Demystifying network tokens

Answers to five common merchant questions about network tokens.

Network tokens have sparked immense interest among merchants for their potential to enhance performance, mitigate fraud, and decrease processing costs.

We recently spoke with Vytautas Šernas, Head of Payments at Kilo Health, and Tim Garrett, Digital Enabler Director at Visa, to explore the current network token landscape.

We discussed the advantages of adopting network tokens, issuer readiness, upcoming enhancements, and more. Let's explore some of the key questions addressed during the webinar.

What is a network token?

Although the concept of a network token has been around for almost a decade, there remains some confusion regarding its precise definition, functionality, and differentiation from other tokens within the payments ecosystem.

Let's clarify that before delving deeper.

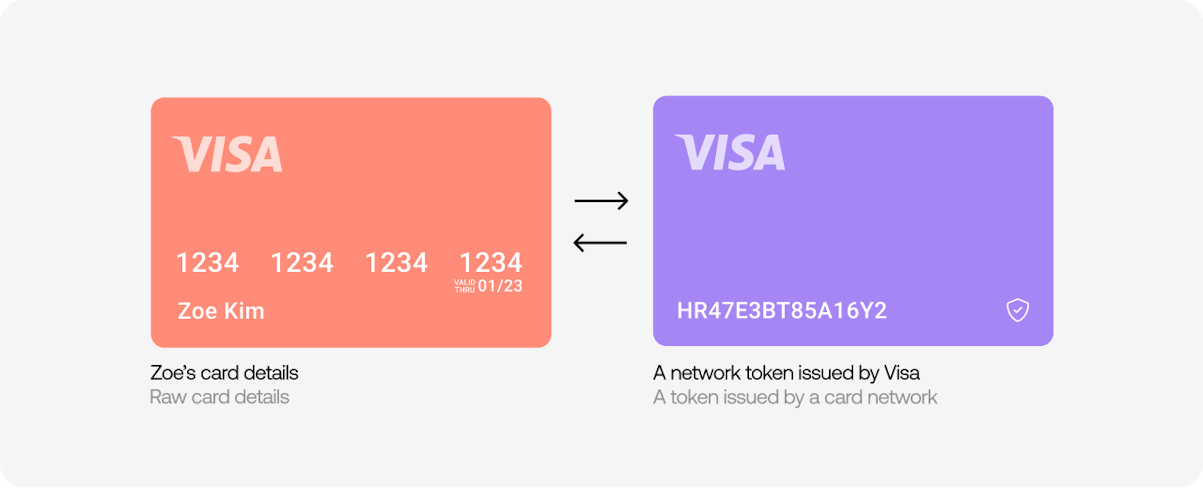

A network token is a proxy to the primary account number (PAN)—the long number on a card. The token is unique to the card, merchant, and payment provider requesting it on the merchant's behalf.

A network token hides the customer's PAN during payment processing, making it much more secure. This contrasts with a Gateway Token, where the Payment Gateway unveils the PAN before being forwarded to the issuer for authorization.

Five questions about network tokens answered

Why should merchants consider adopting network tokens?

Merchants have several compelling reasons to consider network tokens. These encompass performance enhancements, decreased fraud, and a streamlined customer experience. Let's explore each of these in more detail.

Authorization rate uplift

A disparity exists between the authorization rates of card-not-present transactions and those conducted in person. Network tokens aim to help bridge this gap by providing issuers more information alongside the payment and reducing the risk of fraud (see below). Collectively, these aspects instill greater confidence in issuers regarding the transaction's legitimacy, thereby increasing the likelihood of its authorization.

Visa has observed an average 3% increase in authorization rates among merchants leveraging network tokens.

Fraud mitigation

As previously mentioned, network tokens significantly enhance the security of card-not-present transactions. Network tokens feature several built-in mechanisms that deliver improved security.

One is the concealment of the PAN throughout the entire transaction lifecycle. Each token is also uniquely linked to the specific customer and merchant pairing, rendering it unusable by malicious actors for online transactions across various merchants, unlike the PAN.

Another benefit is that the payment provider needs to generate a one-time cryptogram to substitute for the CVV for any customer-initiated payment using a saved card. This adds an additional layer of complexity that drives fraud down.

Visa estimates that utilizing network tokens results in a 50% reduction in fraud compared to PAN payments.

Improved customer experience

While enhanced authorization rates and reduced fraud stand out as the primary advantages of network tokens, it's important to recognize their significant impact on improving the customer experience, particularly in minimizing friction during the checkout process.

Network tokens include an in-built mechanism that keeps a customer's card credentials current, so customers don’t need to update their card information on a merchant's website, eliminating a potential friction point during checkout. It also helps avoid possible drop-offs from recurring transactions (due to expired cards), helping to reduce churn.

Cost reduction

Card schemes like Visa offer merchants reduced interchange fees for transactions processed using network tokens.

What is the current state of issuer adoption of network tokens?

Inconsistent adoption by issuers has posed a challenge for merchants seeking to embrace network tokens, particularly as attempting to apply a network token to a transaction unsupported by an issuer may fail.

However, Visa has actively collaborated with the issuer community to enhance issuer readiness in recent years. As a result, Visa has witnessed a substantial increase in token transactions over the past 12 months, with over 7 billion Visa tokens now integrated into the ecosystem. And Visa estimates that achieving 100% coverage for network tokens could materialize within the next couple of years.

Yet, during this transitional period, leveraging an agnostic solution like Primer for Network Tokenization allows merchants to seamlessly implement tokens across all their payments and smoothly revert to PAN in cases where network tokens are not supported. Taking an agnostic approach has many other advantages, which we’ll explore later.

Should a merchant adopt network tokens if it's already using Account Updater?

Account Updater ensures merchants always have the most up-to-date customer card details. However, merchants using Account Updater will still process transactions using the raw card details, including the PAN. This, as we explored, has several downsides.

In contrast, leveraging network tokens allows merchants to maintain updated customer credentials while unlocking additional benefits, including improved authorization rates and reduced fraud.

What options should merchants consider when implementing network tokens?

The most common approach currently used is to use a payment gateway for network tokens. This means merchants can benefit from this technology without completing any development work.

However, as more merchants explore orchestration platforms, there's a growing consideration for having the orchestration platform serve as the network token provider. This strategy is advantageous as it allows the utilization of network tokens across multiple gateways—something not possible when a gateway serves as the token requestor.

Why KiloHealth choose Primer for network tokens

Over the past two years, KiloHealth has been on a journey to rebuild its payments stack. The ability to be agnostic and avoid dependency on individual payment processors is central to its approach and led KiloHealth to adopt Primer as its Unified Payments Infrastructure.

Vytautas and the KiloHealth team applied these principles when leveraging network tokens, recognizing several advantages, including:

Simplicity: By choosing Primer, KiloHealth streamlined its implementation of network tokens. It ensured ownership of the tokens by its portfolio companies, deviating from the merchant-of-record structure often requested by individual PSPs.

Consistency: Through Primer, KiloHealth achieved the flexibility of using a single token across its diverse range of PSPs.

Performance: Leveraging Primer, KiloHealth has successfully met and exceeded the expected performance benchmarks associated with using network tokens.

What’s next for network tokens?

Payment schemes consistently seek to augment the functionality and usefulness of network tokens. An example of the next wave of innovation is the cloud token framework, which introduces device binding to token transactions. This enhancement gives issuers more comprehensive information about the transaction, further strengthening their confidence in approving the payment.

Another development is the digital authentication framework. It leverages FIDO biometrics to facilitate a seamless one-click checkout experience. It offers merchants liability protection, subject to meeting specific criteria.

Additionally, network token providers are delivering their innovation, harnessing machine learning and AI to decide whether to route a transaction for PAN or network token.

Learn more about network tokens

Few argue that network tokens will provide the foundation for the next wave of innovation in digital payments. Watch the webinar with Visa and KiloHealth to dive deep into network tokens and learn how to make them work for your business.