5 ways to improve your payment authorization rates

Picture this: your customers are excited to purchase from your online store. They filled their cart with their favorite items, entered their payment information, and clicked "Pay." But then, their payment is declined. The frustration! 😖

This can result in lost sales and a negative customer experience. In fact, according to research by the Baymard Institute, the average cart abandonment rate due to payment issues is 17%. So, let's dive in and explore the world of payment authorization rates and 5 ways to improve them! 🚀

Why improve payment authorization rates?

Increase revenue

Improving payment authorization rates means you increase the likelihood of completed transactions and ultimately increased revenue.

Enhance customer experience

Payment declines can frustrate customers, resulting in cart abandonment and causing them to visit competitor’s sites. Increasing authorization rates provides a smoother checkout process and enhances the customer experience.

Decrease declines for good users

While it’s critical to spot fraudulent activity, it’s important to be able to recognise the good users and authorize their transaction effortlessly. By decreasing the decline rate for your good customers, you should be able to focus on spotting the bad.

What are payment authorization rates?

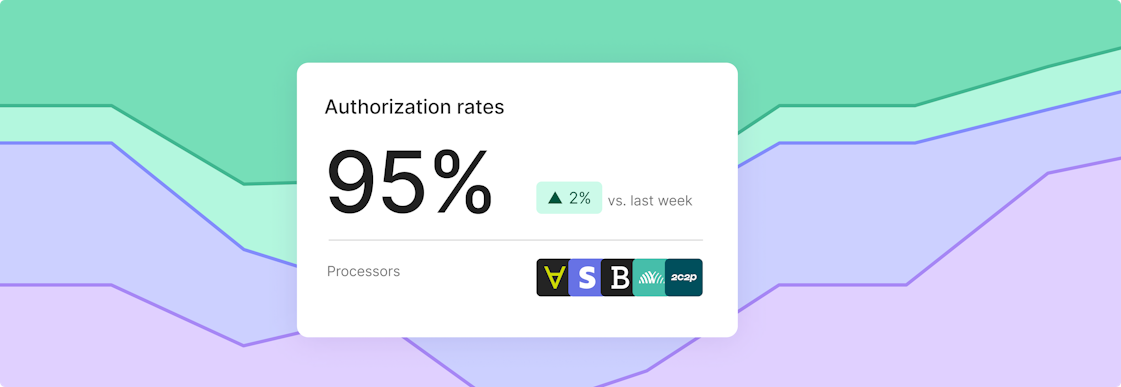

An authorization rate is the number of transactions accepted by the issuing bank divided by the number of transactions submitted. This differs from conversion rates which deal with all the pre-processing actions a customer takes. Authorization rates come into play after the ‘pay’ button has been clicked.

While each is calculated with different data, authorization rates and conversion rates are closely related and must be tracked to understand the complete customer experience.

Uncovering the cause of payment authorization issues

Before you can improve your payment authorization rates, you need to know where the issues lie. But how do you find out your current auth rate and pinpoint the factors affecting it? 🤔

Identify the problems

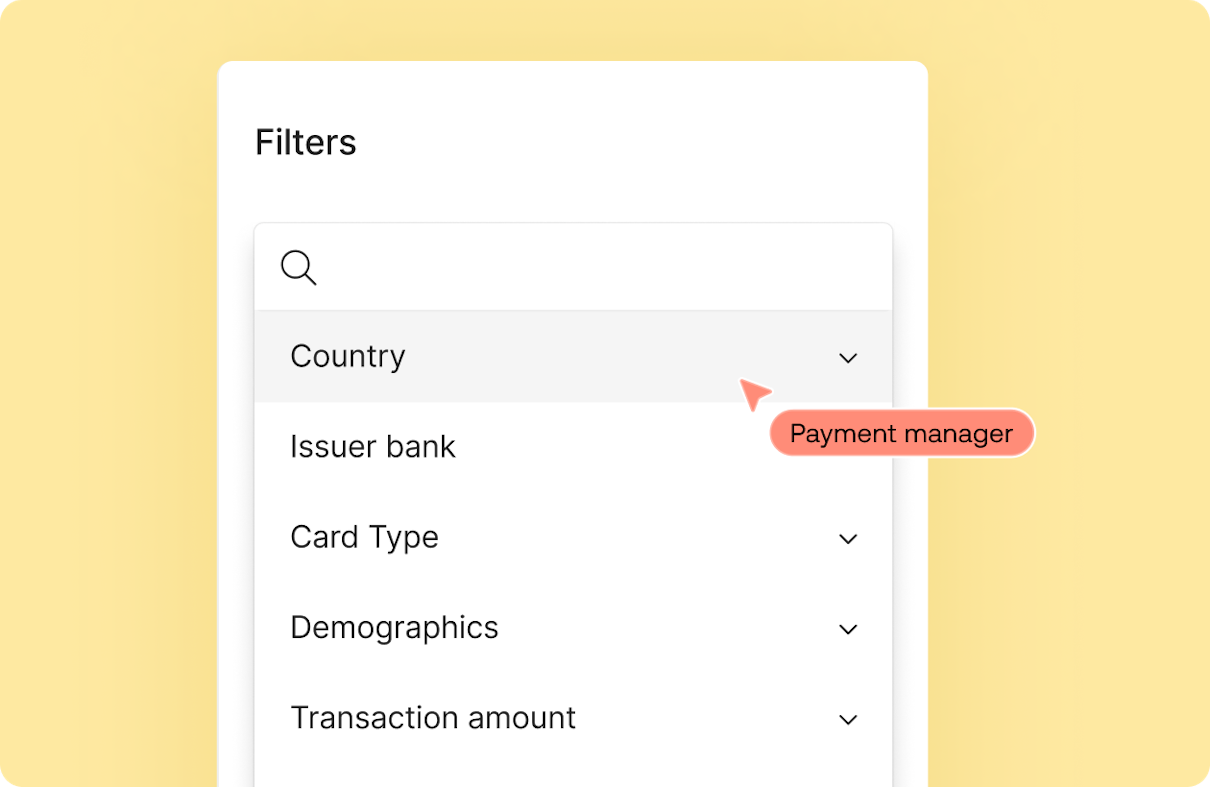

To uncover the root cause of authorization issues, you should analyze data from each payment provider and determine the factors impacting authorization rates.

Driving factors can include the issuing bank, currency, payment service provider, and transaction amount. To easily gather this information, payment insights tools will allow you to gain visibility and standardized data across your entire payment stack

Analyze the factors impacting authorization rates

Now that you know the potential factors influencing your authorization rates, you can analyze them to create a solid improvement strategy.

To tackle low authorization rates, focus on understanding your customers and identifying which demographics have the highest decline rates.

Here are some factors to consider:

Market: Higher decline rates in certain markets could indicate a need to adjust your payment strategy to cater to local preferences or regulations.

Issuing Bank: Investigating the relationship between issuing banks and authorization rates can help you optimize your payment routing strategy.

Card Type: Card type data can help you adapt your payment offerings to better meet your customers' preferences.

Demographics: Understanding demographic patterns can help you tailor your payment options to better serve these customers.

Transaction amount: Whether there are higher or lower transactions, you can adjust the rules accordingly to route transactions effectively while minimizing declines.

By understanding the factors impacting your authorization rates, you can create targeted strategies that address the areas for improvement. The result? Higher authorization rates and a better overall experience for your customers.

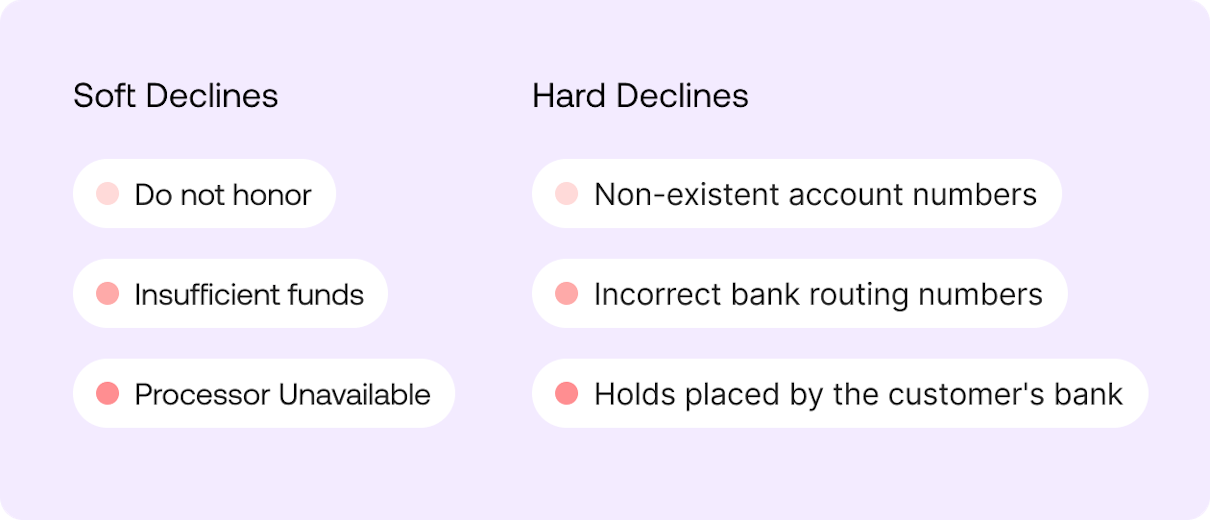

Common causes of authorization Issues

To effectively address payment authorization issues, it's essential to first understand the most common causes of declines. Typically, authorization declines can be grouped into two main categories:

Soft Declines

Soft declines are temporary and can potentially be resolved with a retry or further action from the customer.

Examples include:

'Do Not Honor'

'Insufficient Funds'

'Processor Unavailable'

These are considered "addressable declines" because merchants can take steps to resolve them and potentially turn them into successful transactions.

Hard Declines

Hard declines are permanent and cannot be resolved by the merchant.

Examples include:

Non-existent account numbers

Incorrect bank routing numbers

Holds placed by the customer's bank

Retrying hard declines is considered 'bad behavior' by the card industry, and doing so can lead to degraded authorization rate performance for the merchant account. In these cases, there's little that merchants can do to reverse the decline, and a new payment method may be required.

How to increase authorization rates

By implementing these 5 tips for optimizing your payment processes, you can set the stage for more successful transactions.

1. Implement automatic and delayed retries

Implementing automatic retries is a powerful way to improve your payment authorization rates. When a transaction fails due to temporary issues, such as network connectivity problems or issuing bank server outages, automatic retries can help ensure successful payments.

Here's how to make the most of automatic retries:

Set up intelligent retries: Use an adaptive retry system that analyzes the reason for the initial failure and determines the optimal time to retry the transaction.

Customize retry rules: Different types of failures require different retry strategies. For example, if the first payment service provider you use is temporarily down, you will want to immediately retry that transaction through a second PSP in an attempt to save the transaction.

Monitor retry performance: Track the success rate of your retry attempts and adjust your rules and strategy as needed.

Communicate with customers: Keep customers informed about the status of their transactions and steps taken to resolve issues.

Combine retries with other strategies: Automatic retries work best when combined with other tactics, such as payment orchestration and conversion rates

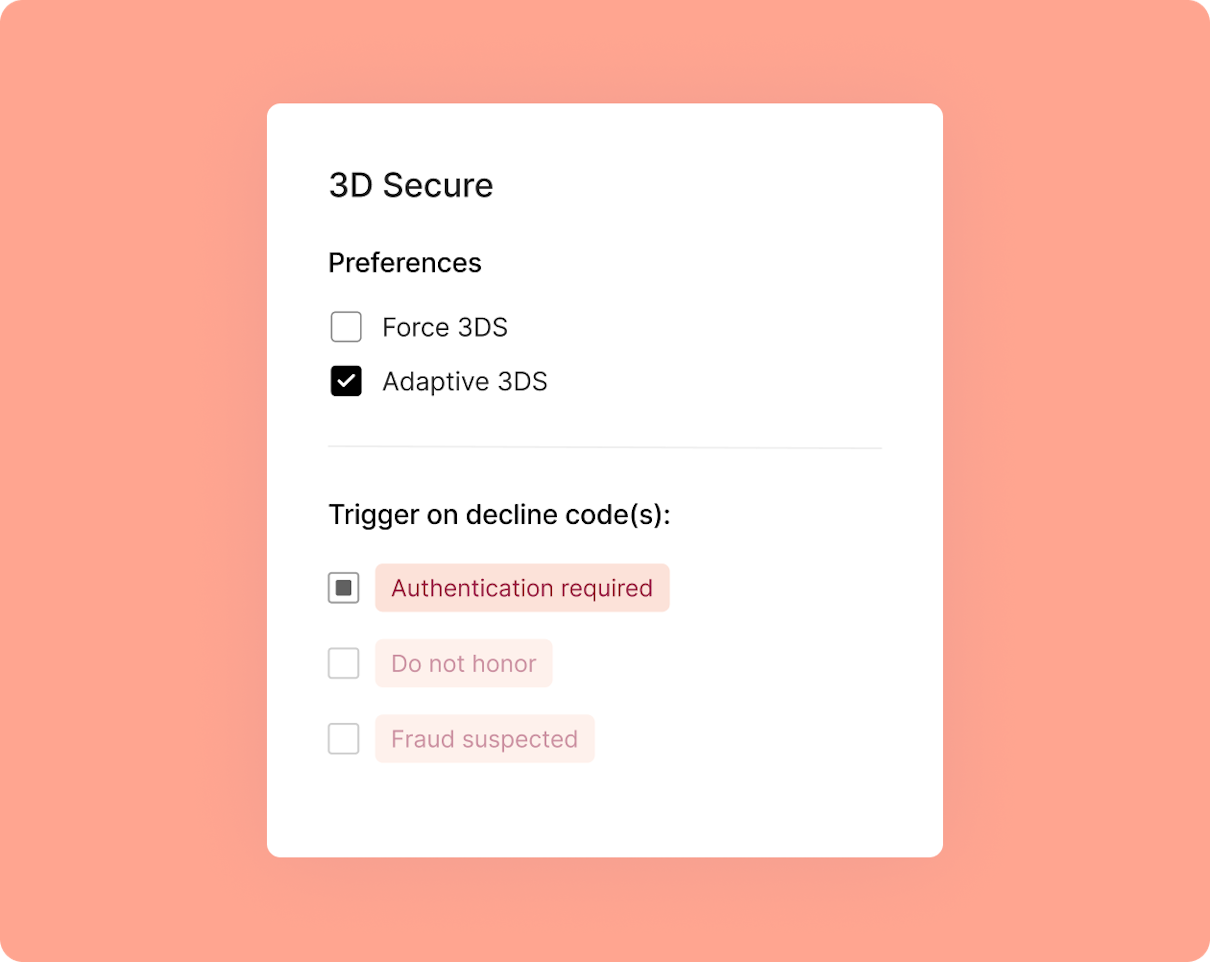

2. Use Adaptive 3DS

Adaptive 3DS (3D Secure) is a fraud prevention technology that adds an extra layer of security to online transactions. Primer’s Adaptive 3DS enhances the security of your payment process and reduces the risk of fraudulent transactions.

Here’s how you can use it to increase authorization rates:

Understand the benefits: Adaptive 3DS provides real-time risk assessment and a frictionless experience for customers. By minimizing the chances of false declines and reducing the need for manual reviews, you can also improve the customer experience.

Choose the right 3DS solution: Look for an adaptive 3DS solution that supports various authentication methods like biometrics, one-time passwords, and push notifications.

Leverage risk-based authentication: Adaptive 3DS solutions use machine learning algorithms to assess the risk level of each transaction. By implementing risk-based authentication, you can ensure that only high-risk transactions are subjected to additional verification, reducing friction for low-risk customers.

Monitor and optimize: Keep track of your adaptive 3DS performance and analyze the data to identify any areas for improvement.

Integrate with your payment stack: Ensure your adaptive 3DS solution is compatible with your payment gateway and other payment infrastructure components.

3. Tackle false decline rates

Fraud tools play a vital role in securing online transactions and recovering potential lost revenue. But it’s important that your fraud detection tools are targeting truly fraudulent transactions rather than penalizing good customers and blocking legitimate transactions.

Here’s how you can fine-tune fraud tools to reduce false decline rates with payments:

Test and customize risk rules: Configure your fraud tool to create custom rules tailored to your needs and risk levels. For example it could be that a customer is traveling and the IP address does not match the same location as the shipping address.

Leverage machine learning and AI: Select a fraud detection solution with advanced features like machine learning, artificial intelligence, and real-time data analysis that will only decline payments based on current threats.

Review average order values - Don’t be hasty to decline based on one-off high order values. Depending on your product and industry, average order values will vary but it’s important to recognise and challenge the right kind of risk.

Manual review to enhance strategy: Regularly analyze the data to find areas for improvement. Manually reviewing batches of questionable transactions will ensure your fraud engine is focussed on surfacing the suspicious behavior while rewarding the good.

4. Utilize checkout data

Collecting more data during the checkout process can sometimes improve your payment authorization rates - but it’s important to err on the side of caution.

By gathering additional billing information, you can provide a more comprehensive and accurate picture of each transaction to the issuing banks. This helps them make informed decisions about authorizations. But there’s a fine balance between asking for enough information to swiftly authorize payments and asking for too many unnecessary fields that could affect the conversion rates at checkout.

How to collect useful data at the checkout which could help authorisation rates:

Request more customer details: Ask for additional information such as customer name, billing address and card verification value (CVV).

Collect device and browser data: Capture information about the customer's device and browser, such as IP address, operating system, and browser version.

Save payment information using network tokens: Using the primary account numbers (PANs), which are the 15- or 16-digit numbers found on every credit or debit card, network tokens are a much safer way to move card data between networks while minimizing the risk of exposing customers’ sensitive information.

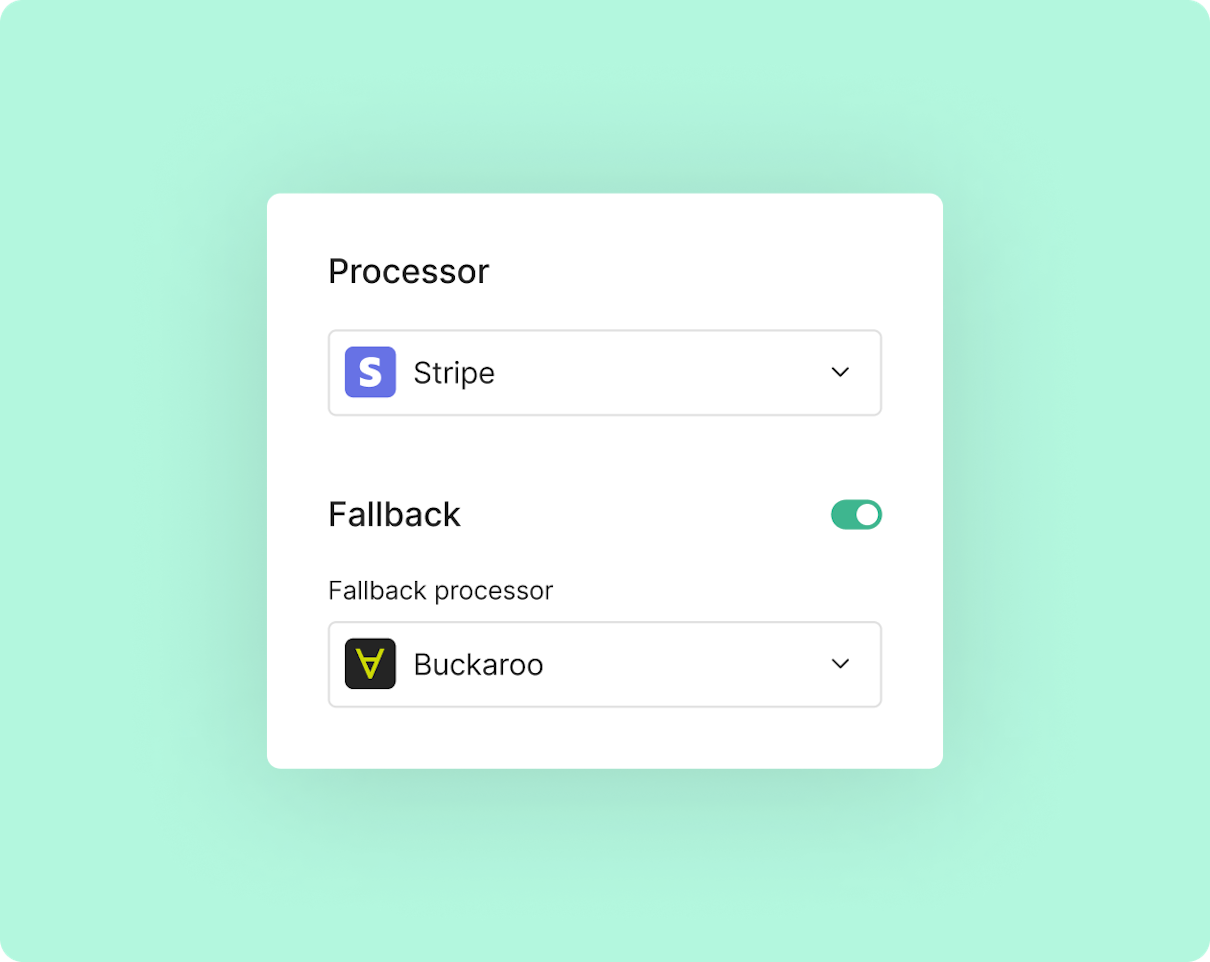

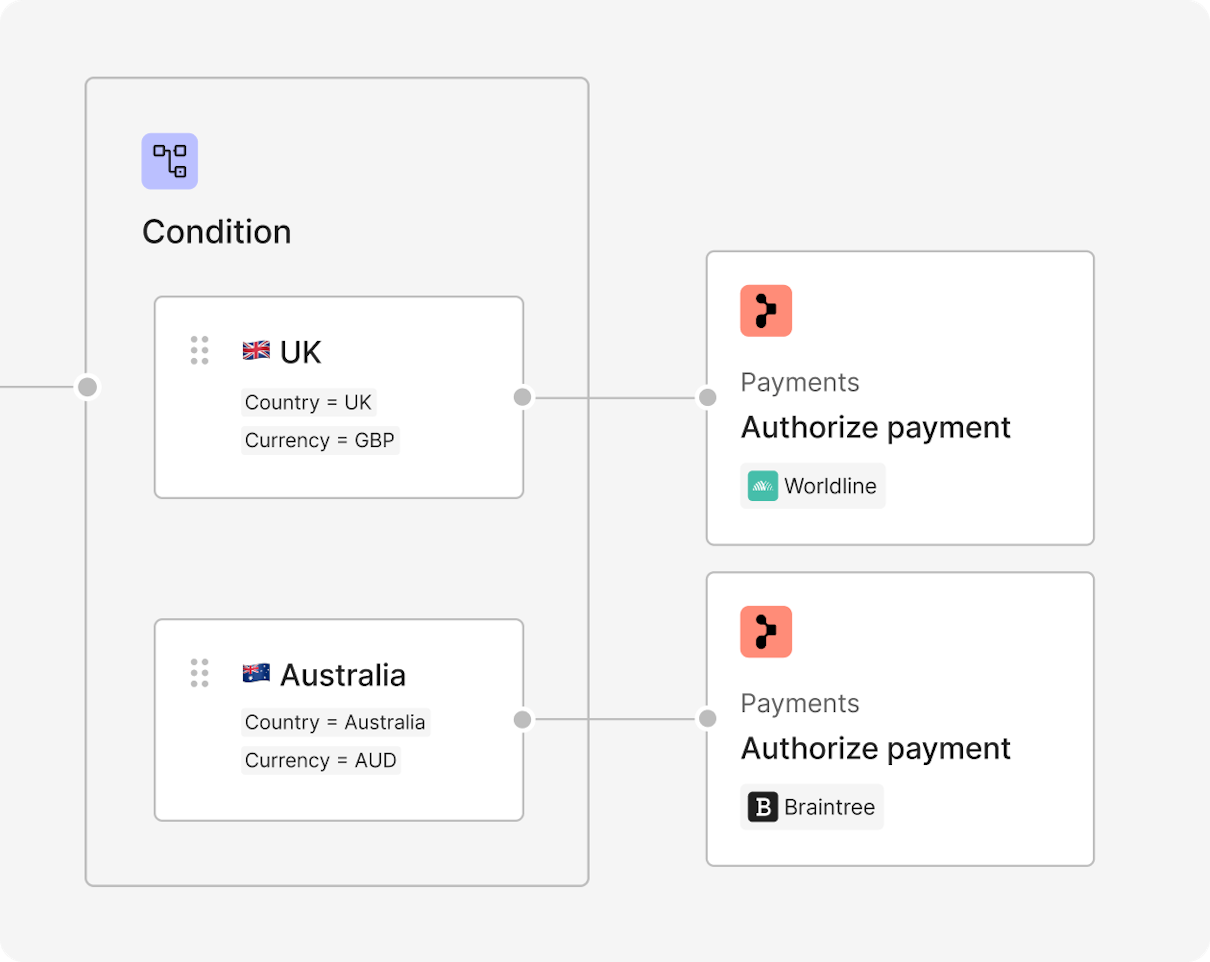

5. Route to the right processor at the right time

Analyzing historical data can provide valuable insights into which payment service providers (PSPs) have higher authorization rates for specific data points, such as particular issuing banks. You can increase your overall authorization rates by routing transactions to the PSP with the highest potential for authorization based on historical data.

Another way to boost authorization rates is through local acquisition. You can take advantage of higher authorization rates and lower costs if you have a local entity. For example, a US-based entity accepting a US card will have a higher acceptance rate and lower cost than a UK-based entity accepting a US card.

By routing transactions to the right processor at the right time, you can improve your chances of successful authorization and ultimately increase authorization rates.

The Bottom line

Improving your payment authorization rates is crucial to the success of your business. By implementing our top tips, you can reduce declines, minimize lost revenue, and improve your overall customer experience. Win-win.

Don't forget, if you need help optimizing your payment flow, our team is on hand to support you. Contact us today to learn more.