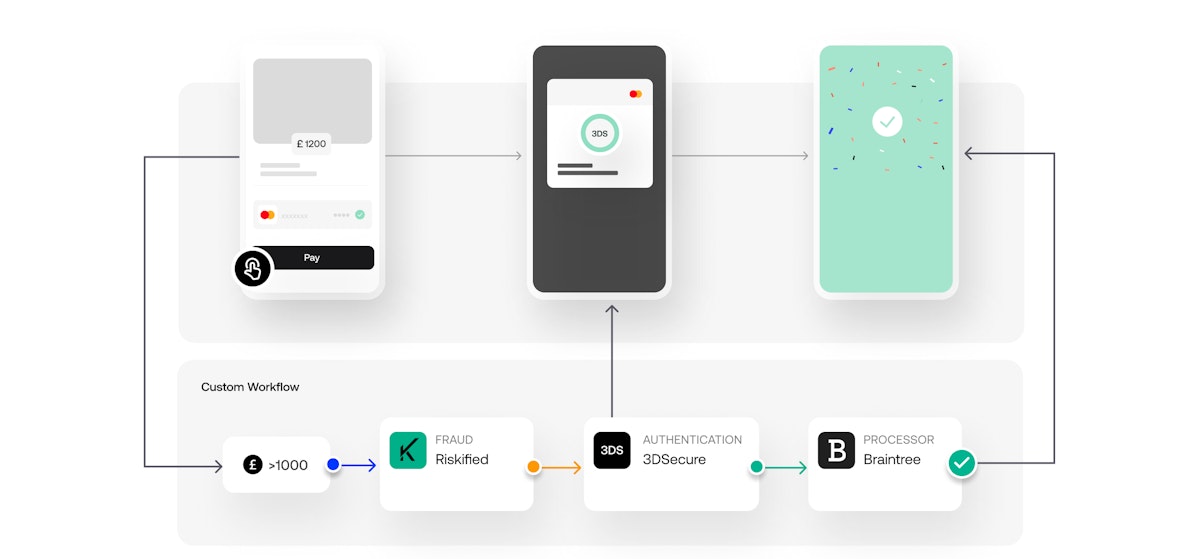

Optimize 3D Secure and improve conversion

3D Secure can often be requested unnecessarily, creating friction and leading to lower conversion. Primer has a unified 3D Secure 2.0 implementation across all processor connections. With Workflows you can configure conditions based on a comprehensive list of payments attributes, as well as recommendations from fraud platforms and other connections.

For example:

If a fraud provider (eg. Riskified) recommends getting additional assurance, trigger 3DS

If the payment amount is higher than

Xand the country of issuance isY, trigger 3DSIf the payment has been declined by the processor due to lack of SCA, trigger 3DS and ask the customer to try again

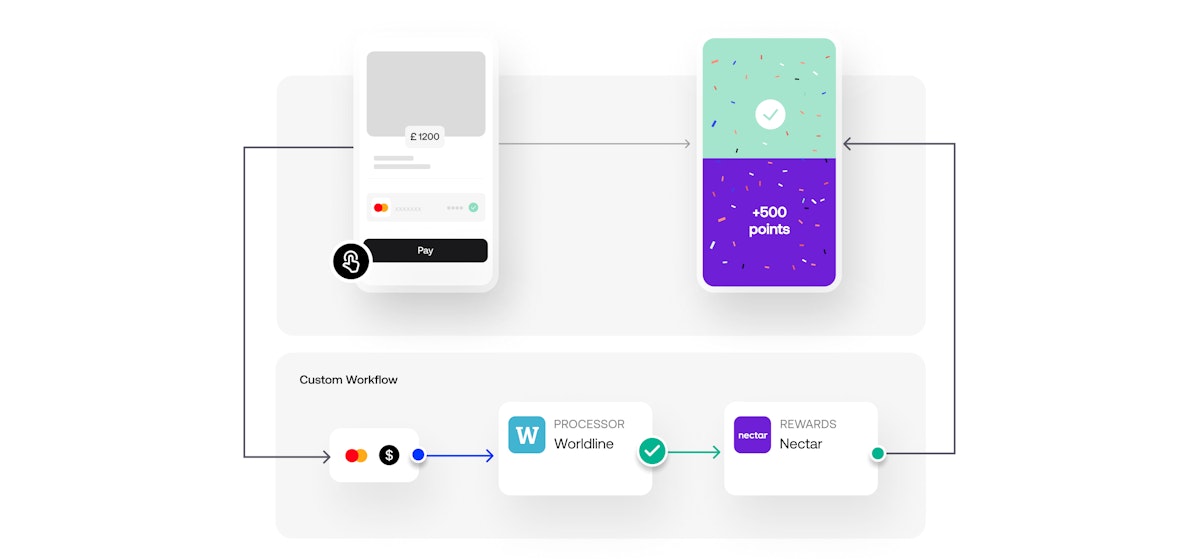

Loyalty and rewards

Your customer may be enrolled in one of many loyalty and rewards programs. When your shoppers are eligible for rewards and other benefits - such as points, miles, or cashback, Universal Checkout will surface this information on the checkout dynamically. This helps to boost loyalty and satisfaction.

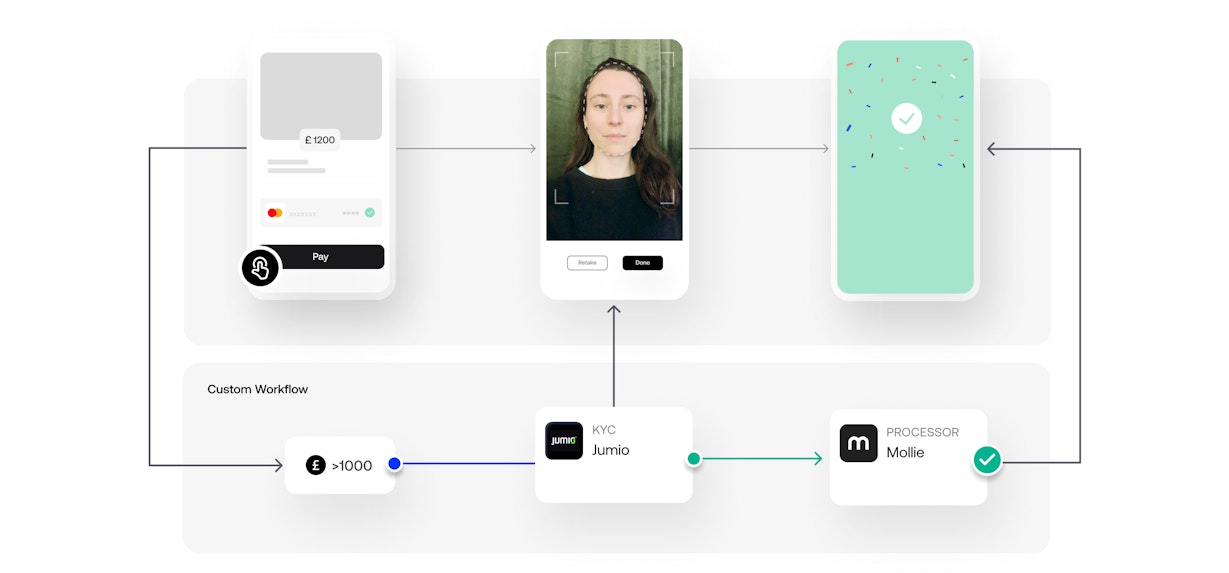

KYC for high-value or sensitive payments

It can be important to know your customer is who they claim to be. This is especially true for high value orders as well as for ride sharing, and food delivery.

Use a KYC provider during checkout to authorize or capture funds only once the customer has been verified. This is a great example of Workflows being used asynchronously (where you can ask the customer to complete the flow at a later date).

Now for the good part: how it works

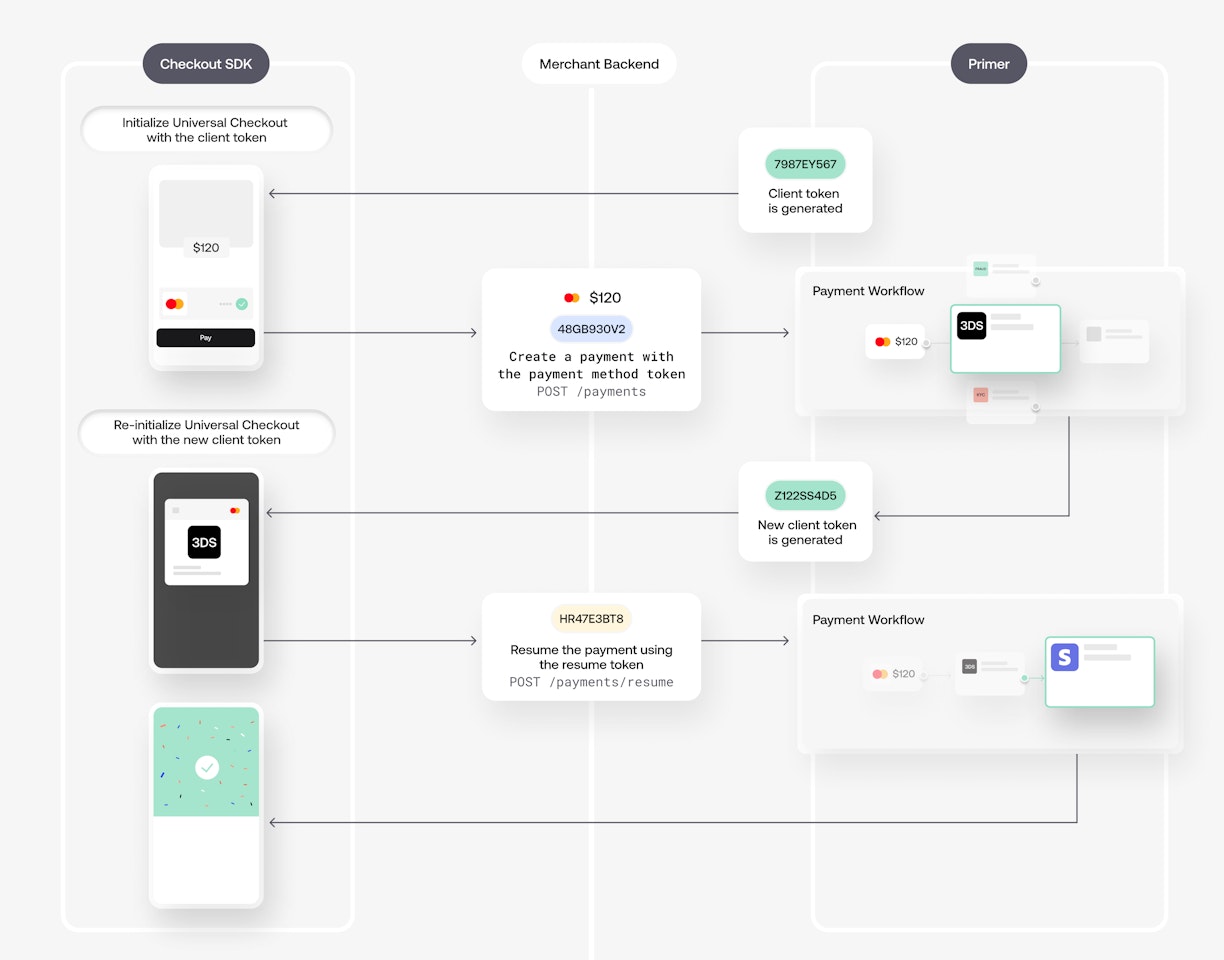

The Universal Checkout SDK is initialized using a Primer "client token." Dynamic payment flows builds on this mechanism to re-initialize the checkout with a new client token when further customer interaction is required. This drastically reduces the traditional touchpoints for new integrations impacting the checkout.

At Primer, we're on a mission to power the best, and most beautiful commerce experiences possible without compromise. We believe payments should be a first-class product area in your business, and with this enhancement we're further fortifying our unified integration to support any number of exciting new payments experiences in the future.

This becomes significantly more powerful in the context of Primer Connect - our open app framework to enable third-parties to build and own their Connections on Primer. Learn more about Primer Connect

We're constantly adding new connection types, and enhancing our Workflows capabilities further. Don't hesitate to reach out to find out how Primer can enhance the buying experience for your customers and reduce complexity for your business.