Don’t leave revenue in the BIN

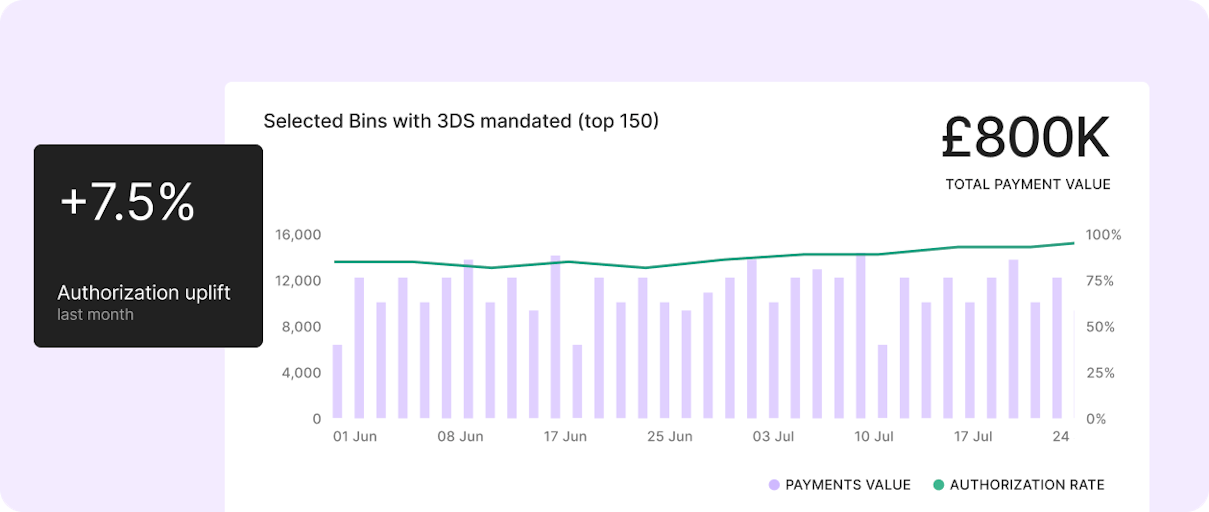

How we delivered a 7.5% authorization uplift for a merchant by mandating a 3DS challenge on its top 150 BINs.

Most people loathe the complexity that comes with accepting payments. I get that. It would be nice if things were more straightforward sometimes. But, for me, that complexity makes payments such an exciting and rewarding space to work in.

Consider 3DS, for instance. Its job is straightforward: confirming a customer's identity through something they are, own, or know.

However, beneath this simplicity lies a world of intricacy. Countless variables impact whether a transaction gets flagged for a 3DS challenge and what happens following that. Variables that ultimately affect a merchant's bottom line.

As a trained statistician, my eyes light up when I see situations like this. That’s because I know that when there are many variables, there’s also lots of potential to optimize and drive improvements for our merchants.

What is a BIN?

In payments, a BIN is short for a Bank Identification Number. It refers to the first six to eight numbers on a bank-issued card. These numbers identify essential information about the card, such as the geographic location of the card issuer and which bank or company issued the card.

The impact of mandating a 3DS challenge

I recently explored this space for one of our merchants. Specifically, I wanted to understand whether mandating a 3DS challenge would lead to higher authorization rates.

The answer was yes—and the impact was significant.

This merchant saw a 7.5% authorization rate uplift across its top 150 BINs by mandating a 3DS challenge. An uplift that saw it realize a six-figure increase in settled revenue over a few months.

The merchant’s authorization rate variance and deviation have also been cut in half. In other words, the authorization rate is less prone to fluctuations, giving the merchant more confidence in predicting its cash flow. Finally, the average five-day authorization rate continues to increase weekly, meaning the merchant should continue to realize additional revenue.

Here are the steps I took to deliver this for our merchant.

I initially identified the merchant’s top 50 BINs before looking at each individually to understand how often a 3DS challenge was triggered. It varied considerably from BIN to BIN, but on average, across all BINs, a 3DS challenge was triggered 38% of the time.

I formed a hypothesis that there was a correlation between whether or not a 3DS challenge was triggered and the authorization rate per BIN and shared this with the merchant. It's important to note that this initiative stemmed from our proactive approach to uncovering optimization opportunities. The merchant approved the plan, giving us the green light to proceed.

Implementing the change was pretty straightforward. We can easily adjust the workflow logic within the Primer platform to recommend a 3DS challenge.

We built a custom chart for the merchant in the Primer dashboard highlighting the BINs where we made the changes. Here, they could track the authorization rate, the number of payments, and the value of these payments.

The merchant recorded a 3.5% authorization rate uplift from this initial test—and a five-figure increase in settled revenue. They gave the green light to extend the strategy to its top 150 BINs.

We implemented the change on the additional BINs, leading to the 7.5% authorization rate increase.

There is low-hanging fruit everywhere in payments.

What I've outlined above may seem straightforward, and truthfully, it was. And it’s an area I’d encourage you to explore yourself to see if you can realize a similar uplift.

It’s also just a small example of the low-hanging fruit that is everywhere in payments. The challenge is that many businesses can't pluck this fruit due to a lack of expertise, insights, capabilities, and flexibility to implement the changes or the time needed to run such experiments—often a combination of these factors.

It’s one of the reasons this particular merchant, and many others, work with Primer. We don’t just offer a market-leading Unified Payment Infrastructure that gives merchants unrivaled freedom and visibility in managing their payments. We also boast a dedicated team of payment experts who work tirelessly as an extension of our customers' teams.

Our core mission is understanding our customers' business models, challenges, and opportunities. We serve as trusted advisors, leveraging our knowledge, data, and functionality to improve performance consistently.

And we’re keen to help more businesses unlock their payment potential. So, don't hesitate to reach out if you'd like to explore how Primer can work for you or if you simply want to engage in a conversation about payments—we're here to chat.