Are you meeting the EU’s co-badged card requirements?

Visa and Mastercard have historically dominated the global card ecosystem, and today, alongside China's Union Pay, they account for the lion's share of global card payment volume.

But the global card networks aren't the only game in town.

In various markets across the globe, you'll find domestic card schemes playing alongside these global giants. These include Cartes Bancaires in France, Dankort in Denmark, mada in the Kingdom of Saudi Arabia, and eftpos in Australia, to name just a few. Often, these payment methods also carry Visa and Mastercard badges, giving rise to the concept of the co-badged card.

In Europe, regulations outline how merchants should accept customer payments using co-badged cards. And, importantly, these regulations are now beginning to be enforced.

In this blog, we'll explore the concept of co-badged cards, how Regulation (EU) 2015/751 impacts merchants accepting payments from co-badged cards, and how we enable businesses to meet these requirements with minimal effort.

Quick read

Merchants operating in Europe must give their customers a choice over which card network they use to process their payments when using a co-badged card.

Depending on the steps merchants take to achieve compliance, the rules could negatively impact customer conversion and payment success at checkout.

Primer’s updated Universal Checkout makes it easy for merchants to comply with these rules while providing customers with a first-class payment experience.

What is a co-badged card?

As we just mentioned, a co-badged card is a debit or credit card issued by a bank that carries the logo of a global card network, like Visa and Mastercard, and a domestic card scheme, like Dankort in Denmark.

Delving into Dankort as a case study, it was introduced in 1983 and has since become integral to card payments in Denmark. The Danish government oversees the Dankort network, regulating the network so it provides low transaction fees. As is the case for most local card schemes, this makes it cheaper for merchants to accept payments and consequently lowers consumer prices.

Is a co-badged card the same as a co-branded card?

No. Although the terms are often confused. As we’ve just covered, a co-badged card is a debit or credit card that carries the logo of a global card network and a domestic card scheme. On the other hand, a co-branded card describes cards with at least one card brand or network paired with at least one non-financial brand. These cards are usually used for loyalty and reward programs.

Some of the most popular co-branded cards are:

Prime Visa from Amazon

Disney World Premier Visa Card

British Airways American Express Credit Card

Costco Anywhere Visa Cards

Most Dankort cards also carry the Visa logo. This dual badging serves various purposes.

Firstly, it allows Danish consumers to use their cards internationally using the Visa network. It also gives customers a choice when making a payment. For instance, Visa offers superior customer protection mechanisms compared to Dankort. As a result, individuals may use the Visa network over Dankort when buying an airline ticket or high-value item.

This landscape isn’t unique to Denmark; the same is true in other markets, such as France, where around 95% of cards are co-badged with Cartes Bancaires and one of the global card networks. However, it’s worth noting that French consumers are typically much less savvy about the different characteristics of each card network.

Understand Regulation (EU) 2015/751

The global card networks have built the rails that power international commerce and are highly regarded by consumers. But not everyone takes such a favorable view. Payments are increasingly becoming a political football, with legislators concerned about the power consolidated by two American and one Chinese companies.

These fears are giving rise to more countries launching their card schemes, as is the case in Indonesia. Simultaneously, lawmakers are proactively introducing regulations to ensure a level playing field. They aim to guarantee fair competition when domestic card networks coexist with global counterparts, allowing consumers to choose their preferred payment scheme.

Europe, in particular, has taken a proactive stance through Regulation (EU) 2015/751, a comprehensive set of rules affecting online payments. Notably, two articles within this regulation directly impact the acceptance of co-badged cards: Article 8 and Article 10.

Before we look at the two articles, a point worth noting is that this regulation isn’t new; legislators signed it into law nearly eight years ago. But it matters more now due to the growing risk of possible fines for merchants not complying.

Article 10: ‘Honour All Cards’ rule

The crux of Article 10, specifically in the context of co-badged cards, lies in paragraph four. It clarifies that merchants are not obligated to accept payments from every card scheme—a practical approach. However, it emphasizes that merchants must communicate which card schemes they accept to their customers.

Article 8: Co-badging and choice of payment brand or payment application

Article 8 stipulates that when a merchant supports both networks of a co-badged card entered by the customer, the customer must be free to choose which network to use. In the case of a merchant-initiated transaction (MIT), the merchant must process the payment using the card network initially selected by the customer.

The rules state that the merchant can set a default option. A move that benefits merchants, allowing them to establish a preference that optimizes costs. This is especially important given that PSD2 eliminated the option for merchants to impose additional fees based on the chosen payment method or card network.

How to meet co-badged card requirements with Primer

In principle, it's not overly complicated for merchants to comply with the regulations by prompting users always to select their preferred card network at the checkout.

However, having spoken with many payment leaders over recent months, it's become apparent that many are facing several issues with this approach, which Primer's Universal Checkout can solve.

Let's take a look at them.

1) Avoiding unnecessary complexity and friction

Problem: We're in an age where the online checkout is an extension of the brand experience. Forcing every customer to pick what card network they wish to use to complete their payment creates unnecessary complexity and friction at the checkout. At best, this will dilute the brand experience. At worst, it may force customers to abandon their carts—research shows that a lengthy and confusing checkout process contributes to 15% of all abandoned shopping carts.

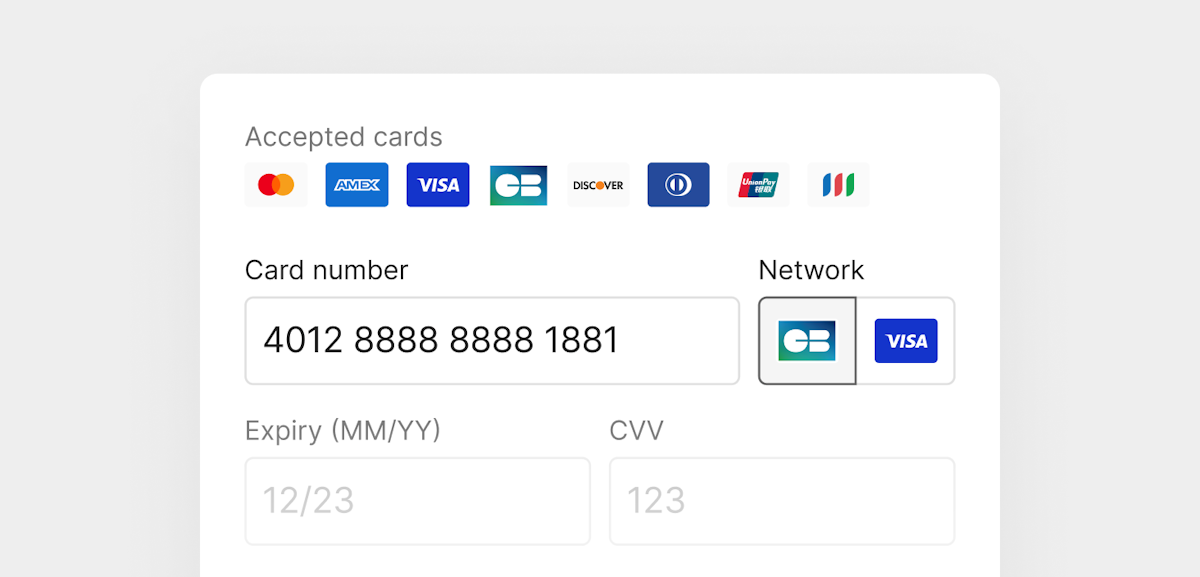

Solved: With Primer, we use BIN data to detect when customers are paying with co-badged cards and present a choice to these customers. Customers not using co-badged cards aren't presented with a choice. These capabilities mean merchants using Primer's Universal Checkout comply with the regulation while ensuring they provide their customers with the most seamless checkout experience—and without taking on any additional complexity.

2) Avoiding false declines

Problem: A user selecting the wrong card network may result in payment declines.

Solved: The solution above also addresses this issue for merchants. That’s because customers not using co-badged cars aren't given a choice. This diminishes the likelihood of the user selecting the wrong card network and experiencing a decline as a result.

3) Avoiding increased payment costs

Problem: Given that most consumers have limited knowledge about the differences between various payment schemes, it is reasonable to assume that they will often choose one of the more well-known global payment schemes when selecting a payment network. This poses a challenge for merchants, who may incur higher costs when customers opt to use one of these global card schemes.

Solved: We've made it easy for merchants to choose the default scheme they want to present customers—which we anticipate most cardholders will do. This means our customers have more control over how they process their payments to satisfy their unique objectives.

Final thoughts

Regulation (EU) 2015/751 directly impacts Europe. However, there are also similar rules in other markets. For instance, in Australia, there are guidelines around co-badged cards or ‘dual-network debit cards’ as they are more commonly known in Australia. While in Saudi Arabia, the rules around mada cards also mean merchants must consider how they process co-badged cards.

Other countries will probably adopt similar structures to encourage fair competition and allow customers to choose their preferred card network. These measures highlight the growing intricacy of the payment industry, and it is essential for merchants to seek partners who can help them deal with this complexity so they can focus on their primary business.